Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week ending November 10, 2023.

Economist Views

Click to expand the below image.

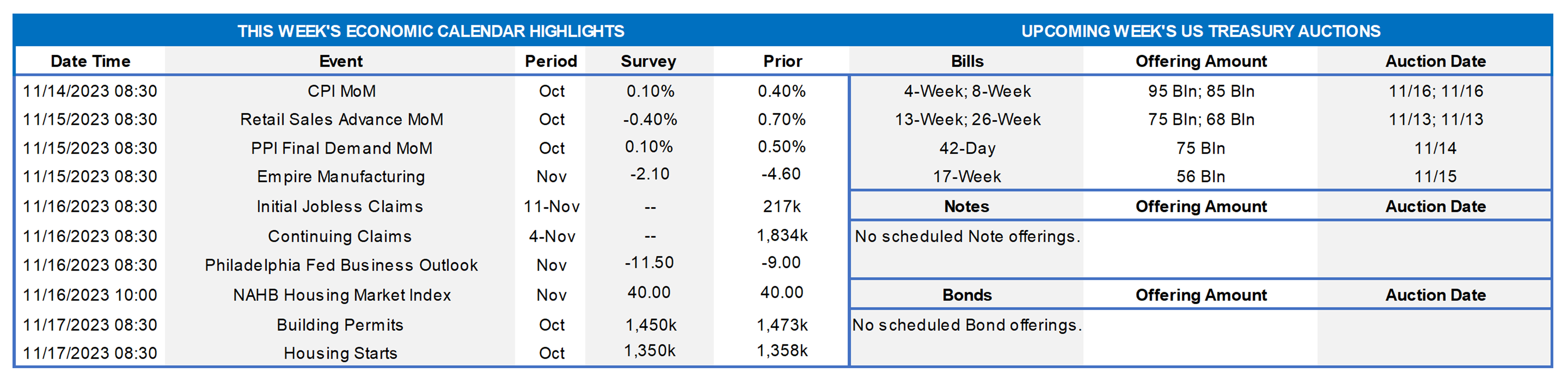

After a relatively quiet data week, the upcoming week serves a more high-profile set of releases. The economic data will be watched closely for clues on further deceleration in inflation, via the Consumer and Producer price index reports. The Retail Sales data release will reveal how consumer spending is faring. Other data this week includes Empire Manufacturing from New York State, the Philadelphia Fed Business Outlook, and Building Permits and Housing Starts.

Consumer Price Index: Economists call for a smaller increase compared to last month, .10% vs. last month’s .40% month-over-month increase.

Retail Sales: A pullback in Retail Sales is expected compared to last month – a decrease of 0.40% compared to last month’s surge of 0.70%.

Producer Prices: PPI this month is expected to come in lower at 0.10% compared to last month’s month-over-month 0.50%.

Empire Manufacturing: This weeks reading expected to still be weak from New York State, but economists forecast a slight improvement vs. October’s weaker print.

Initial and Continuing Claims: Initial claims came in slightly weaker this past week, while continuing a bit higher than estimates. Fair to say both data points will continue to hover around the 217k initial and 1,830k continuing for this week.

Building Permits: Economists expect a slightly weaker figure for this month compared to last – 1,450K estimate vs. 1,473K actual last month.

Housing Starts: Estimate for this release is a slightly weaker number vs. last month by 8K — 1,350K estimate vs. 1,358K actual last month.

Fed Speakers:

- 11/14 Chicago Fed President Goolsbee speaks on the Economy & Monetary Policy

- 11/16 New York Fed President Williams speaks at US Treasury Market Conference

- 11/16 Fed Governor Barr speaks at the US Treasury & Market Conference

- 11/17 San Francisco Fed President Daly speaks in Frankfurt

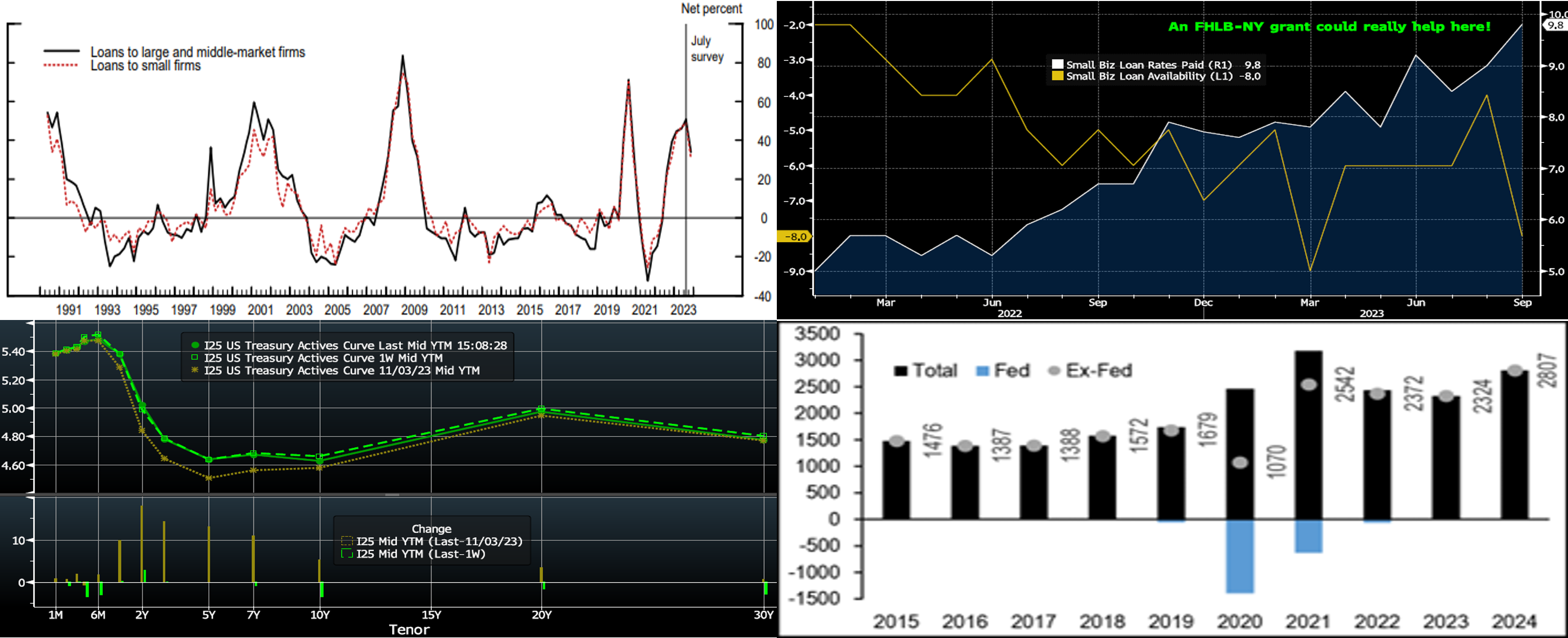

CHART 1 UPPER LEFT

Source: FRB Senior Loan Officer Opinion Survey on Bank Lending Practices (“SLOOS”). Released this past week and generally corresponding to Q3 activity, the October 2023 SLOOS addressed changes in the standards and terms on, and demand for, bank loans to businesses and households. Regarding loans to businesses, survey respondents, on balance, reported tighter standards and weaker demand for commercial and industrial (C&I) loans to firms of all sizes over the quarter. Furthermore, banks reported tighter standards and weaker demand for all commercial real estate (CRE) loan categories. For loans to households, banks reported that lending standards tightened across most categories of residential real estate (RRE) loans. Meanwhile, demand weakened for all RRE loan categories, not surprising given the surge in rates. Shown here is the “Net Percent of Respondents Tightening Standards for C & I Loans”. While loosening a bit from the July (Q2) survey, banks are overall still clearly in tightening mode.

CHART 2 UPPER RIGHT

Source: Bloomberg; National Federation of Independent Businesses (NFIB). Small businesses have encountered tightening credit conditions and higher borrowing costs. As seen here in the NFIB’s “Small Business Average Rate Paid on Short-term Loans” index (White, RHS, %), borrowing costs have soared since early 2022. And credit availability has notably declined in this same period, as seen in the “NFIB Small Business Credit Conditions Availability of Loans” index (Gold, LHS, diffusion index). The FHLB-NY’s Small Business Recovery Grant (SBRG) program can help mitigate these challenges for your small business customers. Applications for grants open at 8:30 a.m. (not before, applications received prior to 8:30 will be ineligible) this Monday November 13th. For full details on this easy-to-use program, kindly visit the SBRG webpage.

CHART 3 LOWER LEFT

Source: Bloomberg. Top pane is yield (LHS, %), bottom pane is change (LHS, bps). From last Thursday afternoon to this one, the UST curve is relatively unchanged. But it had moved lower on Friday 11/3 (see tan lines) post the slightly softer-than-expected jobs report. Yields remained lower through the week until reversing course this past Thursday afternoon; a weak 30-year UST auction followed by hawkish comments from Fed Chair Powell (speaking at IMF conference) were the catalysts of the reversal. The market will focus next on the upcoming week’s CPI data. In terms of market-implied pricing of the Fed, the peak Funds rate in February now stands at ~5.40%, a bp lower than last week and equating to ~28% chance of another 25 bps hike. The years 2024 and 2025 increased marginally from a week ago, with the year-end 2024 forward ~2.5 bps higher week-on-week, now ~4.548%.

CHART 4 LOWER RIGHT

Source: JP Morgan; US Treasury; FRB-NY. The Fed passed on a rate hike last week, but, as a reminder, the runoff of its securities portfolio continues apace and serves as a policy tightening tool. Here is a view of this dynamic and its impacts on fresh UST supply. Charted here is the gross duration supply (in $bn of 10-year UST duration equivalents) of USTs minus Fed purchases; note that late-2023 and 2024 are forecasts. In 2020-2021 and then a tad in 2022, Fed purchases (blue bars) offset some of the added supply. But this source of steady demand is no longer present, thereby adding an element of upward pressure on term rates. Last week’s lighter-than-expected UST refunding announcement, auctioned this past week, led to a decline in term yields owing to market relief that the supply could be more easily absorbed. Nonetheless, the absence of the Fed may continue to pose a challenge to growing UST supply in the year ahead.

FHLBNY Advance Rates Observations

Front-End Rates

- Short-end rates were down 3 to 4 bps week-over-week. Helping the decline was improved issuance levels and the market pricing Fed expectations a tad lower. Net T-bill supply remains positive, given announcements from Treasury regarding upsized auctions and issuance needs. But the supply continues to be absorbed relatively well, as Money Market Funds (MMFs) switch from the Fed’s RRP to T-bills with competitive yields. Moreover, although shy of the recent high points, MMFs currently stand near all-time high AUM levels.

- Economic data, particularly the CPI release, will likely be the main event this upcoming week.

Term Rates

- The longer-term curve, generally mirroring the moves in USTs and swaps, was modestly changed week-on-week, with shorter tenors up a few bps but the 5-year-and-out unchanged to a few bps lower.

- On the UST term supply front, the upcoming week serves a reprieve from auctions. Note that UST auctions usually occur at 1pm and can cause volatility around that time. Please contact the desk for further information on market dynamics, rate levels, or products.

FHLB-NY is pleased to announce that we will offer $5 million in grant funding under the 2023 Small Business Recovery Grant (SBRG) Program on November 13, 2023. The SBRG Program provides grant funds to benefit FHLB-NY members’ small business and non-profit customers. Please watch for updates and visit the SBRG webpage.

Price Incentives for Advances Executed Before Noon – In effect as of Tuesday, September 5, 2023 – The FHLB-NY is pleased to now offer price incentives for advances executed before Noon each business day. These pricing incentives offer an opportunity to provide economic value to our Members, while improving cash and liquidity management for the FHLBNY. For further details, kindly refer to the bulletin.

The Symmetrical Prepayment Advance Feature

For those anticipating term funding needs, and with rates on an uptrend, it can be an appropriate juncture to consider our SPA feature. This feature allows the member to capture, at prepayment, changes in the fair value of the advance which are favorable to the member. Contact Member Services Desk to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.