Member Services Desk

Weekly Market Update

Economist Views

With Federal Reserve policymakers taking a well-deserved rest from the lecture circuit, the focus of market participants will turn to a series of pre-Christmas economic releases. Echoing the upbeat survey from the University of Michigan, the Conference Board’s sentiment gauge probably ended the year on a high note. Existing home sales likely took a breather last month, but contracts to purchase newly constructed dwellings probably rebounded. Durable goods bookings are expected to have moved higher in November, extending the recovery from April’s pandemic low. Reflecting recent COVID-related business closings, initial claims for unemployment insurance benefits likely remained elevated during the latest reporting period.

Real GDP Growth: Updated input data suggest that the Bureau of Economic Analysis’ final assessment of summer-quarter growth could be raised from November’s 33.1% annualized estimate.

Conference Board Consumer Confidence: Available sentiment soundings suggest that the Conference Board’s consumer confidence gauge moved back above the century mark in December, after a 96.1 reading in November. Market participants will pay particular attention to the so-called labor differential – the percentage of respondents believing jobs are plentiful less those feeling that they are hard to get – for clues to potential changes in the year-end unemployment rate.

Existing Home Sales: Lagged purchase-contract signings point to a modest dip in closings from the 14-year high 6.85mn seasonally adjusted annual rate posted in October. With the number of homes on the market expected to contract by 7.7% to 1.31mn during the reference period, the months’ supply of unsold dwellings probably dipped to a record low of 2.4 months.

Durable Goods Orders: Durable goods bookings likely climbed for a seventh consecutive month in November, albeit by a smaller amount than October’s 1.3% gain. Movements in non-defense capital goods shipments excluding jetliner deliveries will provide clues to the pace of business equipment spending during the current quarter.

Initial Jobless Claims: Soaring Coronavirus cases and the attendant adverse impact on business activity suggest that new claims for unemployment insurance benefits likely remained elevated, following the 885K new filings during the period ended December 12.

New Home Sales: Reported increases in single-family building permits and housing starts hint that new home purchases likely rebounded in November, after the surprising dip recorded in October.

Federal Reserve Appearances: None

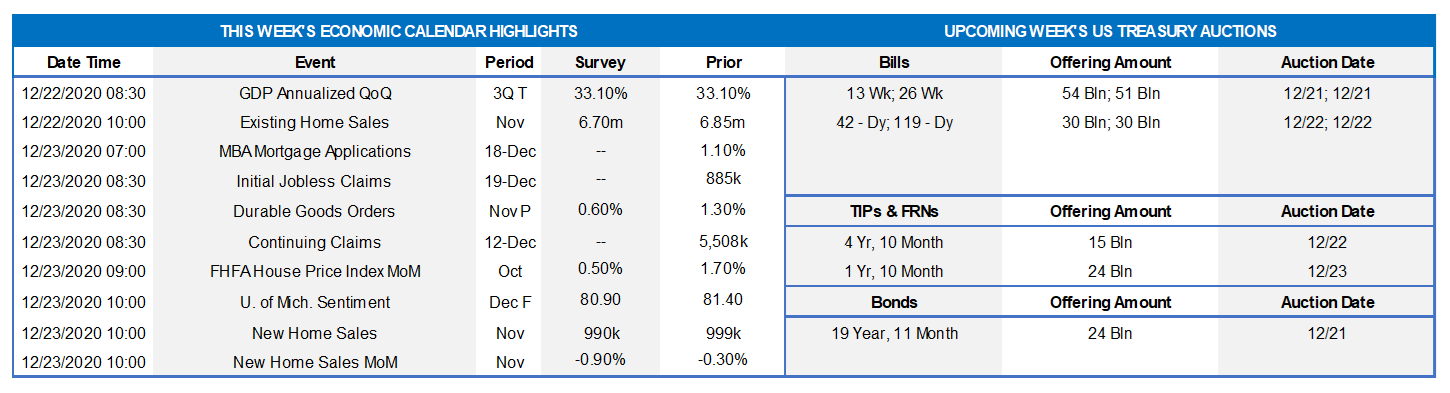

CHART 1 – UPPER LEFT

Source: Fed Reserve; FHLBNY. While Fed policymakers expect real GDP to grow at an above-trend pace and the unemployment rate to move below the full employment level over the next three years, no change in the federal funds rate target from the 0% lower bound is envisioned over that span, as seen here in the relatively unchanged “Dot Plot” of Fed member projections. Despite an extended period of monetary accommodation, the median longer-run federal funds rate expected by Federal Reserve officials remains at 2.5%.

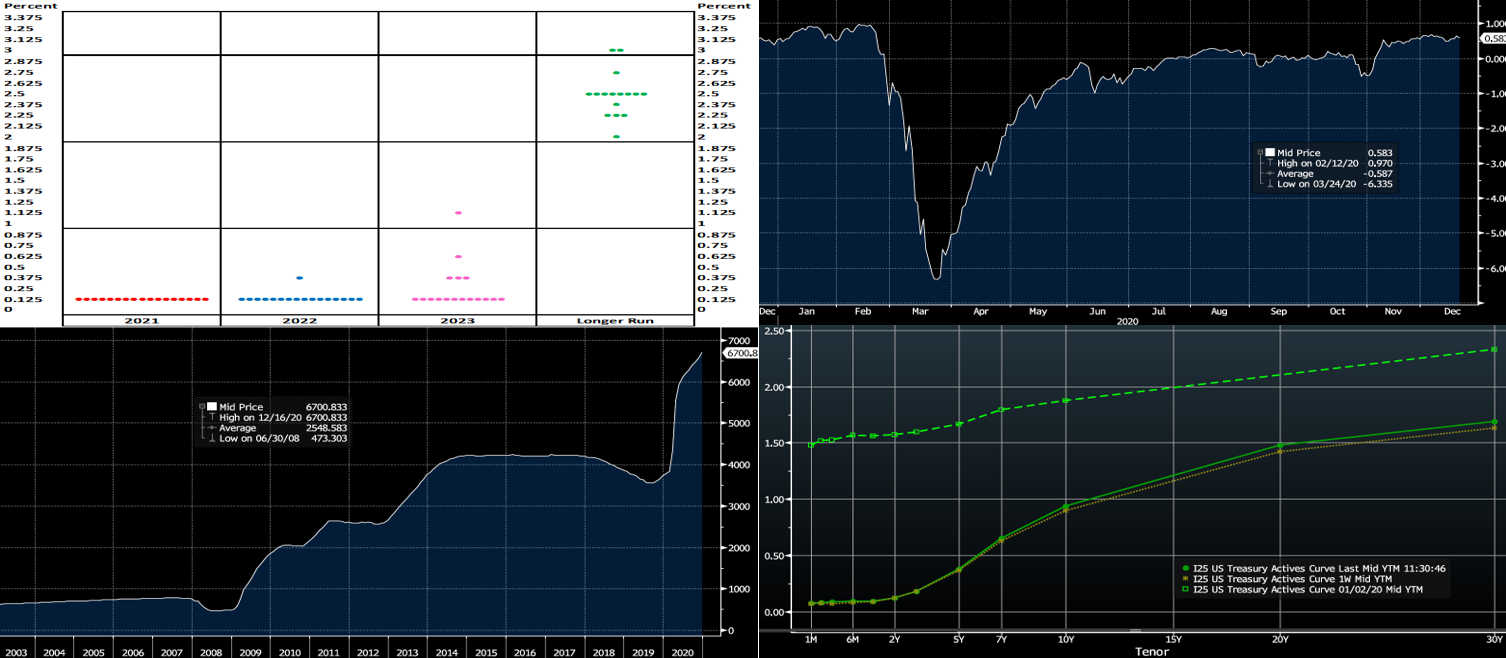

CHART 2 – UPPER RIGHT

Source: Bloomberg. Depicted here is the Bloomberg U.S. Financial Conditions Index which tracks the overall level of financial stress in the U.S. money, bond, and equity markets to help assess the availability and cost of credit. A positive value indicates accommodative financial conditions, while a negative value indicates tighter financial conditions. Presently, equity markets sit at or near all-time highs, mortgage rates are at all-time lows, and rates and credit spreads overall trade near record low levels. Given that conditions are clearly accommodative, the Fed refrained from undertaking any imminent new initiatives such as a formal announcement/program of extending the maturity profile of its asset purchases. Important to note, especially in this holiday season, is that these conditions and many other economic data-points are macro-focused; many business sectors and workers currently are not in an “easy” or “accommodative” state. In this vein, the Fed has signaled that it will remain accommodative on policy, and it continues to advocate for further legislative fiscal relief to address economic inequalities and headwinds.

CHART 3 – LOWER LEFT

Source: Bloomberg. A primary reason for low rates and accommodative financial conditions has been the Fed’s massive asset purchases to combat the pandemic. Seen here is the Fed’s SOMA (System Open Market Account) portfolio of securities, mostly UST’s and agency MBS, acquired via open market operations. It has skyrocketed this year to ~$6.7trn, well above historical levels.

CHART 4 – LOWER RIGHT

Source: Bloomberg. The UST curve modestly “bear steepened” from its levels of a week ago. The Fed’s guidance and programs have served to pin the shorter maturities, and so again it was maturities 4-year and longer that led the move. The slight move higher in longer rates resulted from apparent tangible progress on a fresh relief package and some positive vaccine news. Shorter rates were relatively unchanged, as the dramatically worsening current Covid-19 situation and job market data held them steady. Being the last edition of the year, added here is the yield curve back on January 2, 2020. Clearly, the pandemic and the Fed’s response served to dramatically drive rates lower and the curve steeper. Let’s never forget the past year but hope and work for a better and healthier 2021!

FHLBNY Advance Rates Observations

Front-End Rates

Short-end Advance rates were 1 to 2bps higher week-on-week. T-bill issuance was its usual market feature, but net supply has slowed and thereby allowed for easier market absorption. Contributing to the slight uptick in rates was a ~$55bn outflow from money market funds’ AUM this past week, led by a sizable ~$39bn flow out of Government-Only funds. From a bigger-picture vantage point, an overall moderation in market supply of short paper in recent months has kept short-end rates relatively steady.

Heavy T-Bill issuance will remain a theme; UST issuance overall is now net positive supply in that more is being issued than what the Fed is buying in its programs. However, with short UST rates at rock-bottom levels, and the Fed likely on hold for a long period, rates may trade in a sideways pattern. Importantly, net T-bill issuance has been lower since mid-summer and even negative in recent weeks, and Treasury has announced plans to shift issuance out the curve; a new fiscal relief package could complicate/alter this forecast but remains to be seen. Even with a new relief package and related borrowing, these supply/demand and Treasury issuance dynamics should keep short rates in check on the upside.

Term Rates

Medium and longer-term advance rates were modestly changed on the week, with the shorter end relatively unchanged but 10-year up a few bps. Rates 3-year and shorter generally remain pinned in a narrow range. Please refer to the previous section for further color on market dynamics.

Rates still trade at historically low levels across the yield curve, and the curve is priced for the Fed to be on hold for several years. If suitable or sensible from an ALM perspective, it may be worthwhile to consider extending liabilities and locking in term rates. If not in need of funding now but anticipating future needs, a Forward Start Advance can be an appropriate solution, especially given the still relatively flat yield curve. Please call the Member Services Desk to discuss rate levels and potential ideas.

On the UST supply front, this holiday week is light in term space. Corporate issuance should dissipate from its historic record annual pace, given the impending holiday weeks. Attention will remain on the prospect of further relief legislation and certainly also on COVID-19 developments.

Best wishes for the holidays; see you in 2021!

The Symmetrical Prepayment Advance Feature

With rates at or near multi-year lows, it is a compelling juncture to use the SPA feature on term advances. This feature allows member to capture, at prepayment, changes in the Fair Value of the advance which are favorable to the member. Contact us to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the

MSD Team.

Special Member Alert

The FHLBNY recently announced a newly expanded and flexible Disaster Relief Funding (DRF) advance program which offers discounted rate advances with maturities 1-mo and greater. Additionally, we have announced that PPP loans will be accepted as eligible collateral. Please contact us with any questions.