Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week ending November 8, 2024.

Economist Views

Click to expand the below image.

Having weathered the elections and another Fed ease, the market will contend with a busy economic data calendar and a plethora of public appearances by Federal Reserve officials. The Bureau of Labor Statistics’ update on consumer prices is expected to show that progress toward the desired 2% target stalled last month. October updates on retail sales and industrial production will allow economists to update their tracking estimates for Q4 real GDP growth. The current median Street estimate calls for a slowdown to a below-trend 1.7% annualized clip, following the 2.8% gain witnessed during the summer quarter. Jobless claims probably remained in recent ranges, hinting at the potential for a sharp snapback in nonfarm payrolls in November, after the weather-and strike-constrained 12K rise posted in October. A steady stream of monetary policymakers, including a quartet of FOMC voters, are slated to give their thoughts on a variety of timely topics.

NFIB Small Business Optimism Index: Sentiment likely improved in October, lifting the National Federation of Independent Business’ gauge to a 3-month high of 92 from 91.5 in the preceding month.

Consumer Prices: Consumer prices probably continued apace in October. Capped once again by lower gasoline pump prices, the Consumer Price Index (CPI) probably edged .2% higher for a fourth straight month. Excluding volatile food and energy costs, the so-called core CPI is expected to have risen by .3% during the reference period, matching reported August and September gains. Those projections would place the overall and core CPIs 2.5% and 3.3% above their respective year-ago levels.

Jobless Claims: Labor market conditions likely remained healthy during the period ending November 9, with initial claims for unemployment insurance benefits staying in a historically low 215K-225K range. The total number of persons receiving regular state benefits probably once again registered below 1.9mn once again during the week of November 2.

Empire State Manufacturing Survey: Manufacturing activity in New York State probably stabilized in early November, with the general business conditions diffusion index – the percentage of respondents experiencing a pickup less those witnessing a decline – returning to zero from the surprisingly weak -11.9% reading posted in the prior month.

Retail & Food Services Sales: Powered by an anticipated pickup in auto-dealership revenues, sales probably climbed by .8% in October, after a .4% gain in September. Net of a projected 2.9% jump in vehicles, retail sales likely edged .3% higher, following a .5% prior-month rise. As always, watch “control” sales excluding auto, building materials and gas for clues to the pace of spending at the beginning of Q4. Barring any prior-month revisions, a .4% rise would place core purchases in October 3.8% annualized above their July-September average, after a solid 6.5% annualized Q3 advance.

Industrial Production & Capacity Utilization: Production at the Nation’s factories, mines and utilities likely dipped by .2% in October, after a .3% decline in September. With additions to productive capacity expected to eclipse output during the reference period, the aggregate operating rate probably retreated to a nine-month low of 77.2%.

Federal Reserve:

- Nov. 12 Fed Governor Waller to deliver a speech and participate in moderated Q&A at the Clearinghouse 2024 conference.

- Nov. 12 Federal Reserve to release Senior Loan Officer Opinion Survey on Bank Lending Practices.

- Nov. 12 Philadelphia Fed President Harker to speak about Fintech, AI and the changing financial landscape at Carnegie Mellon.

- Nov. 13 Dallas Fed President Logan to give opening remarks at an energy conference hosted by the FRBs of Dallas and KC.

- Nov. 13 St. Louis Fed President Musalem to speak on the US economy and monetary policy.

- Nov. 14 Fed Chair Powell to speak before the Dallas Regional Chamber, Dallas Fed and World Affairs Council of DFW.

- Nov. 14 New York Fed President Williams to give a speech on “Making Missing Markets” at a New York Fed event.

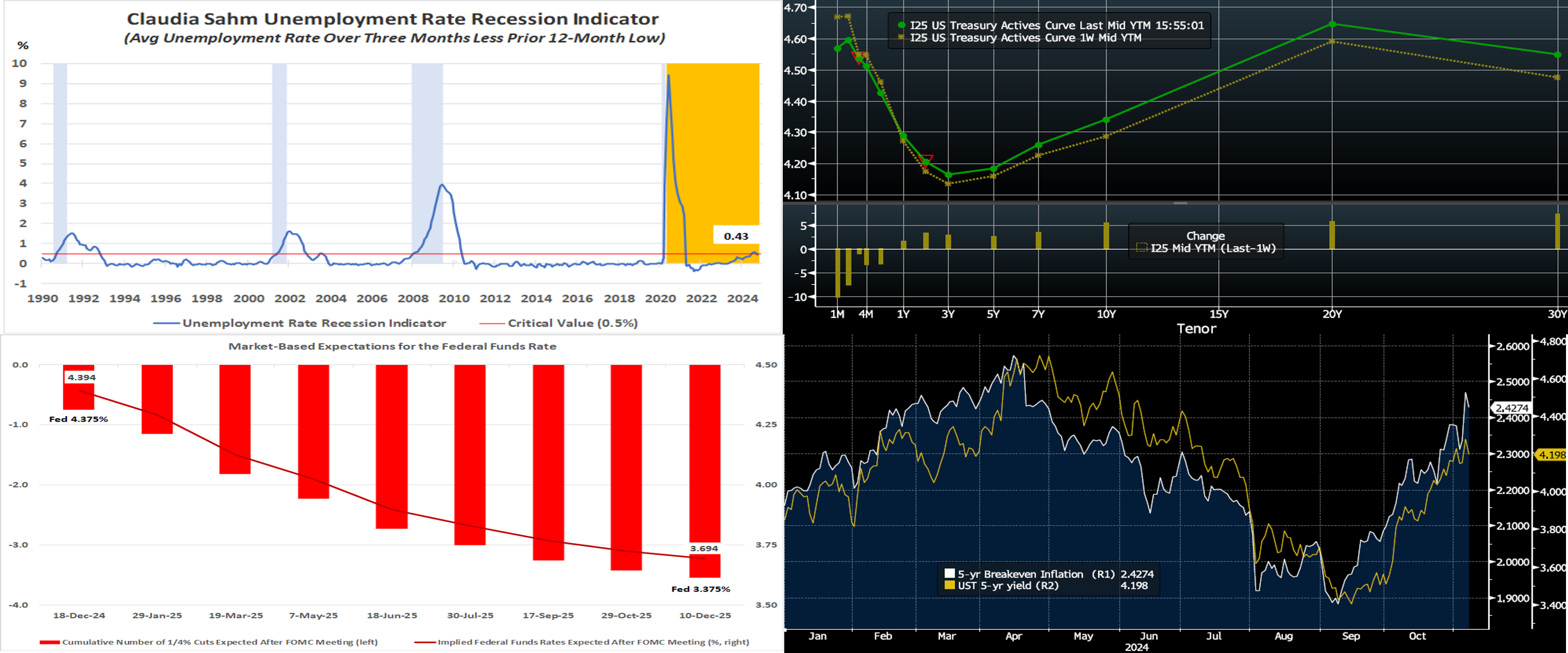

CHART 1 UPPER LEFT

Source: Bureau of Labor Statistics; National Bureau of Economic Research; FHLBNY. Notes: Blue-shaded areas denote recessions; orange area highlights current economic expansion. While adverse weather conditions and strikes ground net job creation to a near halt in October, there was some encouraging news in last month’s employment report. The labor-market recession metric developed by former Federal Reserve Economist Claudia Sahm – the average unemployment rate over the latest three months less its prior 12-month low – retreated to a four-month low of 0.43%, back below the critical 0.5% mark associated with the beginning of previous business-cycle downturns.

CHART 2 UPPER RIGHT

Source: Bloomberg. Top pane is yield (LHS, %), bottom pane is change (LHS, bps). As of Thursday afternoon, after notable events including elections and the FOMC meeting, the UST term curve moved higher week-on-week and thereby kept its recent trend intact. The 5-year was ~3 bps higher, while the 10-year rose ~6 bps. In terms of market-implied pricing of the Fed, for end-2024 the market forwards price for Fed Funds ~4.41%, the same as a week ago. The market prices end-2025 ~3.70%, or 12 bps higher than last week and now well above the Fed’s last median projection from its September FOMC meeting of 3.375%. The market’s end-2026 forward is ~3.71%, ~8 bps higher than last week and notably higher than the Fed’s September long-run projection of 2.875%. For more information on the FOMC outcome and a view of market pricing, please refer to the next chart.

CHART 3 LOWER LEFT

Source: Bloomberg. As expected, the FOMC cut the fed funds rate target range by 25 bps to 4½% to 4¾%. There were only minor tweaks to the post-meeting statement relative to September’s. Acknowledging recent job reports, the communique noted that labor market conditions have generally eased since early-2024. It reiterated that the unemployment rate has increased but remains low. Policymakers removed the observation that inflation has made “further” progress toward the 2% goal. The reference to gaining greater confidence that inflation is moving sustainably toward target was also omitted. The risks to achieving its employment and inflation goals were deemed roughly in balance. Shown here is the post-FOMC pricing, via forwards, of Fed policy through end-2025.

CHART 4 LOWER RIGHT

Source: Bloomberg. Term yields have risen precipitously since mid-September, as can be seen here in the trend of the UST 5-year yield (Gold, RHS-2, %, pre-FOMC meeting) which has risen ~80 bps in that timeframe. A predominant portion of this increase appears related to heightened inflation concerns related to ongoing solid economic data and the added potential for government policy-related tax cuts, tariffs, and deficits. Indeed, as can be seen here, the 5-year Breakeven Inflation rate derived from TIPS (Treasury Inflation Protected Securities — Breakeven is derived by subtracting the TIPS yield from that of the UST 5-year yield) has increased ~55 bps since mid-September from ~1.88%, near the Fed’s desired 2% target, to now ~2.43%. Given that the Fed just cut rates by another 25 bps, these moves may seem counterintuitive; essentially, the market is pricing for greater uncertainty and volatility in the months ahead. This topic arose in the FOMC press conference in which Chair Powell acknowledged the rise in “Breakevens” but that the longer-term, or more forward-looking, 5-year forward Breakeven was more contained; this measure is indeed closer to the 2% target but, at ~2.30%, still above it. The upcoming week’s inflation data may prove impactful on these conditions.

FHLBNY Advance Rates Observations

Front-End Rates

- Short-end rates, midday Thursday prior to the FOMC meeting, were lower form the week prior, given that maturity points have crossed further into the Fed-easing timeline. The 1-week was 19 bps lower, 1-month 10 bps lower, 3-month 7 bps lower, and 6-month 1 bp lower. Net T-bill issuance has increased in the past month, but robust Money Market Fund AUM levels have helped to absorb the short-end supply. MMFs may become more willing to extend maturity now that the past week’s events are in the rearview mirror.

- The market will focus on economic data and the plethora of Fedspeak in the holiday-shortened week ahead.

Term Rates

- The longer-term curve, generally mirroring moves in USTs and swaps, was 4 to 6 bps higher on the week. The 5-year increased by 5 bps week-on-week. Kindly refer to the previous section for color on market dynamics and changes. We encourage members to engage with the Member Services Desk for current rate levels and market dynamics.

- On the UST term supply front, the upcoming week serves a reprieve from auctions. Note that UST auctions usually occur at 1pm and can occasionally spur volatility around that time. Please contact the Member Services Desk for further information on market dynamics, rate levels, or products. Note that our “800 number” is again ready for use at 1-800-546-5101 option 1.

Price Incentives for Advances Executed Before Noon: In effect as of Tuesday, September 5, 2023, the FHLBNY is pleased to now offer price incentives for advances executed before Noon each business day. These pricing incentives offer an opportunity to provide economic value to our members, while improving cash and liquidity management for the FHLBNY. For further details, kindly refer to the Bulletin.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.