Member Services Desk

Weekly Market Update

Economist Views

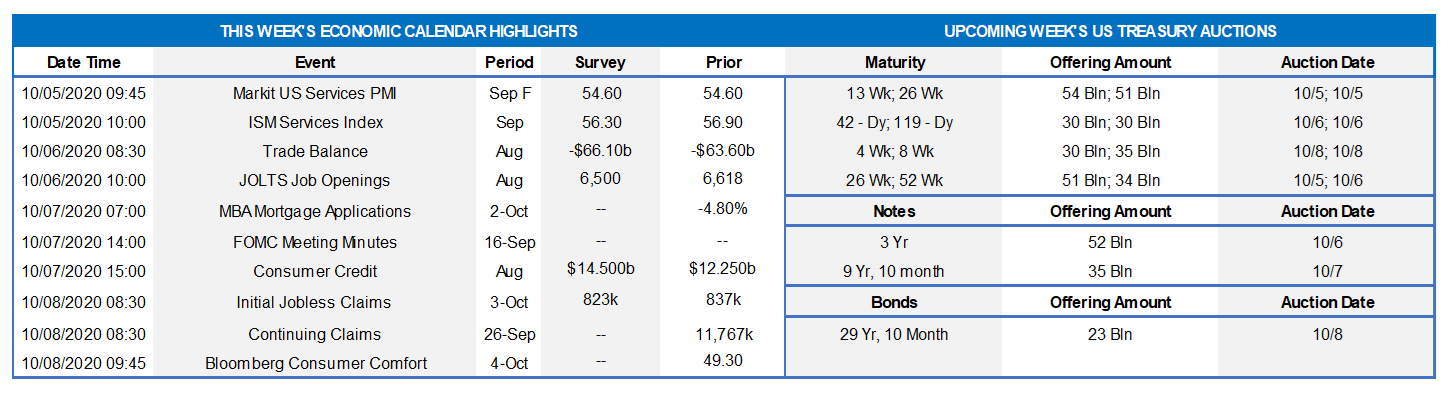

Click to expand the below image.

Having weathered the Bureau of Labor Statistics’ (BLS) update on the employment situation in September, market participants will have a series of second-tier economic reports to contend with this week. Federal Reserve officials will make almost a dozen public appearances this week to discuss a variety of topics, but Chair Powell’s Tuesday talk to the National Association for Business Economics (NABE) in Chicago will likely receive the most attention.

ISM Non-Manufacturing Activity Index: Available Fed district bank surveys suggest that service-sector activity rebounded in September, propelling the ISM’s barometer to a two-year high of 60.5.

Merchandise Trade Balance: Consistent with recent improvements in economic activity, the merchandise trade gap likely widened to a record $66bn in August from $63.6bn in July.

JOLTS Job Openings: A reported pickup in online jobs postings suggests that the BLS’ tally of available positions climbed to a six-month high of 6.73mn in August. Even if accurate, the projected number of job openings would be less than half the 13.55mn persons unemployed in that month.

Jobless Claims: Online inquiries for how to file for unemployment insurance benefits suggest that initial claims dipped to 825K during the period ended October 3, after an 837K tally the prior week. While a 29-week low, that count would still be well above the 233K average that prevailed before the COVID-19 pandemic struck with a vengeance in late March.

Federal Reserve Appearances:

Oct. 5: Chicago Fed President Evans to give luncheon speech at local NABE meeting.

Oct. 5: Atlanta Fed President Bostic to speak on regulating financial technology.

Oct. 6: Philadelphia Fed President Harker to discuss machine learning.

Oct. 6: Fed Chair Powell to address NABE conference in Chicago.

Oct. 6: Atlanta Fed President Bostic to speak about and inclusive recovery.

Oct. 6: Dallas Fed President Kaplan to participate in conversation with Bank of Mexico’s Diaz.

Oct. 7: Fed Presidents Rosengren (Boston), Bostic (Atlanta), and Kashkari (Minneapolis) in virtual conference on racism and the economy.

Oct. 7: FOMC minutes from September 16 meeting released.

Oct. 7: N.Y. Fed President Williams to moderate Henry Kissinger discussion.

Oct. 7: N.Y. Fed President Williams to speak about flexible average inflation targeting.

Oct. 7: Chicago Fed President Evans to discuss U.S. economy and monetary policy.

Click to expand the below images.

CHART 1 – UPPER LEFT

Source: BLS; FHLBNY. In the wake of this past Friday’s employment report, the broadest takeaway is that the recovery continues but still has a long row to hoe. The U.S. has reclaimed a little over half of the jobs lost in the wake of the COVID-19 pandemic. While all industries have significant ground to recover to return to their February payroll levels, three of the hardest hit service-producing segments, namely retail trade, leisure & hospitality, and educations & health, have made significant progress over the past four months.

CHART 2 – UPPER RIGHT

Source: Bloomberg. The UST curve remains mired in a tight range, particularly the 5-year and shorter sector. As has been the case in recent months, the Fed’s guidance and programs have served to pin the shorter maturities, and so it has been the longer end of the curve leading any moves. This past week experienced some mild “bear steepening”, with the 10-year and longer yields rising a few basis points. The move had been larger on Thursday, but uncertainty instilled to the markets from the President’s COVID case, along with the somewhat tamer job report, caused the move to ebb.

CHART 3 – LOWER LEFT

Source: Mortgage Bankers Assoc.; Goldman Sachs Research. Jumbo mortgage rates remain slightly elevated to conforming levels. Factors in this condition are likely global investor demand for liquid and higher credit (via the Agency guarantee) securities that are backed by conforming mortgages, i.e. MBS.

CHART 4 – LOWER RIGHT

Source: Bloomberg. Depicted here (in $bn) is bank holdings of Agency mortgage securities (RHS), or MBS, vs. residential loans (LHS). Owing to massive deposit levels, banks have been large buyers of the increased MBS production over the last six months; yet, mortgage loans have been on a downward trend. Despite the higher relative yield on loans (note that the yield differential is larger than displayed in our CHART 3, due to the guarantee fees charged by the Agencies on the conforming loans backing MBS). Many banks may be opting for MBS over loans because of credit reasons and/or MBS’ more optimal treatment in capital and liquidity (LCR) requirements. For those without such constraints, there may be opportunity in loans to increase portfolio yield and net interest margins.

FHLBNY Advance Rates Observations

Front-End Rates

Short-end advance rates finished unchanged to 1bps higher week-over-week. Heavy T-bill issuance was a feature, as usual, but net supply has been slowing and thereby allowing for easier market absorption. Money market funds experienced ~$10.3bn of outflow on the week. Overall market supply of short paper has moderated in recent months, however, thereby blunting the impact of these investor outflows.

Heavy T-Bill issuance will remain a theme; UST issuance overall is now net positive supply in that more is being issued than what the Fed is buying in its programs, and so this scenario could prove a small challenge. However, with short UST rates at rock-bottom levels, and the Fed likely on hold for a long period, rates may trade in a sideways pattern. Net T-bill issuance has been lower since mid-summer, and Treasury has announced plans to shift issuance out the curve, but a new fiscal relief package may complicate/alter this forecast.

Term Rates

Medium and longer-term advance rates were unchanged to a few bps higher on the week, in a very slight “bear steepening” move. Rates 5-year and shorter remain pinned in an extremely tight range, and so again it was the portion of the curve past 5-year that led the week’s move. Late in the week, the curve retraced from higher levels when White House COVID-19 case announcements injected some uncertainty and a mild “risk-off” tone in the market.

Rates are at record low levels across the yield curve, and the curve is priced for the Fed to be on hold for several years. If suitable or sensible from an ALM perspective, it may be worthwhile to consider extending liabilities and locking in term rates. Note that the impending election has the potential to spur moves in the curve and rates. Please call the Member Services Desk to discuss rate levels and potential ideas on extending existing higher-rate advances.

Next week features fresh UST 3/10/30-year auctions. Given the current market climate and Fed guidance, these auctions should be absorbed without any impact. Corporate issuance may add further to its historic record pace. Attention will remain on the prospects of further relief legislation and certainly also on COVID-19 developments.

The Symmetrical Prepayment Advance Feature

With rates at or near multi-year lows, it is a compelling juncture to use the SPA feature on term advances. This feature allows member to capture, at prepayment, changes in the Fair Value of the advance which are favorable to the member. Contact us to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the

MSD Team.

Special Member Alert

The FHLBNY recently announced a newly expanded and flexible Disaster Relief Funding (DRF) advance program which offers discounted rate advances with maturities 1-mo and greater. Additionally, we have announced that PPP loans will be accepted as eligible collateral. Please contact us with any questions.