Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week ending November 15, 2024.

Economist Views

Click to expand the below image.

Market participants will face a comparatively light economic release calendar in the upcoming week. Updates on housing activity are expected to be positive on balance. Jobless claims probably remained at historically low levels in their latest reporting periods, hinting at a sharp pickup in hiring and the possibility of a dip in the civilian unemployment rate in the Bureau of Labor Statistics’ November employment report. Consumer confidence likely rose in the wake of the 2024 elections. A pair of district Federal Reserve Bank Presidents – Austin Goolsbee of Chicago and Beth Hammack of Cleveland – are scheduled to make public appearances.

New York Fed Services Activity Survey: Service-producing activity across New York, northern New Jersey and western Connecticut probably rebounded in early November, with the current business activity diffusion index improving to 5% from -2.2% in October.

NAHB Housing Market Index: Weighed down by the recent backup in mortgage rates, homebuilder sentiment likely remained below the neutral 50-point for a seventh straight month in November.

Housing Starts & Building Permits: A combination of near-record high temperatures and all-time low precipitation suggests that the number of new housing units started and building permits issued rose sharply from the respective annualized rates of 1.35mn and 1.43mn posted in September.

Jobless Claims: Labor market conditions likely remained healthy during the period ending November 16, with initial claims for unemployment insurance benefits staying in a historically low 215K-225K band. The total number of persons receiving regular state benefits probably once again registered below 1.9mn during the week of November 9.

Leading Indicators: The Conference Board’s gauge of prospective economic activity is expected to have fallen for an eighth straight month in October, dipping by .3% from September. There remains little evidence that the economy is in immediate danger of faltering, however. Indeed, a model constructed by the Federal Reserve Bank of St. Louis estimated the probability that the economy was in recession in September at a negligible 1.02%.

Existing Home Sales: A snapback in home-purchase contract signings over the August-September span suggests that existing home sales climbed by 4% to a five-month high seasonally adjusted annual rate of 3.99mn in October. With the number of available homes on the market likely to expand by 1.4% to 1.41mn on a not seasonally adjusted basis during the reference period, the supply at the estimated sales pace would move one tick lower to 4.2 months.

Michigan Sentiment Index: Consumer sentiment probably improved further over the latter half of November, propelling the final estimate to a seven-month high of 73.5%.

Federal Reserve:

- Nov. 18 Chicago Fed President Austan Goolsbee to give welcome remarks at the Financial Markets Group Fall Conference.

- Nov. 21 Cleveland Fed President Beth Hammack to provide welcome remarks at the 2024 Financial Stability Conference.

- Nov. 21 Chicago Fed President Austan Goolsbee to participate in a Q&A with the Central Indiana Corporate Partnership.

- Nov. 21 Cleveland Fed President Beth Hammack to moderate a conversation with Sandra Thompson, Director of the FHFA.

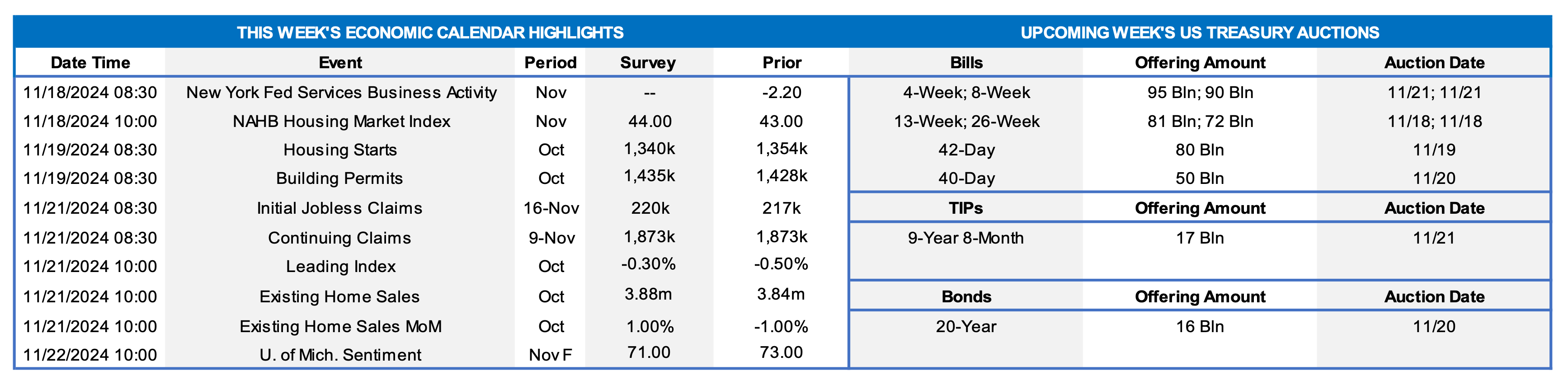

CHART 1 UPPER LEFT and CHART 2 UPPER RIGHT

Source: Federal Reserve Board; National Bureau of Economic Research. Note: Shaded areas denote recession. Per Chart 1, the Fed’s 2024 Senior Loan Officer Opinion Survey on Bank Lending Practices, or SLOOS, revealed that standards continued to firm, albeit at a decelerating pace, across all types of CRE loans – construction & land development, nonfarm residential, and multifamily – during Q3. Demand for CRE borrowings remained weak, again albeit at a decelerating pace, across the board in the latest canvass, per Chart 2. The net percentage of respondents reporting stronger demand for construction & land development loans registered at -14.8%, extending the streak of negative readings that began in the summer of 2021. The diffusion of nonfarm nonresidential lending improved to -9.8% after the -19% posted in the July edition. While up from the -17.5% witnessed during Q2, the -8.2% multifamily lending diffusion in the latest survey marked the ninth straight sounding in negative territory.

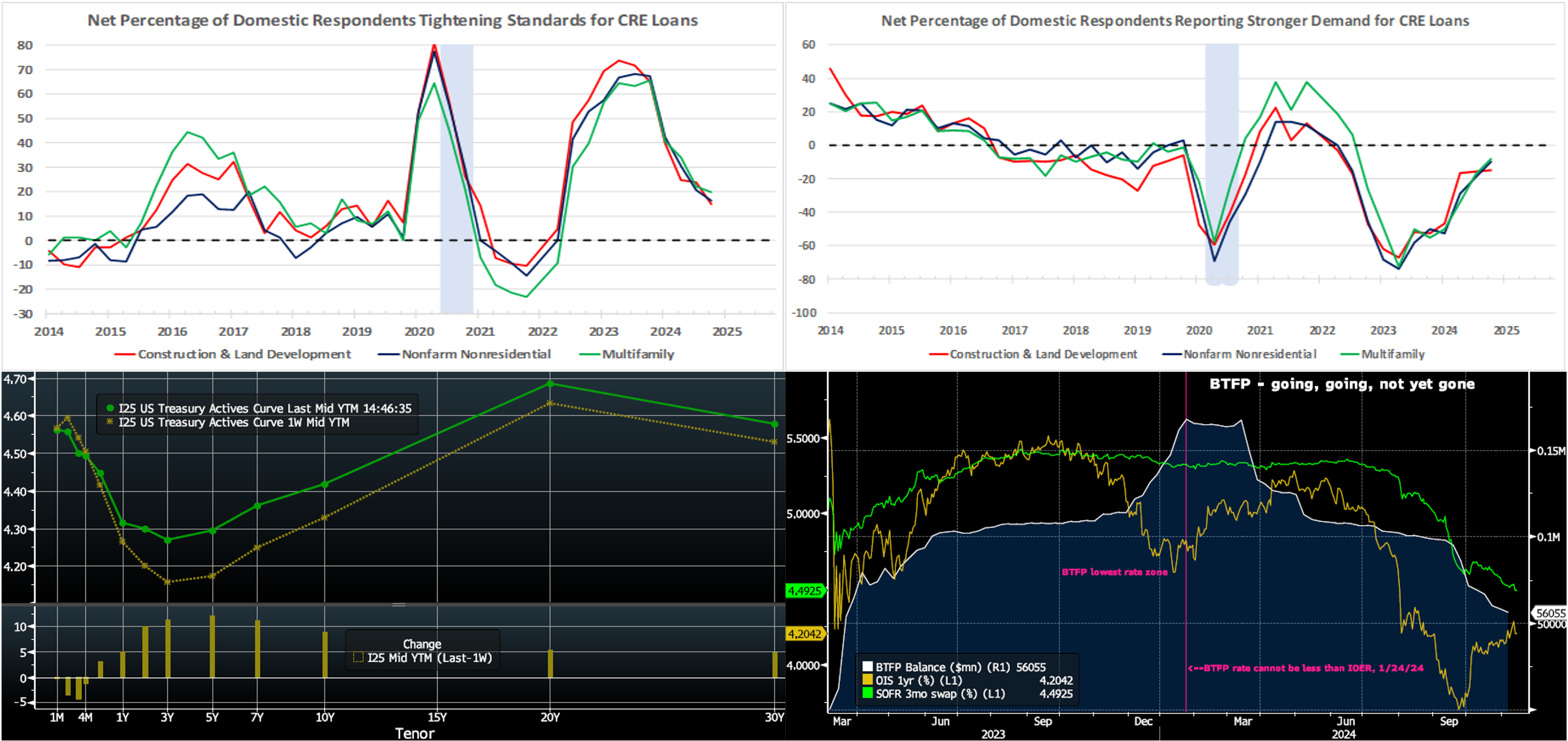

CHART 3 LOWER LEFT

Source: Bloomberg. Top pane is yield (LHS, %), bottom pane is change (LHS, bps). As of late Thursday, this holiday-shortened week, the UST term curve was higher from the week prior, led by the belly. While 1- and 2-year were 5 and 9 bps higher, respectively, the 5-year increased by ~12 and the 10-year by ~8 bps. Fed speakers were relatively mild market impact-wise, at least until Chair Powell sounded a cautious note late Thursday during this writing, thereby prompting a further 3 to 5 bps backup of the curve. The inflation data released this week, while likely not necessarily worrisome enough to prevent another Fed rate cut, nonetheless revealed a potential stalling of disinflationary trends. In turn, rates gravitated higher. In terms of market-implied pricing of the Fed, for end-2024, the market forwards price for Fed Funds is ~4.44%, up ~3 bps from a week ago. The market prices end 2025 ~3.87%, or 17 bps higher than last week and now well above the Fed’s last median projection from its September FOMC meeting of 3.375%. The market’s end-2026 forward is ~3.81%, 10 bps higher than last week and notably higher than the Fed’s September long-run projection of 2.875%.

CHART 4 LOWER RIGHT

Source: Bloomberg. Here we revisit a previously covered topic, in case it has slipped off any member’s radar. The Fed’s Bank Term Funding Program (BTFP) balance (White, RHS) has been on a steadily declining trend; indeed, after reaching a high of ~$168bn last January and the program’s subsequent end in March, it has fallen to ~$56bn. Clearly, many users captured the attractive BTFP rates, set at 1-year OIS plus 10 bps, of January, which was just prior to the Fed flooding the rate at the Interest on Excess Reserves (IOER) rate. With these BTFP loans maturing in early 2025 and no prepayment fees on them, it is instructive to review and compare them to current market and advance rates. As a proxy for short-rates, the 3-month SOFR swap rate (Green, LHS, %) currently trades at 4.49%. In this light, replacing BTFP loans now appears timely and sensible. As always, remember to incorporate the dividend in any analysis of our advance rates; please contact the desk for a copy of our “All-in Rate” tool, which can assist in determining the economic impact of the dividend.

FHLBNY Advance Rates Observations

Front-End Rates

- Short-end rates, as of mid-morning Thursday, were lower than a week ago. The Fed’s 25 bps cut last Thursday afternoon drove the Overnight advance lower by ~28 bps. Other tenors also declined but to a lesser degree, given that the cut was already priced into the curve. The 3-month declined by 6 bps, as it moved further into the timeline of potential further fed easing. Net T-bill issuance has increased in the past month, but robust Money Market Fund AUM levels have helped to absorb the short-end supply. MMFs, meanwhile, have recently extended duration, thereby helping our paper.

- The market will focus on economic data and Fed speakers in the week ahead.

Term Rates

- The longer-term curve, generally mirroring moves in USTs and swaps, was higher week-on-week, led by the belly. The 2-year was 8 bps higher, and the 5-year 11 bps higher. Kindly refer to the previous section for color on market dynamics and changes. We encourage members to engage with the Member Services Desk for current rate levels and market dynamics.

- On the UST term supply front, the upcoming week serves a 20-year nominal and a 10-year TIPS auction. Note that UST auctions usually occur at 1pm and can occasionally spur volatility around that time. Please contact the Member Services Desk for further information on market dynamics, rate levels, or products. Note that our “800 number” is again ready for use at 1-800-546-5101 option 1.

Price Incentives for Advances Executed Before Noon: In effect as of Tuesday, September 5, 2023, the FHLBNY is pleased to now offer price incentives for advances executed before Noon each business day. These pricing incentives offer an opportunity to provide economic value to our members, while improving cash and liquidity management for the FHLBNY. For further details, kindly refer to the Bulletin.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.