Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week ending December 2, 2022.

Economist Views

Click to expand the below image.

Market participants will face a very quiet statistical calendar this upcoming week. Available soundings suggest that service-producing activity probably continued apace in November. An anticipated worsening of the international trade deficit in October may prompt markdowns to economists’ Q4 real GDP growth projections. Initial claims for unemployment insurance benefits probably remained in their recent range, but the rising number of benefit recipients hint that the jobless rate is heading higher. Producer prices probably rose slightly last month but remained well above those of November 2021. Silence will prevail on the Fed-speak front, as policymakers prepare for the upcoming Federal Open Market Committee (FOMC) meeting.

Factory Orders: Powered by a larger-than-anticipated increase in durable goods bookings, total factory orders likely rose by .4% in October, following a .2% uptick in September.

ISM Services Index: The pace of service-producing activity probably was little changed in November, with the ISM’s barometer edging marginally higher to 54.7% from 54.4% in October.

International Trade Balance: A dramatic widening of the merchandise deficit likely propelled the shortfall on international trade in goods and services to a four-month high of $79.5bn in October from $73.3bn in September.

Jobless Claims: New claims for unemployment insurance benefits probably remained in the recent 220-245K range during the week ended December 3. Pay attention to continuing claims, which climbed above the 1.6mn mark this past week for the first time since late February, for growing evidence that recently furloughed employees are having a more difficult time finding work.

Producer Prices: The Producer Price Index (PPI) for final demand is expected to climb by .3% in November, after a similarly modest .2% uptick in October. That projection, if realized, would place the headline PPI 7.3% above its year-ago level.

University of Michigan Consumer Sentiment Index: Rosier appraisals of current and future economic conditions underpinned by hopes of receding inflation likely propelled the closely followed consumer confidence gauge to an eight-month high of 61 in December from 56.8 in November.

Federal Reserve Appearances: None. Federal Reserve officials will observe the traditional blackout period ahead of the December 13-14 FOMC meeting.

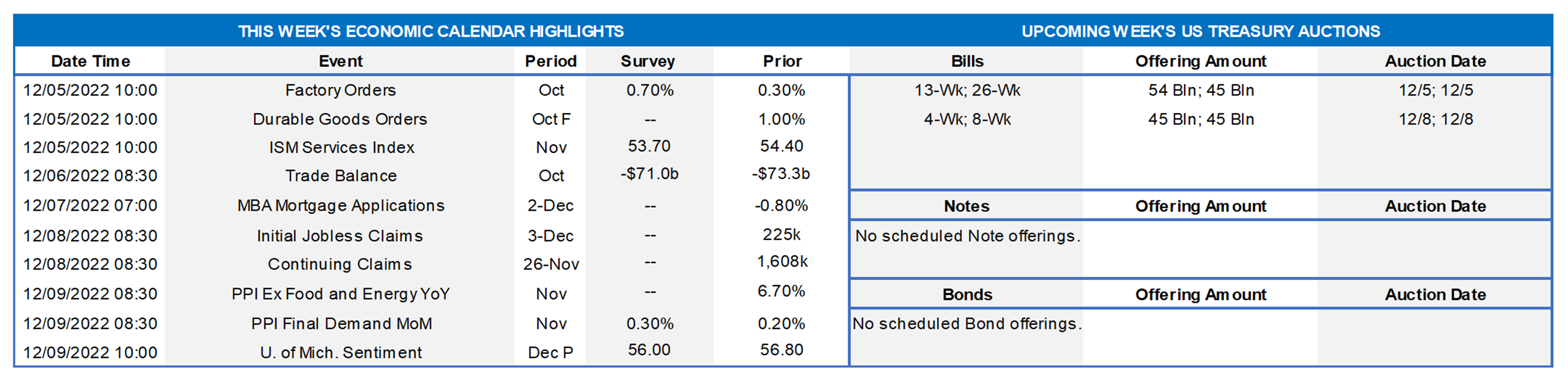

CHART 1 UPPER LEFT

Source: Apartmentlist.com, National Bureau of Economic Research; FHLB-NY. Notes: Blue-shaded areas denote recession and orange-shaded denotes current economic expansion; percentage changes are over the 12-month period ended November. Lower shelter costs likely will provide significant relief on the inflation front in coming months. Apartment rental rates are “rolling over” across the country and within the FHLB-NY district. Peaking at $1386 in August, the national average monthly rental cost has fallen by 2.2% to $1356 last month. New York State and New Jersey have witnessed even-larger pullbacks over the latest three months of 4.7% and 3%, respectively, to $1718 and $1786.

CHART 2 UPPER RIGHT

Source: See prior chart. Within the FHLB-NY district, canvassed metropolitan statistical areas have universally seen declines from their mid-summer peaks, ranging from 11.5% in Atlantic City-Hammonton, NJ to 4% in NYC-Newark-Jersey City, NY-NJ-PA. Despite recent “rolling over” of housing prices and rents, affordability measures have become more challenging. In order to assist with housing affordability challenges, we again encourage members to use our housing and community lending programs; please contact the desk and/or visit https://www.fhlbny.com/community. Note also that FHLB-NY recently awarded $25.3mn for thirty affordable housing initiatives; please find the prese release at https://www.fhlbny.com/news/press-releases/2022/press112122.

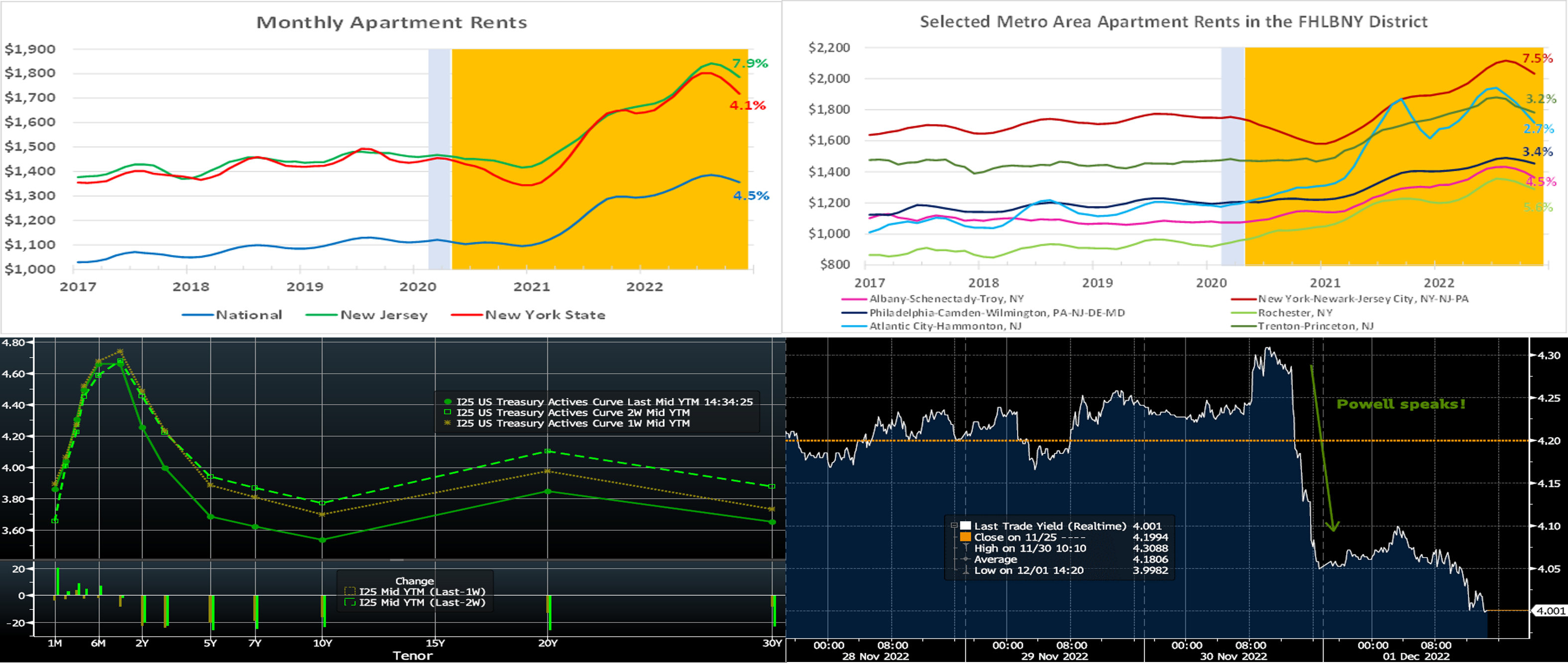

CHART 3 LOWER LEFT

Source: Bloomberg. Note: Top pane is yield (LHS,%), bottom pane is change (bps). UST yields, as of late Thursday, finished notably lower from our last edition two weeks ago, excluding very short tenors which now cross deeper into the expected Fed-hike zone. The 2-year-and-out sector is 20 to 25 bps lower than a few weeks ago. Much of the decline in yields occurred this past week, post remarks from Fed Chair Powell on Wednesday afternoon. Powell essentially indicated that a slower pace of hikes is forthcoming, while also noting that the peak fed funds rate is likely to be “somewhat higher” than the median projection (4.6%) from this past September’s FOMC. He also stated that a soft landing for the economy was still plausible. While the comments were, realistically, not earth-shattering, the market nonetheless pushed yields and Fed-pricing lower. Month-end bond fund buying, in tandem with short-covering by trading types, also likely played a role in the move. The market now prices for a 100% chance of a 50 bps hike at the December 14th FOMC and with ~5%, roughly unchanged from two weeks ago, probability of a 75 bps hike. The peak funds rate in spring 2023 last stands at ~4.88%, down from 5% of two weeks ago.

CHART 4 LOWER RIGHT

Source: Bloomberg. Here is a look at the 3-year UST yield (RHS, %) in 10-minute increments over the past week. For readers who may wonder why we often refer to “Fed-speak”, this chart provides context. Clear from the chart is the dramatic dip in yields on Wednesday afternoon, sparked by Powell’s comments. For those with term funding needs, such episodes provide excellent opportunities to obtain funding at relatively better levels. As a reminder, our advance rates move dynamically with the market, and we encourage members to engage with the desk for timely updates and color on markets and levels.

FHLBNY Advance Rates Observations

Front-End Rates

- Short-end rates are anywhere from 5 to 30 bps higher from our last edition two weeks ago, with the changes led by the 3-week to 2-month zone which have now crossed deep into the Fed hike expected at the December 14th FOMC; please see the prior slide for more market and Fed-pricing color. Economic data will provide further direction to rates this week.

- Given the Fed’s tightening and data-dependent posture, rates will remain highly responsive to the Fed and economic data, both of which will be sparser in the coming week.

Term Rates

- The longer-term curve finished lower from two weeks ago, roughly mirroring moves in the UST and swaps markets. The 2-year-and-out sector, as of Thursday afternoon, is ~20 to 22 bps lower. Kindly refer to the previous section for relevant market color. The advance curve remains inverted out to 5-year, thereby offering opportunities to extend in advance duration for minimal or lower coupon cost. The flat curve and high implied volatility environment also can serve to make putable advances more compelling.

- On the UST term supply front, this upcoming week offers a reprieve from auctions. Fed-speak will be absent, owing to the pre-December 14th FOMC blackout. Kindly call the Member Serivces Desk for information on market dynamics, rate levels, or products.

Product Alert: FHLBNY is pleased to announce the reintroduction, after a temporary suspension owing to Libor-cessation, of the Putable Advance, Fixed-Rate with SOFR Cap Advance, and ARC with SOFR Cap/Floor Advance. The Callable Advance continues to be offered. This expansion of the product menu will provide members with more options and flexibility for the management of funding and/or hedging needs.

Forward Start Advance (FSA): For members with upcoming borrowing or refunding plans, consider the FSA as a method to opportunistically “lock in” rates before advance settlement date. Please contact the Member Services Desk at (212) 441-6600 for more information.

The Symmetrical Prepayment Advance Feature

For those anticipating term funding needs, and with rates on an uptrend, it can be an appropriate juncture to consider our SPA feature. This feature allows the member to capture, at prepayment, changes in the fair value of the advance which are favorable to the member. Contact Member Service Desk to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.