Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week ending December 20, 2024.

Economist Views

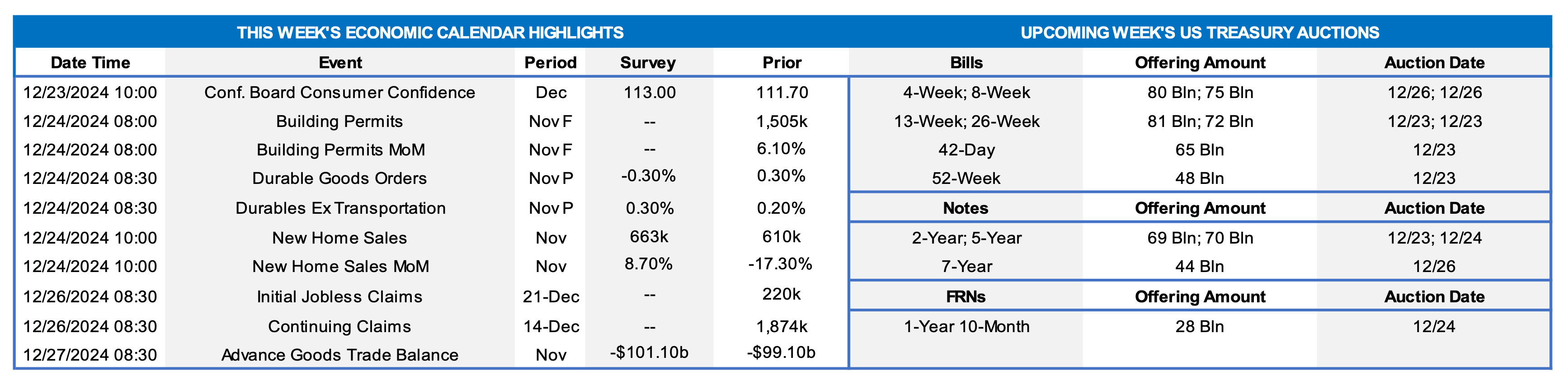

Click to expand the below image.

**The MSD Weekly Update will return on Friday, January 10, 2025. Best wishes for the holidays and the new year! **

Having weathered the Federal Open Market Committee meeting and digested the latest Summary of Economic Projections, market participants will enjoy a well-deserved rest as they prepare to enjoy traditional yearend holidays. The few soundings on the economy scheduled for release likely will be positive. Consumer confidence probably improved in the final month of 2024, while new home sales bounced back sharply in November. Jobless claims are expected to have remained at levels consistent with healthy labor market conditions. Current tracking estimates for current-quarter real GDP growth are centered at an annual rate of 2%, although the more thorough analysis of economists at the Atlanta Federal Reserve projects a 3.2% gain, little changed from the summer quarter’s clip. The Federal Reserve public appearance calendar will also be exceptionally light, with only a pair of FOMC voters slated to hit the stage.

Conference Board Consumer Confidence: Preliminary soundings from the University of Michigan suggest that the sentiment gauge climbed to a 17-month high of 113.2 in December from 111.7 in the preceding month. Pay attention to the labor differential – the percentage of respondents believing that jobs are plentiful less those feeling positions are hard to get – for clues to any potential change in the civilian unemployment rate in the upcoming Bureau of Labor Statistics’ report.

Durable Goods Orders: Projected modest increases in transportation equipment requisitions and other hard goods bookings probably propelled orders .3% higher in November, after a similar increase in the prior month.

New Home Sales: Reported increases in single-family housing starts and building permits suggest that contracts to buy a newly constructed dwelling leaped by 13.1% to a seasonally adjusted annual rate of 690 in November, completely reversing October’s surprising decline.

Jobless Claims: Labor market conditions likely remained healthy during the period ending December 21, with initial claims for unemployment insurance benefits staying in a historically low 215K-225K band. The total number of persons receiving regular state benefits probably once again registered below 1.9mn during the second week of the month.

Merchandise Trade Balance: The merchandise trade deficit is expected to have widened to $101bn in November from the $98.3bn shortfall witnessed in the prior month.

Federal Reserve:

- Dec. 20 San Francisco President Mary Daly to appear on Bloomberg Surveillance in New York.

- Dec. 20 New York Fed President John Williams to appear on CNBC.

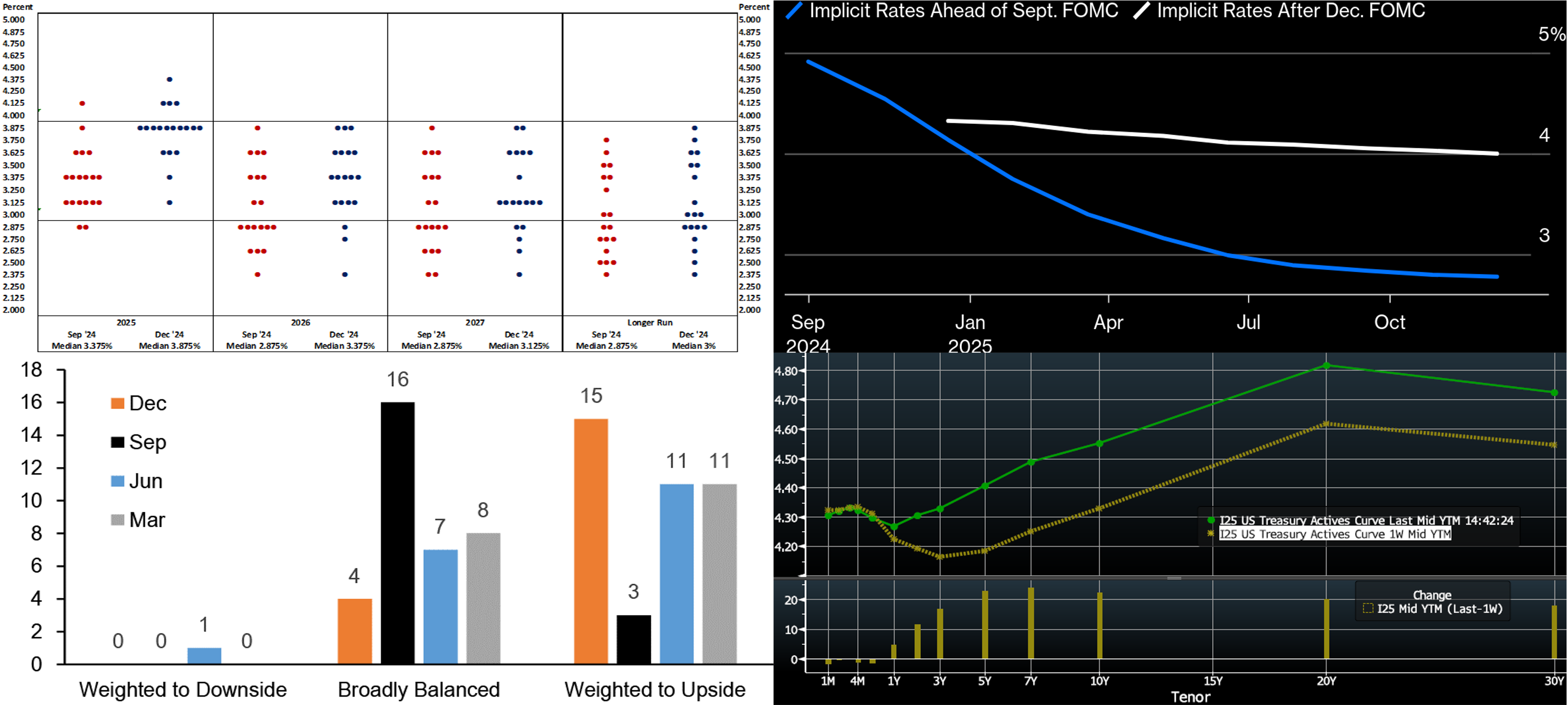

CHART 1 UPPER LEFT

Source: Board of Governors of the Federal Reserve System; FHLB-NY. Per convention, the Fed released an updated Summary of Economic Projections or SEP. The so-called “dot plot” contained significant updates to policymakers’ expectations for the federal funds rate target range out to the end of 2027 and over the longer run. In this vein, while the Fed provided the expected 25-bps cut, the communique and overall result have been dubbed a “hawkish cut.” Fed officials now anticipate 50 bps of cuts in administered rates likely will be appropriate over the course of 2025, down from 100 bps in the September SEP. The projected year-end 2025 range for the federal funds rate now stands at 3¾% to 4%. Policymakers envision an additional 50 bps of accommodation will be appropriate in 2026, lowering the federal funds rate target to 3¼% to 3½%, followed by a single 25-bps cut to 3% to 3¼% in 2027. The longer-run federal funds rate was raised slightly to 3% from the 2.875% posted in the September SEP.

CHART 2 UPPER RIGHT

Source: Bloomberg. Portrayed here is the notable upward adjustment in rate expectations by both the Fed and the market over the last three months. Charted here is the market’s forward pricing ahead of the September FOMC (Blue, RHS, %) and then as of yesterday post-FOMC (White, RHS, %). At the September FOMC, the market aggressively priced for Fed Funds of less than 3% for yearend-2025, while the Fed’s projection (“dot”) at that time was 3.375%. The market pricing subsequently backtracked over the past few months and is now just under 4% and well above the September dot. And so, as mentioned last week, an upward adjustment to the Fed’s dot plot appeared in the offing. Indeed, the Fed’s yearend-2025 dot was revised higher to now 3.875%. While these changes closed the bulk of the market vs. dot plot discrepancy for yearend-2025, the market prices yearend 2026 and 2027 are also near 4%, which is well above the latest Fed dots of 3.375% and 3.125%.

CHART 3 LOWER LEFT

Source: Federal Reserve Board; JP Morgan. A specific reason for the Fed’s “hawkish cut” and upward revisions to the dot plot is that the bulk of the FOMC now views risks to inflation as weighted to the upside. The change in sentiment from September to now is notable. Whereas only 3 of 19 participants viewed risks to core-PCE inflation as weighted to the upside back in September, now 19 do. In turn, the Fed’s median core PCE inflation forecast for 2025 was revised .3% higher from September to now 2.5%.

CHART 4 LOWER RIGHT

Source: Bloomberg. Top pane is yield (LHS, %), bottom pane is change (LHS, bps). As of Thursday afternoon, the UST term curve was markedly higher than a week ago. The 2, 5, and 10-year yields rose by 12, 23, and 22 bps, respectively. Economic data has remained generally sturdy, financial conditions measures (stock prices, credit spreads, implied volatility levels) remain “not tight”, and the Fed delivered the “hawkish cut” outlined above. Hence, yields have risen to the top side of the past 6-month range. The market prices end-2025 fed funds ~3.98%, or ~21 bps higher than last week. The market’s end-2026 forward is ~3.96%, ~30 bps higher than last week, and which is clearly still higher than the Fed’s fresh projection cited above of 3.375%. Despite limited data and Fedspeak in the holiday weeks ahead, the market can occasionally be prone to notable moves during such stretches, owing to less participation and liquidity.

FHLBNY Advance Rates Observations

Front-End Rates

- Short-end rates, as of midday Thursday, were lower from a week ago, led by the shortest tenors. The 3-week-and-in zone was 13 to 31 bps lower. The 1-month-and-out sector was lower by 1 to 9 bps, with shorter tenors leading the move. Naturally, the Fed’s rate cut prompted the adjustment in the shortest tenors. The short-end curve, meanwhile, continues to cross further into the curve’s timeline of additional Fed easing, and investor demand for shorter paper has been solid. Net T-bill issuance is projected to remain negative for the next few weeks; this dynamic and persistent and robust Money Market Fund AUM levels should help our paper.

- The market will focus on data during the holiday weeks and any potential for yearend stresses.

Term Rates

- The longer-term curve, generally mirroring moves in USTs and swaps, was higher from a week ago. The 2, 5, and 10-year increased by 13, 25, and 23 bps, respectively. Kindly refer to the previous section for color on market dynamics and changes. We encourage members to engage with the Member Services Desk for current rate levels and market dynamics.

- On the UST term supply front and in a challenging holiday timeframe, the upcoming week serves 2/5/7-year auctions. Note that UST auctions usually occur at 1pm and can occasionally spur volatility around that time. Please contact the Member Services Desk for further information on market dynamics, rate levels, or products. Note that our “800 number” is again ready for use at 1-800-546-5101 option 1.

Price Incentives for Advances Executed Before Noon: In effect as of Tuesday, September 5, 2023, the FHLBNY is pleased to now offer price incentives for advances executed before Noon each business day. These pricing incentives offer an opportunity to provide economic value to our members, while improving cash and liquidity management for the FHLBNY. For further details, kindly refer to the Bulletin.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.