Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week ending December 6, 2024

Economist Views

Click to expand the below image.

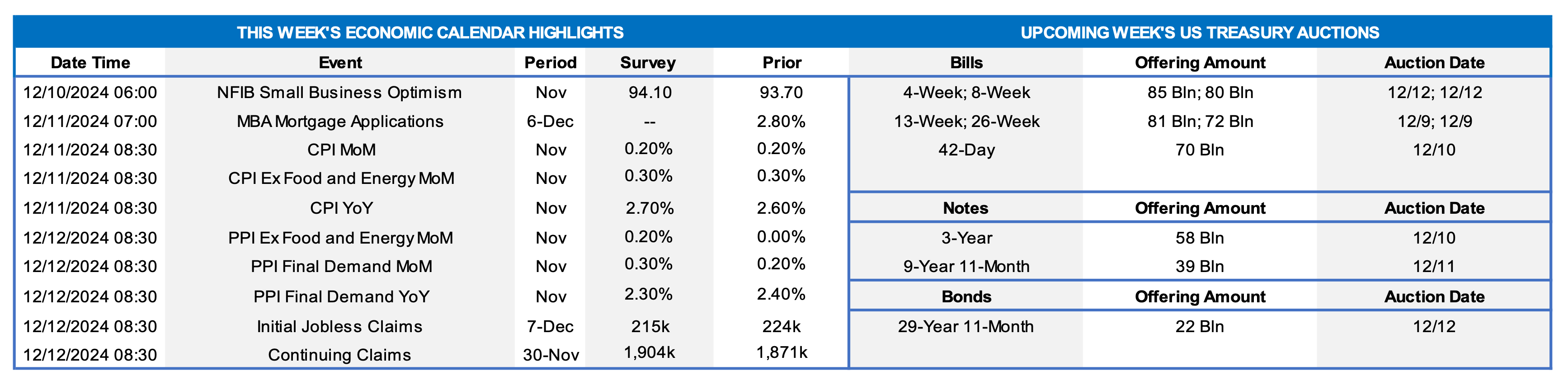

With the Bureau of Labor Statistics’ update on the employment situation in November in the rear-view mirror, the attention of market participants will turn to the inflation side of the Federal Reserve’s dual mandate. Progress in returning closely followed consumer inflation gauges to the desired 2% target probably stalled last month, leaving the probability of a 25-bps cut in the federal funds rate at the upcoming Federal Open Market Committee little changed from that following the November jobs report. Aside from the consumer price report, the data calendar is relatively light. Federal Reserve policymakers will be silent, observing the blackout period ahead of their mid-December FOMC gathering and decision.

NFIB Small Business Optimism Index: Echoing reported improvements in consumer confidence, small business sentiment likely brightened in November, lifting the National Federation of Independent Business’ gauge to a nearly three-year high of 95.5 from 93.7 in the preceding month.

Consumer Prices: Consumer prices likely continued apace in November. Despite higher gasoline pump prices, the Consumer Price Index (CPI) probably edged .2% higher for a fifth straight month. Excluding volatile food and energy costs, the so-called core CPI is expected to have risen by .3% during the reference period, matching the monthly gains witnessed over the August-October span. Those projections would place the overall and core CPIs 2.6% and 3.3% above their respective year-ago levels.

Producer Prices: Producer prices probably quickened slightly last month, with the Producer Price Index (PPI) for final demand climbing by .3%, after a .2% uptick in October. That projection, if realized, would place the headline PPI 2.7% above its year-ago level.

Jobless Claims: Labor market conditions likely remained healthy during the period ending December 7, with initial claims for unemployment insurance benefits staying in a historically low 215K-225K band. The total number of persons receiving regular state benefits probably once again registered below 1.9mn during the week of November 30.

Federal Reserve:

- Federal Reserve officials will observe the blackout period on public appearances ahead of the Dec. 17-18 FOMC meeting.

CHART 1 UPPER LEFT and CHART 2 UPPER RIGHT

Source: NY State Association of Realtors; NJ Realtors; FHLBNY estimates. Notes: Blue-shaded areas denote recession; orange-shaded areas denote current economic expansion. While the number of new listings across the Empire and Garden States has steadily expanded since the end of the spring quarter, the record-low stock of available dwellings on the market continues to propel median home prices to new all-time highs. At an estimated 47,200 after seasonal adjustment in October, the number of homes on the market in New York and New Jersey stood 4.4% below the 49,395 recorded 12 months earlier. The estimated median selling price across the two states rose 1.4% higher to a peak of $468,170 during the reference period, clocking in at a hefty 10.3%, or $43,535, above the amount received by sellers in October 2023. The latest local realtor reports also revealed that homes were changing hands at a historically brisk 44 days in October, with owners, on average, receiving 1.85% above the asking price.

CHART 3 LOWER LEFT

Source: Bloomberg. Top pane is yield (LHS, %), bottom pane is change (LHS, bps). As of Thursday afternoon, the UST term curve is lower and slightly flatter from our last edition two weeks ago. The 2-year is ~20, 5-year ~23, and 10-year ~25 bps lower. Yields essentially retraced some of the upward move of the Fall and now await direction from forthcoming data. A big slice of data arrives in the employment report to be released the morning after this writing. With a heavy slate of UST supply on the way next week, a strong number may push the curve back higher. In terms of market-implied pricing of the Fed, for end-2024 the market forwards price for Fed Funds ~4.42%, a few bps lower than two weeks ago. The market prices end-2025 ~3.74%, or about 13 bps lower than two weeks ago but still well above the Fed’s last median projection from its September FOMC meeting of 3.375%. The market’s end-2026 forward is ~3.56% which is clearly higher than the Fed’s September long-run projection of 2.875%. In this light, this month’s FOMC “dot plot” may be poised for revisions by the Fed.

CHART 4 LOWER RIGHT

Source: Bloomberg. Shown here is the KBW Regional Bank Stocks Index (KRX, gold, LHS) and the UST 1-year/5-year yield curve slope (White, RHS,%). The KRX has risen ~20% for the full calendar-year 2024, and it has risen ~16% in the past month. Note that it has also surpassed its levels of early-2023 prior to the March 2023 bank liquidity market turmoil. While bank stocks appear to have recently benefited from post-election investor sentiment of decreased bank regulation and potential increased merger & acquisition activity, bank stocks likely also have benefited from the steepening of the yield curve, given the historical theory that the banking sector performs better in a steeper curve environment in which borrowing in shorter tenors at lower rates and lending in somewhat longer tenors at higher rates can boost NIM and NII measures. As can be seen here, the 1-year/5-year slope almost reached the “promised land” above 0-bps in mid-November but has since retracted to ~16 bps inversion. For the year ahead, the prevailing hope in the banking sector is that the shorter rates will continue to decline and provide a further steepening of the curve.

FHLBNY Advance Rates Observations

Front-End Rates

- Short-end rates, as of mid-morning Thursday, were lower in the 3-week-and-out zone by 6 to 9 bps from two weeks ago. These tenors now cross further into the curve’s timeline of pricing additional Fed easing. Net T-bill issuance is projected to turn negative in the month ahead; this dynamic and persistent and robust Money Market Fund AUM levels should help our paper.

- The market will focus on a limited slate of economic data in the week ahead. The Fed will be in blackout mode ahead of the December 17/18th FOMC meeting.

Term Rates

- The longer-term curve, generally mirroring moves in USTs and swaps, was lower and slightly flatter from two weeks ago. The 2-year dipped ~20, 5-year ~24, and 10-year ~25 bps. Kindly refer to the previous section for color on market dynamics and changes. We encourage members to engage with the Member Services Desk for current rate levels and market dynamics.

- On the UST term supply front, the upcoming week serves a sizable slate of 3/10/30-year auctions. Note that UST auctions usually occur at 1pm and can occasionally spur volatility around that time. Please contact the Member Services Desk for further information on market dynamics, rate levels, or products. Note that our “800 number” is again ready for use at 1-800-546-5101 option 1.

Price Incentives for Advances Executed Before Noon: In effect as of Tuesday, September 5, 2023, the FHLBNY is pleased to now offer price incentives for advances executed before Noon each business day. These pricing incentives offer an opportunity to provide economic value to our members, while improving cash and liquidity management for the FHLBNY. For further details, kindly refer to the Bulletin.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.