Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week ending November 1, 2024.

Economist Views

Click to expand the below image.

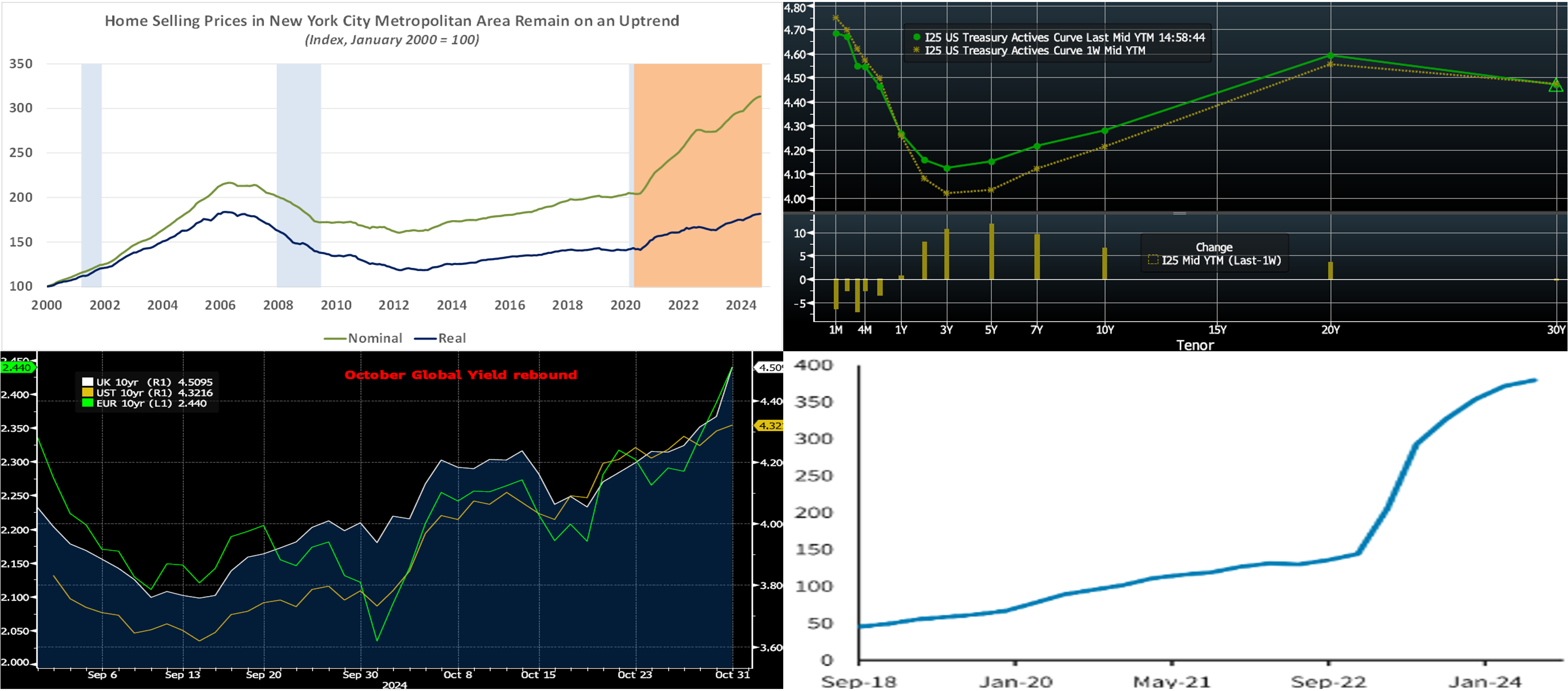

While the outcome of the 2024 elections will occupy center stage this week, the Federal Open Market Committee (FOMC) will also meet to determine any changes in administered rates. Market-based expectations, which had entertained the possibility of another 50 bps cut at the time of the FOMC’s mid-September gathering, have receded and now anticipate a 25 bps reduction in the fed funds target range to 4.5-4.75%. The post-meeting communiqué likely will reiterate that economic activity has continued to expand at a solid pace, although job gains have slowed, and the unemployment rate has risen but remains at a low level. The statement probably will repeat that the FOMC has gained greater confidence that inflation is moving sustainably toward the desired 2% target and that the risks to achieving the goals of the Fed’s dual mandate are roughly in balance. In considering additional adjustments to the federal funds rate, the FOMC will carefully assess incoming data, the evolving outlook, and the balance of risks. The FOMC likely will continue to reduce its holdings of UST and agency debt and agency MBS at the pace set out at the April meeting, with monthly redemption caps on UST’s at $25bn and that on agency debt and agency MBS at $35bn, with any amount above the caps reinvested in UST’s. To date, runoffs of maturing securities have pared the System Open Market Account, or SOMA, to $6.6trn from the $8.5trn peak reached in April 2022. The economic release calendar will be light with the Institute for Supply Management’s update on service-producing activity receiving the most attention.

Factory Orders: A tug of war between lower durable goods and rebounding nondurables bookings probably left orders .3% lower in September, following a downwardly revised .6% decline in August.

International Trade Balance: Opposing and unfavorable movements in merchandise exports and imports likely propelled the combined deficit on international trade in goods and services to a 28-month high of $84bn in September from $70.4bn shortfall posted in the prior month.

ISM Service-Producing Activity Index: The expansion in service-producing activity probably widened in October, lifting the barometer to a 27-month high of 56% from 54.9% in September.

Nonfarm Productivity & Costs: Productivity in the nonfarm business sector is expected to have slowed marginally to a seasonally adjusted annual rate of 2.3% during Q3, following a 2.5% advance during the spring.

Jobless Claims: Labor market conditions likely were firm during the period ending November 2, with initial claims for unemployment insurance benefits remaining in a 210K-230K range. The total number of persons receiving regular state benefits probably clocked in near 1.85mn during the week of October 25.

Consumer Credit: Consumer installment credit growth probably reaccelerated as the summer quarter ended. The median economist forecast calls for a $13.5bn increase in September, after an $8.9bn takedown in the prior month. Unit labor costs are expected to have remained in check during the summer, climbing by 1% annualized following a modest .4% Q2 gain.

Michigan Sentiment Index: The improvement in consumer confidence witnessed over the latter half of October likely continued in early November, lifting the gauge to a seven-month high of 73.5.

Federal Reserve:

- Nov. 7 Federal Open Market Committee monetary policy decision released.

- Nov. 7 Federal Reserve Chair Powell to hold post-meeting press conference.

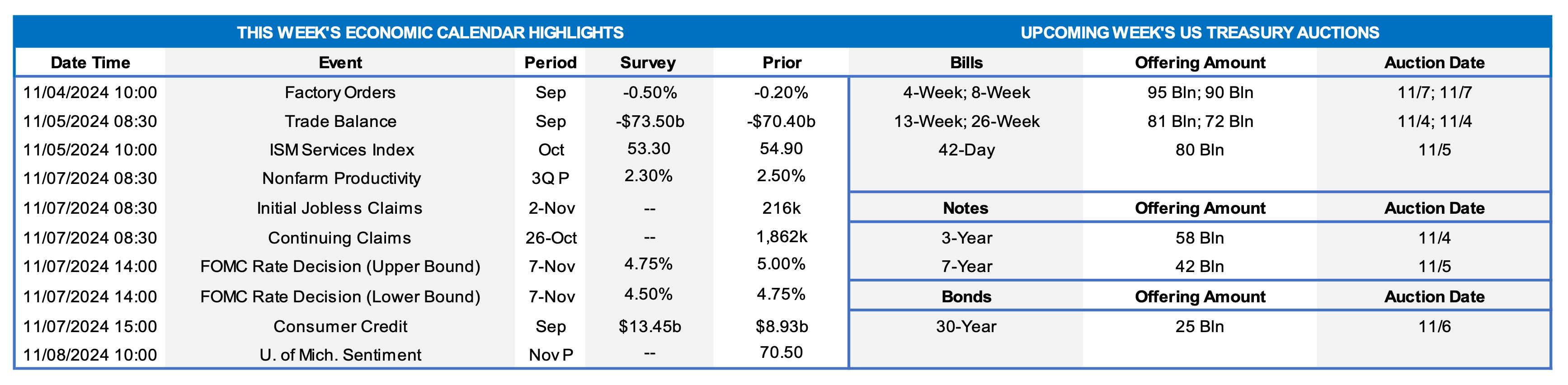

CHART 1 UPPER LEFT

Source: National Bureau of Economic Research; S&P CoreLogic Case-Shiller; FHLB-NY. Notes: Blue-shaded areas denote recessions; orange-shaded highlights current economic expansion. Home selling prices remained on an uptrend in the New York City (NYC) metropolitan area in August. S&P CoreLogic Case-Shiller (SPCLCS) reported that nominal selling prices climbed by 0.3% during the reference period – the 20th consecutive monthly rise. Over the latest 12 months, home prices have risen by 8.1%, outpacing the SPCLCS 20-City average of 5.2% by a significant margin. Adjusting for consumer price inflation excluding shelter costs, real home prices have climbed by 5.7% since August 2023 and now stand just 1.2% shy of the record high set in March 2006 before the onset of the Great Financial Crisis.

CHART 2 UPPER RIGHT

Source: Bloomberg. Top pane is yield (LHS, %), bottom pane is change (LHS, bps). As of Thursday afternoon, and keeping the month’s trend intact, the UST term curve was higher week-on-week. While the 2-year rose ~8 bps, the 5-year was ~12 bps higher. The Fed was in blackout mode in the lead-up to the upcoming week’s FOMC meeting. Economic data continued to reflect a sturdy economy, with a solid Q3 advance GDP report and steady jobs-related data. Inflation-related measures portrayed good improvement albeit still a tad above Fed targets of 2%. In terms of market-implied pricing of the Fed, for end-2024 the market forwards price for Fed Funds ~4.41%, a tad above the Fed’s latest “dot plot” projection of 4.375%. The market prices end-2025 ~3.60%, or 13 bps higher than last week and now above the Fed’s last median projection from its September FOMC meeting of 3.375%. The market’s end-2026 forward is ~3.63% which is notably higher than the Fed’s long-run projection of 2.875%.

CHART 3 LOWER LEFT

Source: Bloomberg. The notable rebound in yields in the past month has not been in a vacuum, as global investors have pushed yields higher across multiple large bond markets. Here can be seen, as of midday Thursday, the rise in not only the 10-year UST yield (Gold, RHS, %) but also that of the UK 10-year (White, RHS, %) and Euro 10-year (Green, LHS, %). While the UST has risen ~67 bps from its mid-September level, the UK yield has increased by ~75 bps since mid-September and the Euro yield by ~40 bps since end-September. These observations serve as a reminder that global bond markets can be interconnected, with many of them sharing similar themes related to budget deficits and debt issuance levels.

CHART 4 LOWER RIGHT

Source: SNL; Barclays Research. Reciprocal deposits (LHS, $bn) have markedly increased in the past two years. Reciprocal deposit networks help solve the problem of obtaining FDIC insurance on larger deposits over the $250K limit. A bank can spread large balances and swap FDIC insured-eligible lots with other banks in the network. In this way, bank customers obtain FDIC insurance and can maintain an account at a single bank. These larger customer accounts often belong to high net-worth individuals or businesses and so, in this way, provide a means to insure otherwise potentially uninsured and flight-prone deposits. Despite this clear positive attribute, these deposits account for only 2% of all bank deposits. Partly this small overall share is due to banks under $100bn, rather than the largest banks, holding the largest concentration. Also, regulatory caps limit higher balances; currently banks can treat the lesser of $5bn or 20% of total liabilities in reciprocal deposits as “core” deposits and thereby avoid higher FDIC insurance assessments. Time will tell, but perhaps regulators will look to fine-tune these caps, given that the product can improve stability of deposits.

FHLBNY Advance Rates Observations

Front-End Rates

- Short-end rates were mixed week-over-week. The shortest tenors 1-week-and-in rose by 4 bps on month-end and UST settlement dynamics. The 2- to 3-week zone dipped by 4 or 5 bps, as these tenors now cross further into the timeline of the Fed’s expected rate cut in the upcoming week. The 1-month-and-out sector was generally unchanged on the week. Net T-bill issuance has increased this month, but robust Money Market Fund AUM levels have helped to absorb the short-end supply. MMFs may become more willing to extend maturity once past the events of the upcoming week.

- The market will focus on the upcoming FOMC and elections. Fedspeak will be in blackout mode until the FOMC release.

Term Rates

- The longer-term curve, generally mirroring moves in USTs and swaps and led by the belly tenors, moved higher week-on-week. While the 2-year rose 10 bps, the 5-year increased by 12 bps. Kindly refer to the previous section for color on market dynamics and changes. We encourage members to engage with the Member Services Desk for current rate levels and market dynamics.

- On the UST term supply front, the upcoming week serves 3/10/30-year auctions which perhaps could be challenging to absorb, given the week’s potentially high-impact events. Note that UST auctions usually occur at 1pm and can occasionally spur volatility around that time. Please contact the Member Services Desk for further information on market dynamics, rate levels, or products. Note that our “800 number” is again ready for use at 1-800-546-5101 option 1.

Price Incentives for Advances Executed Before Noon: In effect as of Tuesday, September 5, 2023, the FHLBNY is pleased to now offer price incentives for advances executed before Noon each business day. These pricing incentives offer an opportunity to provide economic value to our members, while improving cash and liquidity management for the FHLBNY. For further details, kindly refer to the Bulletin.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.