Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week of December 7, 2020.

Economist Views

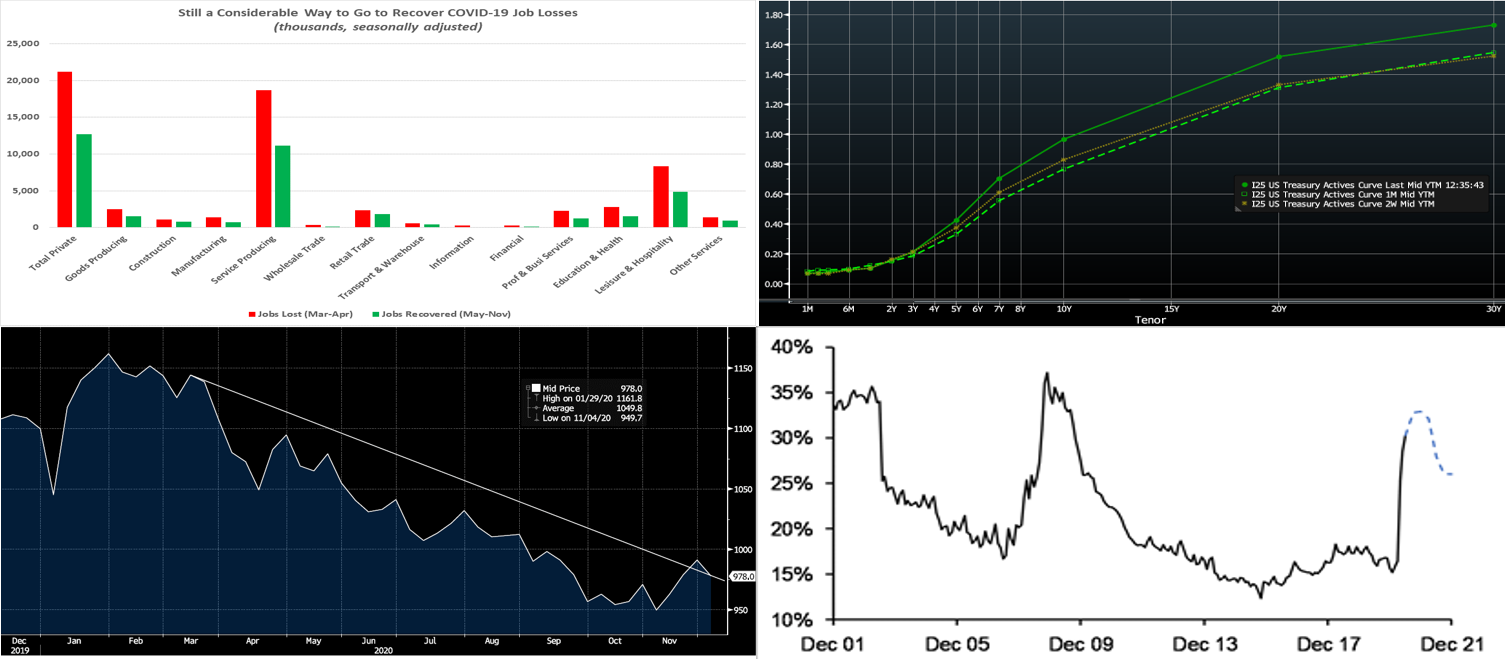

Click to expand the below image.

Having weathered the Bureau of Labor Statistics’ (BLS) update on the employment situation in November, market participants will contend with a series of comparatively minor economic releases this week. The key report likely will be the update on consumer prices last month. Federal Reserve officials will observe a blackout period on public monetary policy discussions ahead of the December 15-16 FOMC meeting.

NFIB Small Business Optimism Index: Already reported positive labor-market soundings suggest that the National Federation of Independent Business’ sentiment gauge improved in November, after no change in the preceding month.

JOLTS Job Openings: Online job postings climbed higher in October, suggesting that the BLS’ tally of available positions will climb to a three-month high of 6.6mn.

Initial Jobless Claims: Searches for information on applying for unemployment insurance benefits suggest that initial claims probably declined by 28K to 683K during the filing period ended December 5 – the lowest tally since mid-March.

Consumer Price Index: A modest uptick in core consumer goods and services costs is expected to push the Consumer Price Index (CPI) 0.1% higher in November, after no change in the preceding month. The median consensus projections are expected to leave the overall and core CPIs 1.1% and 1.5% above their respective year-ago levels.

Michigan Sentiment Index: The University of Michigan’s consumer confidence gauge has improved in December in six of the past seven years. A print exceeding the Street’s median projection could be in the offing in this report.

Federal Reserve Appearances:

Dec. 11: Dec. 11 Fed Vice Chair for Supervision Quarles to participate in a virtual event. Moderated Q & A period, with text to follow.

Click to expand the below images.

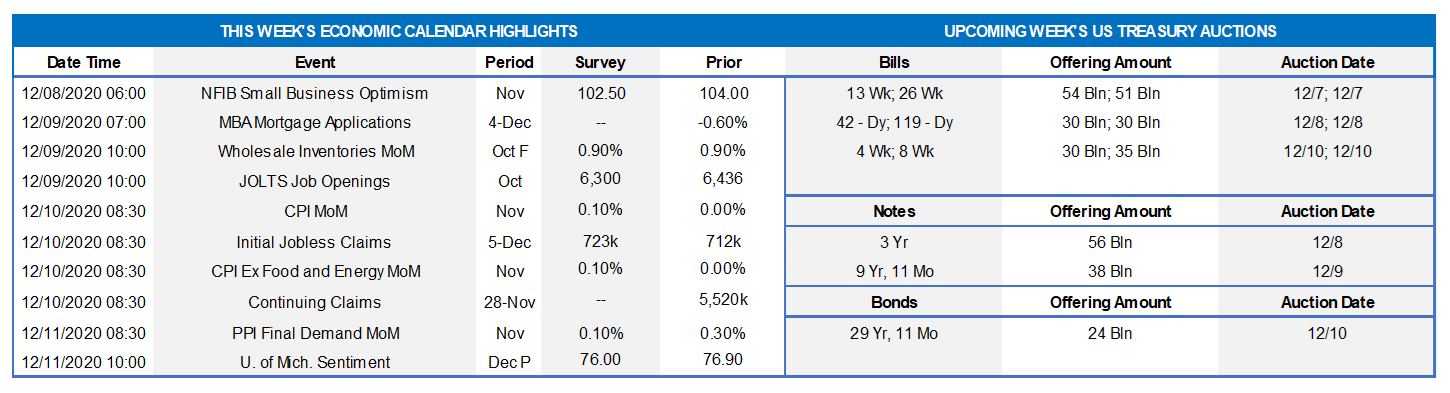

CHART 1 – UPPER LEFT

Source: BLS; FHLBNY. Considerable ground remains to be made up to return payroll employment to the level prevailing before the Coronavirus crisis struck. Since April, private-sector employers have added 12.7mn workers, thereby recouping 59.8% of the 21.2mn positions lost. Construction, retailing, transportation, and warehousing have enjoyed the largest recoveries through November.

CHART 2 – UPPER RIGHT

Source: Bloomberg. The UST curve has notably “bear steepened” in the past two weeks and since a month ago. The Fed’s guidance and programs have served to pin the shorter maturities, and so again it was maturities past 4-year leading the shifts. A few factors have been driving the moves. With the Covid-19 pandemic staging a major resurgence, the Fed is on hold and clamoring for further fiscal relief to help support workers and the economy, and it appears that greater urgency for some form of legislation could be gaining traction in Congress. Another relief package would lead to greater government borrowing, and the market expects Treasury to steer a greater share of its future borrowing to longer maturities. Indeed, there will be large 10 and 30-year UST auctions this week, and Street dealers and investors are raising their yield demands on this longer debt. Meanwhile, the economy should be afforded, in a more medium-term horizon, significant support when the COVID vaccination process successfully and hopefully plays out. Hence, a steeper curve has resulted from these dynamics.

CHART 3 – LOWER LEFT

Source: Bloomberg. Depicted here is the USD amount ($bn) of Commercial Paper (CP) Outstanding in the market. A notable decline of ~$162bn has occurred since early March. Many issuers, such as foreign banks, have simply not needed funds. Moreover, with rates at record lows and insatiable buyer demand, many issuers have opted to “term out” debt by issuing longer term bonds instead. This dynamic has contributed to an impactful decline in short-end supply. Consequently, LIBOR and other short-end rates have been driven lower and are not expected to trade notably higher any time soon.

CHART 4 – LOWER RIGHT

Source: JP Morgan, Federal Reserve. Here is the T-bill share (in %) of total marketable Treasury debt outstanding along with J.P. Morgan’s projections through the end of 2021. The T-bill share of total Treasury debt outstanding has risen well above longer-term averages, doubling since March, but it has already begun and is forecasted by market participants to continue to normalize from these extreme levels. Key to this forecast is that Treasury is expected to shift more of its borrowing out the curve. The resulting decrease in T-Bill issuance adds to the previously cited dynamic of markedly lower short-end supply.

FHLBNY Advance Rates Observations

Front-End Rates

Short-end advance rate, absent a quickly reversed 2bp dip, have remained essentially unchanged over the past two weeks. T-bill issuance has been a market feature, as usual, but net supply has slowed and thereby allowed for easier market absorption. Money market funds’ AUM is down ~$9bn from two weeks ago. But an overall moderation in market supply of short paper in recent months has offset any impact from this AUM decline; see the previous section for pertinent color on this theme.

Heavy T-Bill issuance will remain a theme; UST issuance overall is now net positive supply in that more is being issued than what the Fed is buying in its programs, and so this scenario could prove a small challenge. However, with short UST rates at rock-bottom levels, and the Fed likely on hold for a long period, rates may trade in a sideways to slightly lower pattern. Net T-bill issuance has been lower since mid-summer and even negative in recent weeks, and Treasury has announced plans to shift issuance out the curve, but a new fiscal relief package could complicate/alter this forecast. Even with a new relief package and related borrowing, these supply/demand and Treasury issuance dynamics should keep short rates in check on the upside.

Term Rates

Over the past two weeks, medium and longer-term Advance rates were unchanged to 13bps higher in progressive fashion from 2 to 10-year. Rates 3-year and shorter generally remain pinned in a narrow range, and so again it was the portion of the curve thereafter that led the moves. Please refer to the previous section for further color on the market trend.

Rates still trade at historically low levels across the yield curve, and the curve is priced for the Fed to be on hold for several years. If suitable or sensible from an ALM perspective, it may be worthwhile to consider extending liabilities and locking in term rates. If not in need of funding now but anticipating future needs, a Forward Start Advance can be an appropriate solution, especially given the still relatively flat yield curve. Please call the Member Services Desk to discuss rate levels and potential ideas.

On the UST supply front, this week brings 3/10/30-year auctions. Corporate issuance should add yet again to its historic record annual pace albeit slower as the holidays approach. Attention will remain on the prospect of further relief legislation and certainly also on COVID-19 developments which have been worsening further.

The Symmetrical Prepayment Advance Feature

With rates at or near multi-year lows, it is a compelling juncture to use the SPA feature on term advances. This feature allows member to capture, at prepayment, changes in the Fair Value of the advance which are favorable to the member. Contact us to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the

MSD Team.

Special Member Alert

The FHLBNY recently announced a newly expanded and flexible Disaster Relief Funding (DRF) advance program which offers discounted rate advances with maturities 1-mo and greater. Additionally, we have announced that PPP loans will be accepted as eligible collateral. Please contact us with any questions.