Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week ending December 13, 2024

Economist Views

Click to expand the below image.

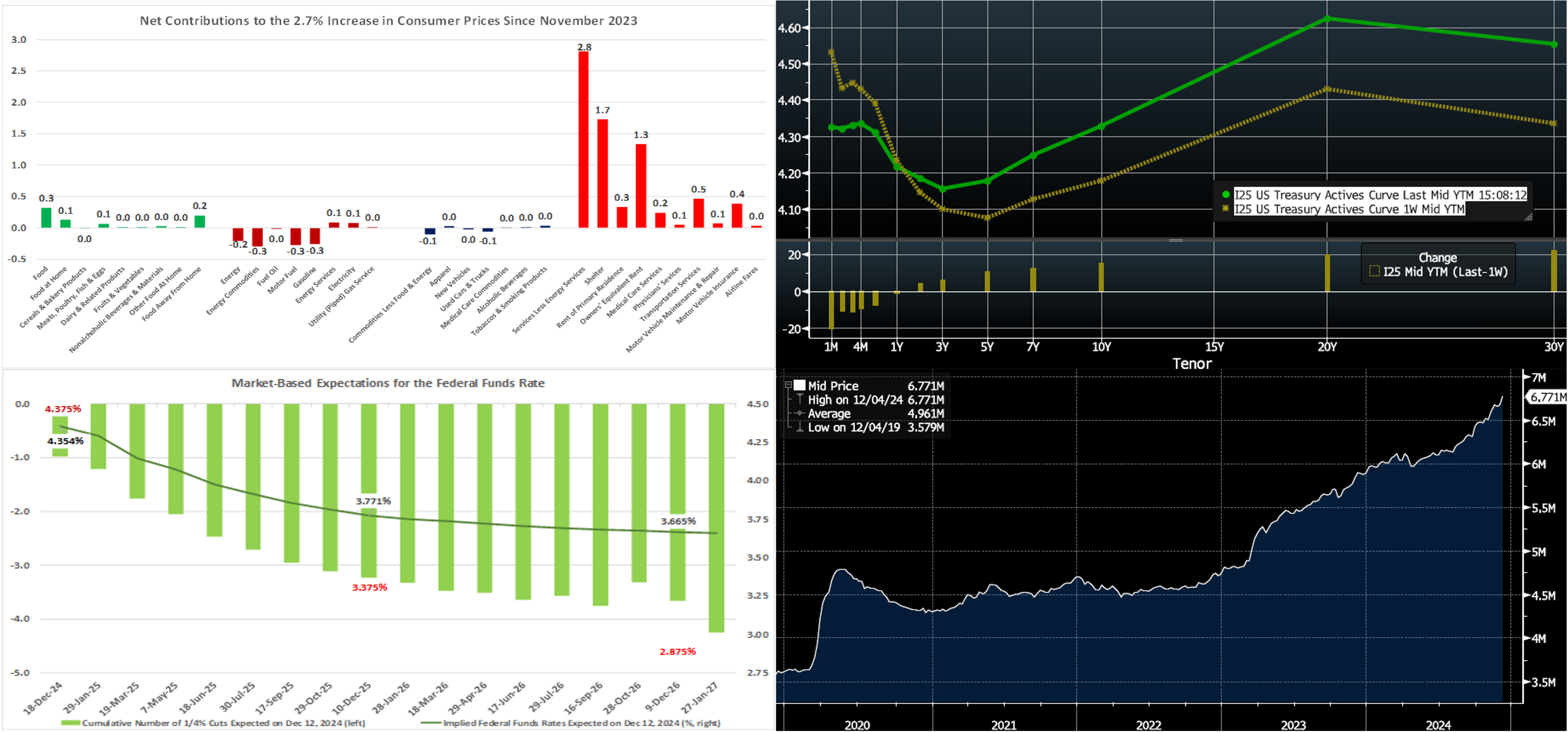

The Federal Open Market Committee (FOMC) is widely expected to lower the federal funds rate target range by another 25 bps to 4¼% to 4½% at the December 18th meeting. The communiqué likely will reiterate that recent indicators suggest that activity has continued to expand at a solid pace, labor market conditions have eased since earlier in the year, and the unemployment rate has moved up but remains low. The press release will likely again declare that the FOMC judges risks to achieving its employment and inflation goals as being roughly in balance, the economic outlook uncertain, and that policymakers remain attentive to risks to both sides of the dual mandate and will monitor developments considering any additional rate moves. The FOMC likely will continue to reduce its holdings of UST, agency debt and agency MBS at the pace set out at the April meeting. The monthly redemption cap on USTs will remain at $25bn, while the monthly redemption cap on agency debt and agency MBS continues at $35bn, with any amount above that cap reinvested in UST debt. The Federal Reserve Board will also release an updated Summary of Economic Projections, or SEP. This so-called “dot plot” of policymakers’ projections for the federal funds rate target through 2027 will garner the heaviest attention from the market.

Empire State Manufacturing Survey: Manufacturing activity likely expanded in New York State in December but at a slower clip than in the preceding month. The general business conditions diffusion index – the percentage of survey respondents witnessing a pickup in activity less those experiencing a decline – probably retreated to 15% from the heady 31.2% reading recorded in November.

Retail & Food Services Sales: Sales likely to be 1% higher in November, after a .4% uptick in October. Net of a projected 2.7% jump in vehicles, sales likely climbed by .6%, following a modest .1% prior- month rise. As always, watch so-called “control” sales, excluding auto, building materials, and gas purchases, in the report for clues to the pace of consumer spending during Q4. Barring any prior-month revisions, a .5% increase would place core purchases over the October-November span 3.8% annualized above their July-September average, after a solid 5.9% annualized Q3 advance.

New York FRB Services Activity Survey: Activity across NYS, Northern NJ, and Southwest CT likely expanded in December, pushing the index into positive territory from the -.5% posted in November.

Industrial Production & Capacity Utilization: Output at the nation’s factories, mines, and utilities probably climbed by .3% in November, erasing the dip witnessed in the prior month. With additions to productive capacity expected to lag output slightly during the reference period, the aggregate operating rate likely moved one tick higher to 77.2%.

NAHB Housing Market Index: Rosier appraisals of sales, combined with a pickup in prospective buyer traffic, likely pushed the gauge above the critical 50-point mark for the first time since April.

Housing Starts & Building Permits: New activity probably rebounded, lifting the rates of starts and permits from their respective 1.31mn and 1.42mn levels posted in October.

Jobless Claims: Labor market conditions likely remained healthy during the period ending December 14, with initial claims for unemployment insurance benefits staying in a historically low 215K-225K band. The total number of persons receiving regular state benefits probably again registered below 1.9mn during the first week of the month.

Real GDP Growth: Government statisticians’ final estimate of real GDP growth during Q3 is expected to be unchanged from the 2.8% annualized clip posted in the BEA’ preliminary report.

Existing Home Sales: Increases in home-purchase signings in early Fall suggest that sales climbed by 3.3% to a 6-month high seasonally adjusted annual rate of 4.09mn in November. With the number of available homes on the market likely to contract by 1.7% to 1.35mn on a not seasonally adjusted basis, the supply at the estimated sales pace would move two ticks lower to four months.

Personal Income & Spending: Powered by a projected pickup in private wage and salary disbursements, income likely rose by .6% in November, after a similar increase in October. Echoing the anticipated acceleration in retail sales during the reference period, nominal consumer spending likely climbed by .6% as well, matching last month’s expected income gain.

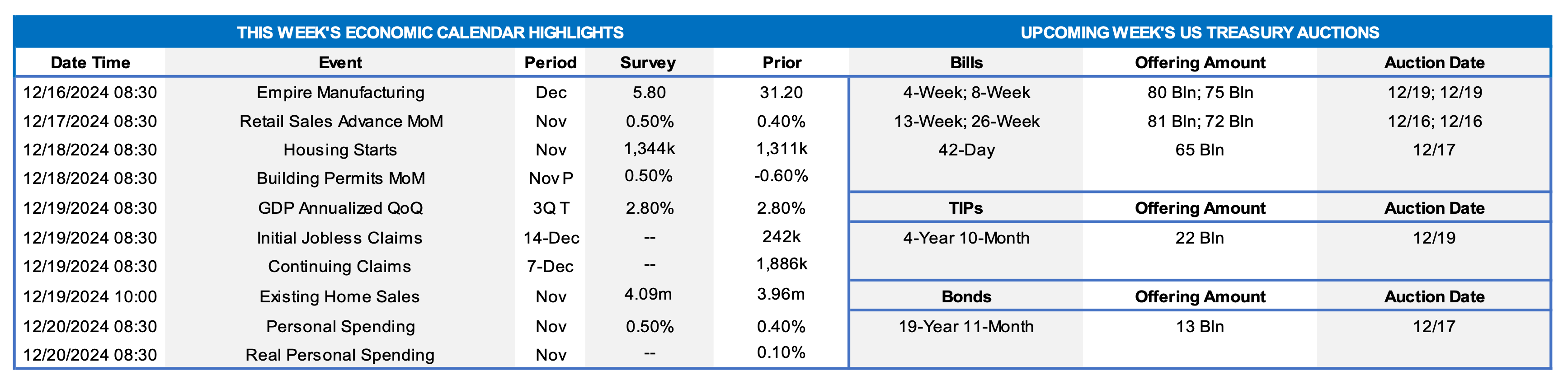

CHART 1 UPPER LEFT

Source: Bureau of Labor Statistics (BLS); FHLB-NY. The BLS released its monthly consumer price index (CPI) report this past Wednesday. While closely followed consumer price measures matched Street expectations in November, it is instructive to look at the factors driving goods and services inflation over the latest 12 months. More than the 2.7% increase in the headline CPI since November 2023 has been attributable to higher non-energy services costs, primarily those for shelter and motor vehicle insurance. On a positive note, available apartment rent data suggest that shelter cost increases may slow significantly in the months ahead.

CHART 2 UPPER RIGHT

Source: Bloomberg. Top pane is yield (LHS, %), bottom pane is change (LHS, bps). As of Thursday afternoon, the UST term curve was higher and steeper than a week ago. The 2-year was ~5 bps higher, while the 5 and 10-year were ~10 and 14 bps higher, respectively. The week was limited data-wise; the CPI report met expectations, and so, despite the evident slowing of disinflationary forces in the past few months, it essentially solidified the odds of another 25-bps cut by the Fed this upcoming week. In terms of market-implied pricing of the Fed, for end-2024, the market forwards price for Fed Funds is ~4.355%, or ~6 bps lower than a week ago. The market prices end-2025 ~3.77%, or ~3 bps higher than last week and still well above the Fed’s last median projection from its September FOMC meeting of 3.375%. The market’s end-2026 forward is ~3.66%, ~10 bps higher than last week, which is clearly higher than the Fed’s September long-run projection of 2.875%.

CHART 3 LOWER LEFT

Source: Bloomberg; FHLB-NY. Following the above observations, here is a fuller view of the market’s pricing of the Fed as of Thursday afternoon. The Fed’s year-end projections from its September FOMC “dot plot” are shown in red-typeface, while the market’s year-end pricing is in black-typeface. While the Fed and the market are in alignment for a likely 25-bps cut at the upcoming FOMC, the market has clearly fallen out of alignment with the Fed for the next few years. In this light, this upcoming week’s FOMC “dot plot” may be poised for revisions by the Fed. The market’s pricing could also adjust lower; indeed, some dealers are currently proposing trades that benefit from a decline in these market forward rates.

CHART 4 LOWER RIGHT

Source: Bloomberg. Money Market Fund (MMF) Assets under Management (AUM), as of last week at ~$6.8trn, have continued to march higher in recent months. Given that the sector’s yields are attractive relative to other investments, this strong AUM is likely to persist. Note that in a few recent Fed-easing cycles, MMF AUM continued to experience growth as the Fed cut rates. Indeed, in 1995, MMFs experienced inflows throughout the entire easing cycle. These dynamics may prove pertinent to bank deposit pricing strategies in the year ahead.

FHLBNY Advance Rates Observations

Front-End Rates

- Short-end rates, as of midday Thursday, were mostly lower than a week ago. The 1- to 6-month sector was 8 to 11 bps lower, led by the shorter tenors. These tenors are crossing further into the curve’s timeline of additional Fed easing, and demand for shorter paper was solid. Net T-bill issuance is projected to turn negative in the next month; this dynamic, persistent, and robust Money Market Fund AUM levels should help our paper.

- The market will focus on the result of the upcoming week’s FOMC meeting. The Fed will remain in blackout mode until the news release on Wednesday afternoon.

Term Rates

- The longer-term curve, generally mirroring moves in USTs and swaps, was mostly higher and steeper from a week ago. The 2-year was 3 bps higher, while the 5 and 10-year were 11 and 15 bps higher, respectively. Kindly refer to the previous section for color on market dynamics and changes. We encourage members to engage with the Member Services Desk for current rate levels and market dynamics.

- On the UST term supply front, the upcoming week serves a 20-year nominal and a 5-year TIPS auction. Note that UST auctions usually occur at 1pm and can occasionally spur volatility around that time. Please contact the Member Services Desk for further information on market dynamics, rate levels, or products. Note that our “800 number” is again ready for use at 1-800-546-5101 option 1.

Price Incentives for Advances Executed Before Noon: In effect as of Tuesday, September 5, 2023, the FHLBNY is pleased to now offer price incentives for advances executed before Noon each business day. These pricing incentives offer an opportunity to provide economic value to our members, while improving cash and liquidity management for the FHLBNY. For further details, kindly refer to the Bulletin.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.