Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week ending September 20, 2024.

Economist Views

Click to expand the below image.

Having digested the Federal Open Market Committee’s pivot to a more accommodative monetary policy stance, market participants will face a crowded calendar of reports and policymaker appearances. Consumer confidence soundings for September are expected to show further improvement. New home sales probably improved as the summer progressed, while durable goods bookings gave back some of July’s jetliner-related leap. Jobless claims likely remained rangebound, suggesting little change in labor market conditions heading into the September employment report. Government statisticians will release annual revisions to the national income series going back to 2019, which could recast the recovery from the COVID-19 pandemic. A steady stream of appearances by Federal Reserve officials, including almost a dozen current FOMC voters, may provide useful color on the recent shift in monetary policy.

S&P CoreLogic Case-Shiller (SPCLCS) 20-City Home Price Index: Prices likely rose in July by .19% after a .42% increase in June, thereby reaching 5.6% above the level posted 12 months earlier.

Conference Board Consumer Confidence: The gauge likely climbed to an eight-month high of 105 in September from 103.3 in the previous month. Pay attention to the labor differential – the percentage of respondents believing that jobs are plentiful less than those feeling positions are hard to get – for clues to the likely change in the civilian unemployment rate this month.

New Home Sales: Weather-related rebounds in single-family permits and starts suggest a rise of 4.2% to a SAAR of 770K in August – the strongest since the 781K contracts signed in February 2022.

Jobless Claims: Initial claims for unemployment insurance benefits likely remained in a tight 225K to 235K range during the filing period ended September 21. Keep an eye on continuing claims, which have been traveling on a saw-toothed path below 1.9mn over the past two months, for signs that recently furloughed employees are having a more challenging time finding work.

Durable Goods Orders: Prompted by a commercial aircraft-led pullback in transport equipment bookings, durable goods orders probably declined by 1.6% in August, reversing a portion of the surprising 9.8% jump witnessed in July. Net of the anticipated weakness in transport requisitions, durable goods orders likely edged 0.3% higher, erasing the .2% prior-month dip.

Real GDP Growth: The Bureau of Economic Analysis’ (BEA) final pass at Q2 real GDP growth is expected to be little changed from the 3% annualized clip of the preliminary report. However, more uncertainty than usual surrounds that estimate. The BEA plans to release results from the 2024 annual update of the National Economic Accounts (NEAs). The update of the NEAs will cover Q1-2019 through Q1-2024 and will result in revisions to GDP and income statistics. The reference year for index numbers and chained-dollar estimates will remain 2017.

Pending Home Sales: Weekly soundings on home-purchase mortgage applications suggest that pending home sales probably declined by 2% to a new record low in August.

Personal Income & Consumer Spending: Powered by an anticipated pickup in private-sector wage and salary disbursements, personal income likely climbed by .5% in August, besting the .3% gain posted in July. By contrast, consumer purchases of goods and services probably slowed, rising by .3% after a .5% prior-month advance.

Michigan Consumer Sentiment Index: To be released on the 27th — Modest improvement is again likely, lifting the full-month barometer to 69.5 from the 69 of the preliminary report.

Federal Reserve:

- Sept. 23 Atlanta Fed President Bostic to give a keynote speech on the economic outlook at the University of London.

- Sept. 26 Federal Reserve Chair to give pre-recorded opening remarks at the 10th annual US Treasury Market Conference.

- Sept. 26 Minneapolis Fed President Kashkari host a fireside chat with Federal Reserve Vice Chair for Supervision Barr.

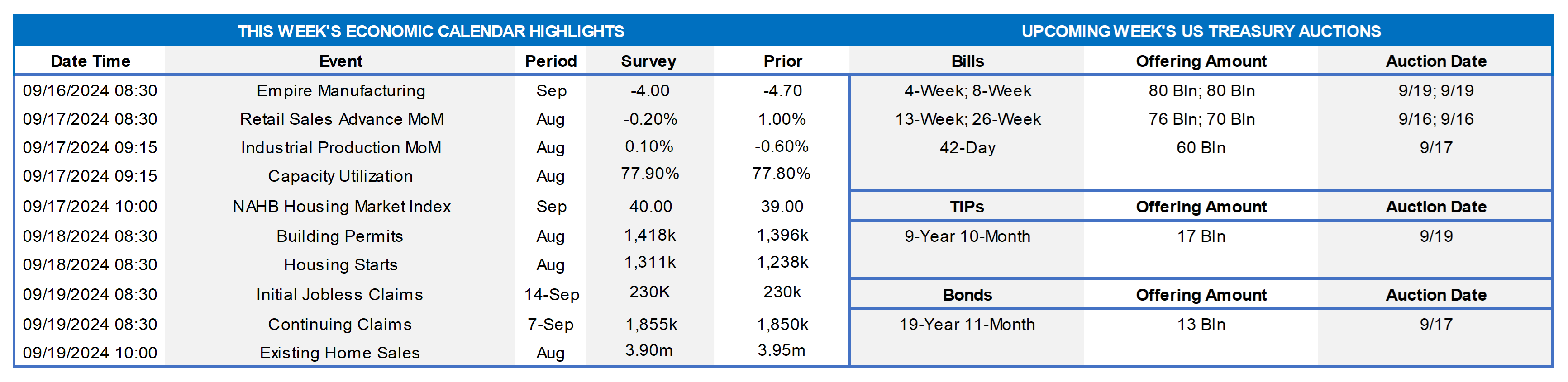

CHART 1 UPPER LEFT

Source: Bloomberg; Board of Governors of the Federal Reserve System; FHLB-NY. The FOMC reduced the federal funds rate target range by 50 bps to 4¾% to 5% at this past week’s meeting, with policymakers updating their expectations for the course of administered rates through the end of 2027. Fed officials anticipate that an additional 50 bps of cuts in administered rates are likely over the balance of 2024, leaving the target range at 4¼ % to 4½% at yearend. Of note, the range of projections was slightly wider in absolute terms than those contained in the June release. The median call for end-2025 now entertains the possibility of a further 100 bps of rate cuts to 3¼% to 3½%, or 25 bps lower than previously forecasted. The median forecast for year-end 2026 calls for an additional 50 bps of reductions to 2¾% to 3%, which now represents the Fed’s new, slightly higher, projection for the federal funds rate to prevail over the longer run. While market pricing is largely in agreement with Fed officials as to where rates might bottom, it prices a notably faster easing pace that would largely finish by the end of 2025 – a full year ahead of policymakers’ median expectation.

CHART 2 UPPER RIGHT

Source: Bloomberg; Bureau of Labor Statistics. Given the Fed’s dual mandate to pursue the goals of maximum employment and price stability, along with the recent declining trend in inflation and a current restrictive real (ex-inflation) Fed Funds rate, this week’s 50-bps cut was designed to “get ahead” of potential weakening labor market conditions and thereby engineer a “soft landing” for the economy. As seen here, Thursday’s weekly jobless claims data provided good news on this front, as initial and continuing claims fell to the lowest levels, respectively, since May and June.

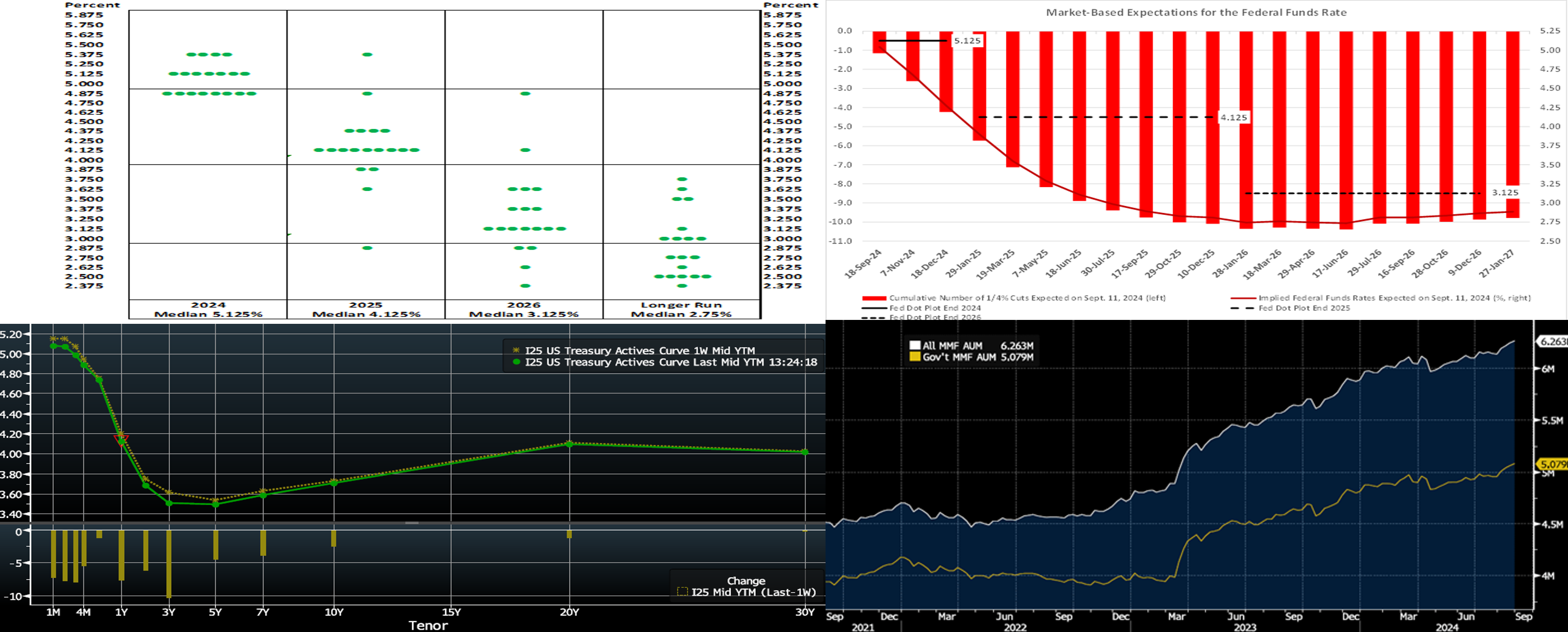

CHART 3 LOWER LEFT

Source: Bloomberg. Top pane is yield (LHS, %), bottom pane is change (LHS, bps). As of Thursday afternoon, the UST curve was steeper from the week prior, with shorter tenors a few bps lower but longer tenors ~3 to 7 bps higher in progressive fashion out of the curve. Given that the market had only priced ~60% chance of a 50-bps cut going into the FOMC, the shortest tenors declined on the announcement of the larger cut. Economic data during the week, meanwhile, was generally better than expected, so longer tenor yields moved a bit higher. In terms of market-implied pricing of the Fed, for end-2024, the market now prices for Fed Funds at 4.12%, which is below the Fed’s fresh projection of 4.375%; see Chart 1 for further color.

CHART 4 LOWER RIGHT

Source: Bloomberg. The average 30-year mortgage rate this week, according to Bankrate.com and a result of the recent drop in market yields, has declined to slightly below 6.20%. As can be seen here, the 30-year MBS Current Coupon (LHS, %, imputed yield of a par-priced MBS), at 4.83%, is near its lowest level in nearly two years and has dropped ~116 bps since July 1st. Contributing to this decline has been the tightening of MBS spreads, reflected here as the yield differential between the Current Coupon and the average of the 5 and 10-year UST yields; this spread (RHS, bps) has declined by ~35 bps since July 1st to 121, as declining implied volatility levels and a Fed “in play” have spurred MBS demand. In turn, these dynamics may prompt higher housing turnover and mortgage volume metrics. On that note, for members who may be unfamiliar, the FHLB-NY offers the Mortgage Asset Program (MAP®) as a secondary market outlet for our members to fund mortgages and be competitive in offering fixed-rate mortgage loan products. Please contact us for further information.

FHLBNY Advance Rates Observations

Front-End Rates

- Short-end rates were notably lower, relative to a week ago, owing to the Fed’s 50-bps cut. While the Overnight rate dropped ~50 bps, the 1- to 6-month tenors declined by 24 to 28 bps, as the market had priced into the curve last week only ~50% chance of a 50-bps cut. Money Market Fund AUM remains robust, thereby underpinning demand for short paper. Net T-bill issuance should decline in the weeks ahead, owing to the just-passed corporate tax date, and likely help spreads on our paper.

- The market will monitor data and Fedspeak in the upcoming week. After this week’s developments, there may be a holding period of sorts as the market digests the Fed’s move.

Term Rates

- The longer-term curve, generally mirroring moves in USTs and swaps, was steeper from a week ago, with shorter tenors declining but longer ones a bit higher. The 2-year dropped 7 bps, while the 5-year was higher by 2 bps. Kindly refer to the previous section for color on market dynamics and changes. We encourage members to engage with the desk for current rate levels and market dynamics.

- On the UST term supply front, the upcoming week serves a slate of 2/5/7-year auctions. Note that UST auctions usually occur at 1pm and can occasionally spur volatility around that time. Please contact the Member Service Desk for further information on market dynamics, rate levels, or products. Note that our “800 number” is again ready for use at 1-800-546-5101 option 1.

Small Business Recovery Grant (SBRG) Program: Starting July 29, 2024, the FHLB-NY will offer $5mn in grant funding under the 2024 SBRG Program. This program provides grant funds to benefit FHLB-NY members’ small businesses, including farms and non-profit customers. Via the program, members will be able to provide grants of up to $10,000 to qualifying small businesses that have faced challenges due to rates, inflation, supply-chain constraints, and/or rising energy costs. Funding will be limited to $50,000 per member.

The FHLBNY is pleased to announce the 2024 0% Development Advance (ZDA) Program, now available with a new streamlined submission process. This program provides members with subsidized funding in the form of interest rate credits to assist in originating loans or purchasing loans/investments that meet the eligibility criteria under the Business Development Advance (BDA), Climate Development Advance (CDA), Infrastructure Development Advance (IDA), or Tribal Development Advance (TDA). Please contact the Member Service Desk for information and/or visit our ZDA information page.

Price Incentives for Advances Executed Before Noon: In effect as of Tuesday, September 5, 2023, the FHLBNY is pleased to now offer price incentives for advances executed before Noon each business day. These pricing incentives offer an opportunity to provide economic value to our members, while improving cash and liquidity management for the FHLBNY. For further details, kindly refer to the Bulletin.

The Symmetrical Prepayment Advance Feature

For those anticipating term funding needs, and with rates on an uptrend, it can be an appropriate juncture to consider our SPA feature. This feature allows the member to capture, at prepayment, changes in the fair value of the advance which are favorable to the member. Contact Member Services Desk to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.