Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week ending November 22, 2024.

Economist Views

Click to expand the below image.

Please note that the Weekly Update will return on December 6th; happy Thanksgiving.

Market participants will contend with a crowded economic release calendar ahead of Thanksgiving Day. Housing data is expected to be subdued, with both price gains and new home purchases decelerating during their respective reporting periods. By contrast, consumer sentiment probably improved markedly in November. Updates on merchandise trade, durable goods orders, and consumer spending in October will allow economists to update their tracking estimates for Q4 real GDP growth. While the Street is currently looking for a 1.7% annualized advance during the fall, projections from both the Atlanta and New York Federal Reserve Banks anticipate a third consecutive above-trend (>1.8%) gain.

S&P CoreLogic Case-Shiller 20-City Home Price Index: Home price increases probably slowed further across the twenty major metropolitan areas canvassed by SPCLCS in September, rising by .14% after a .35% increase in August. That projection, if realized, would place the SPCLCS barometer 4.5% above the level posted 12 months earlier.

New Home Sales: Mixed readings on single-family building permits and housing starts suggest that contracts to buy a newly constructed dwelling retreated by 2.4% to a seasonally adjusted annual rate of 720K in October, erasing almost two-thirds of September’s reported gain.

Conference Board Consumer Confidence: Preliminary soundings from the University of Michigan suggest that this gauge climbed to a nearly three-year high of 115.2 in November from 108.7 in the preceding month. Pay attention to the labor differential – the percentage of respondents believing that jobs are plentiful less those feeling positions are hard to get – for clues to any potential change in the civilian unemployment rate in the upcoming Bureau of Labor Statistics’ report.

Real GDP Growth: Data released following the Bureau of Economic Analysis’ advance report suggest that growth during Q3 will be little changed from the initial 2.8% annualized estimate.

Jobless Claims: Labor market conditions likely remained healthy during the period ending November 23, with initial claims for unemployment insurance benefits staying in a historically low 215K-225K band. The total number of persons receiving regular state benefits probably once again registered below 1.9mn during the week of November 16.

Durable Goods Orders: Powered by a commercial aircraft-led rebound in transportation equipment, durable goods orders likely jumped by 2.9% in October, erasing the 1.6% decline witnessed over the prior two months. Net of the projected strength in transportation, durable goods orders probably moved .4% higher, boosting the cumulative rise since July to 1.5%. Updates on nondefense capital goods shipments, excluding aircraft, will allow economists to update their tracking estimates of real business fixed investment during the fall quarter.

Personal Income & Spending: Capped by a slowdown in wage and salary disbursements, personal income likely climbed by .3% in October after a similar increase in September. Consumer spending growth probably continued apace during the reference period, rising by .5% for a second consecutive month. With the PCE chain price index expected to have moved .2% higher last month, real consumer spending likely rose by .3%, thereby placing October’s inflation-adjusted spending a healthy 2.4% annualized above its Q3 average.

Pending Home Sales: Home purchase mortgage applications suggest that contract signings probably edged .5% higher in October, following the 7.4% leap witnessed in September.

Federal Reserve:

- Nov. 26 Federal Reserve to release minutes from November 6-7 FOMC meeting.

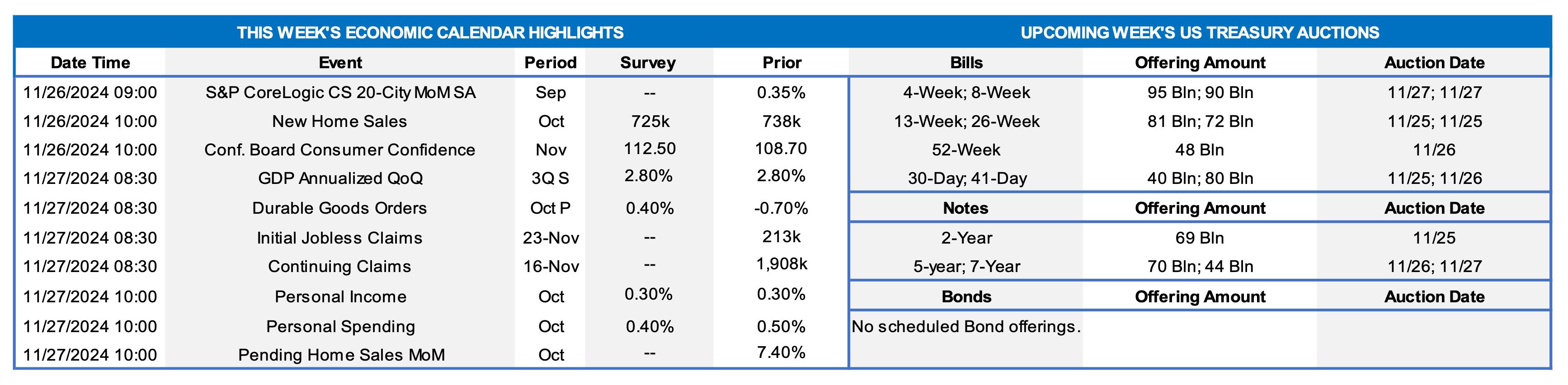

CHART 1 UPPER LEFT and CHART 2 UPPER RIGHT

Source: Apartment List; National Bureau of Economic Research. Notes: Blue-shaded areas denote recession; orange-shaded areas highlight the current economic expansion; percentage changes shown are from November 2023. Apartment rental growth rates have slowed or turned negative across the country and the FHLB-NY district. In contrast to the double-digit year-to-year gains witnessed during the early years of the current economic expansion, apartment rental costs are either slightly above or below those posted this time last year. Indeed, most of the monthly movements in apartment renters’ costs appear to be attributable to normal seasonal movements. This trend bodes well for the Federal Reserve and its goal of returning consumer price inflation back to the desired 2% target. While the Consumer Price Index, excluding volatile food and energy components, was 3.3% above its year-ago level in October, the extended core, which strips out shelter costs, registered at 2.1%.

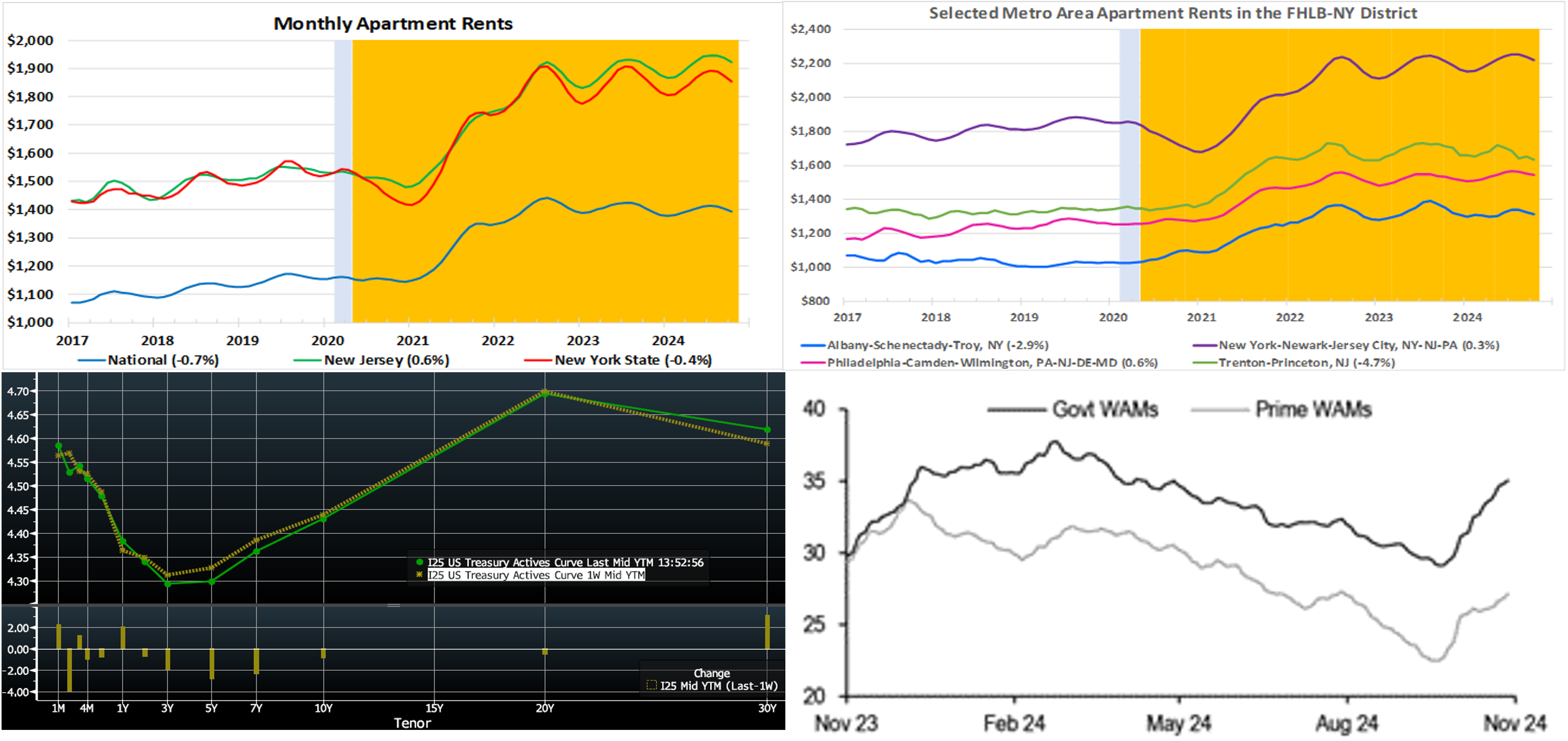

CHART 3 LOWER LEFT

Source: Bloomberg. Top pane is yield (LHS, %), bottom pane is change (LHS, bps). As of Thursday afternoon, the UST term curve moved a touch higher after a volatile week that was driven by geopolitical news. In terms of market-implied pricing of the Fed, for end-2024, the market forwards price for Fed Funds is ~4.44%, up ~2 bps from a week ago. The market prices end-2025 ~3.87%, rather unchanged from last week and now well above the Fed’s last median projection from its September FOMC meeting of 3.375%. The market’s end-2026 forward is ~3.68%, 13 bps lower than last week and notably higher than the Fed’s September long-run projection of 2.875%.

CHART 4 LOWER RIGHT

Source: Crane Data; JP Morgan. Shown here are the 5-day averages of Money Market Fund (MMF) weighted average maturities (WAM, LHS, days). While Prime fund WAMs have risen by 5 days in the past month, those for Government funds have risen by 6 days to 35 days. The increase in fund durations, in concert with record levels of MMF AUM, has underpinned demand for short-end paper. This dynamic has helped spreads on FHLB paper, which, in turn, benefits pricing on our advances. A convenient way to view the beneficial trend is via our floating rate advances; since early to mid-September, spreads on 3-month SOFR floating rate advances have tightened ~10 to 12 bps. Please call the desk to learn more and to discuss market trends.

FHLBNY Advance Rates Observations

Front-End Rates

- Short-end rates, as of mid-morning Thursday, were flat to 3 bps higher. Net T-bill issuance has increased in the past month, but robust Money Market Fund AUM levels have helped to absorb the short-end supply. MMFs, meanwhile, have recently extended duration, thereby helping our paper.

- The market will focus on economic data and Fed speakers in the week ahead.

Term Rates

- The longer-term curve, generally mirroring moves in USTs and swaps, was a 3-5 bps higher for 1y – 4y advances week-on-week, led by the 2yr which was higher by 5 bps. 5yr and greater advance rates were relatively flat. Kindly refer to the previous section for color on market dynamics and changes. We encourage members to engage with the Member Services Desk for current rate levels and market dynamics.

- On the UST term supply front, the upcoming week serves a slate of 2/5/7-year auctions before the holiday. Note that UST auctions usually occur at 1 pm and can occasionally spur volatility around that time. Please contact the Member Services Desk for further information on market dynamics, rate levels, or products. Note that our “800 number” is again ready for use at 1-800-546-5101 option 1.

Price Incentives for Advances Executed Before Noon: In effect as of Tuesday, September 5, 2023, the FHLBNY is pleased to now offer price incentives for advances executed before Noon each business day. These pricing incentives offer an opportunity to provide economic value to our members, while improving cash and liquidity management for the FHLBNY. For further details, kindly refer to the Bulletin.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.