Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week ending September 13, 2024.

Economist Views

Click to expand the below image.

The Federal Open Market Committee (FOMC) meeting will be the marquee event of the week. The FOMC is universally expected to lower the federal funds rate target range by at least 25 bps to 5% to 5¼% at the upcoming gathering, with roughly one quarter of market participants anticipating an even-larger 50-bps cut. The post-meeting communiqué likely will reiterate that economic activity has continued to expand at a solid pace, job gains have moderated, and the unemployment rate has moved up but remains low. The press release probably will state that the FOMC believes that the risks to achieving its employment and inflation goals have moved into better balance, allowing for a more accommodative monetary policy stance. In considering any future adjustments to the federal funds rate target range, the FOMC will continue to monitor the implications of incoming data on the economic outlook.

As per convention, the Federal Reserve Board will release an updated Summary of Economic Projections, or SEP.

Empire State Manufacturing Survey:

The contraction in manufacturing activity in New York State likely continued for a tenth consecutive month in September, with the pace of deterioration little changed from that witnessed in August. The general business conditions diffusion index – the net percentage of survey respondents noting a pickup in activity less those experiencing a decline – probably improved to -4% from the -4.7% reading posted in the prior month.

Retail & Food Services Sales:

Capped by anticipated declines in auto-dealership and gasoline-station revenues, retail and food services sales probably edged .2% higher in August, following the solid 1.0% gain recorded in July. Excluding a projected .2% dip in vehicle sales during the reference period, retail purchases are expected to have climbed by .3%, almost matching the prior month’s .4% gain.

Industrial Production & Capacity Utilization:

Output at the Nation’s factories, mines and utilities likely edged just .1% higher in August, after the surprisingly large .6% decline witnessed in July. With output expected to exceed additions to productive capacity during the reference period, the capacity utilization rate probably edged one tick higher to 77.9%

Housing Starts & Building Permits:

Aided by a positive swing in weather conditions, the number of new housing units started and building permits filed probably rebounded in August, following the respective 6.8% and 3.3% declines witnessed in July.

Jobless Claims:

Initial claims for unemployment insurance benefits probably remained in a tight 225K to 235K range during the filing period ended September 6. Keep an eye on continuing claims, which have been traveling on a saw-toothed pattern below 1.9 million over the past two months for signs that recently furloughed employees are having a more challenging time finding work.

Federal Reserve:

- Sept. 18 Federal Open Market Committee monetary policy decision.

- Sept. 18 Federal Reserve Chair Powell to hold post-FOMC-meeting press conference.

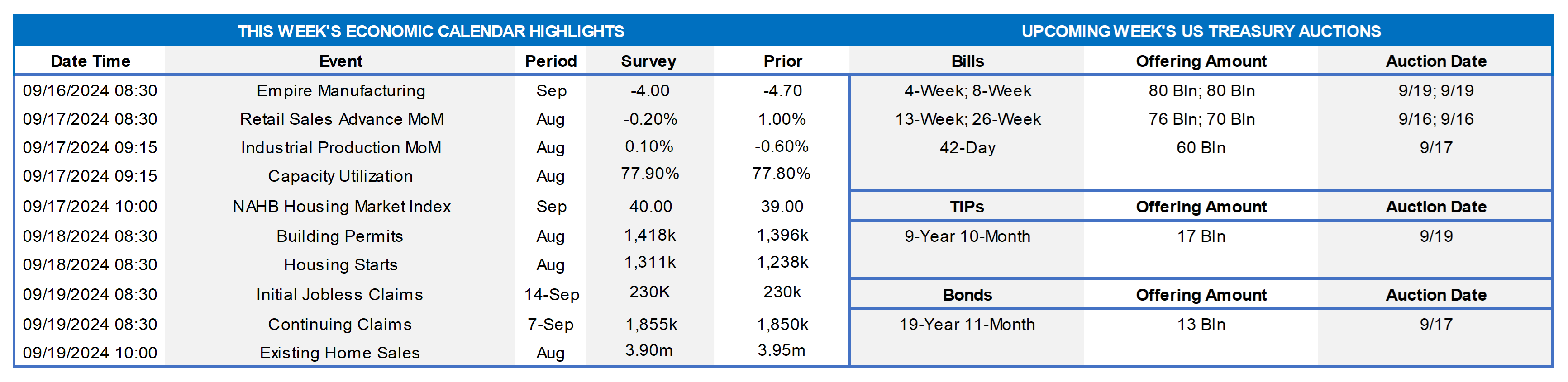

CHART 1 & 2 UPPER LEFT & UPPER RIGHT

Source: Board of Governors of the Federal Reserve System, Bloomberg, and FHLB-NY

As per convention, the Federal Reserve Board will release an updated Summary of Economic Projections, or SEP, following this week’s FOMC meeting. With market-based rate-cut expectations through the end of 2025 far more aggressive than those contained in the June SEP, the so-called “dot plot” of policymakers’ projections for the federal funds rate target will receive considerable attention from traders and investors. At the time of the mid-June FOMC meeting, policymakers believed that the equivalent of just one 25-bps cut in administered rates might be appropriate over the remainder of 2024, leaving the target range at 5% to 5¼% at yearend. The median call for the end of 2025 at that time entertained the possibility of a further 100 bps of rate cuts to 4% to 4¼% and an equivalent reduction to 3% to 3¼% by year-end 2026. Federal Reserve officials’ median forecast for the nominal federal funds rate over the longer run was raised to 2¾%. Market participants’ rate-cut expectations have changed dramatically since that time in response to improving inflation data and softer labor-market readings and are now far more aggressive than those of Fed officials in the June SEP. Traders and investors now envision the equivalent of almost four and one-half 25-bps cuts over the balance of this year, paring the midpoint of the federal funds target range to 4¼% by yearend. Further ahead, market participants expect the policy easing to end in the spring of 2026, with the federal funds rate near the 2¾% projected by policymakers to prevail over the longer run.

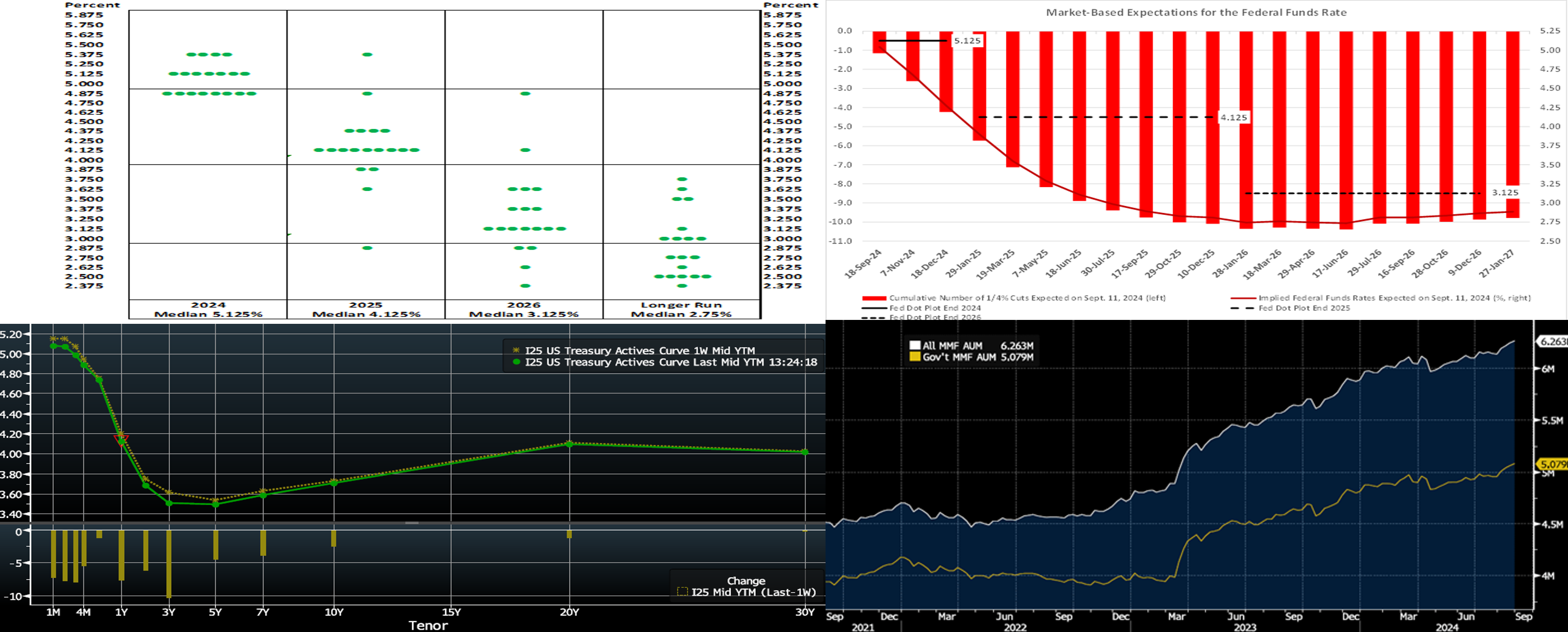

CHART 3 LOWER LEFT

Source: Bloomberg. Bloomberg. Top pane is yield (LHS, %), bottom pane is change (LHS, bps). As of Thursday afternoon, yields were lower across the UST term curve relative to the week prior. The 2-year was ~8 bps lower, and the 5-year ~5 bps lower. Considering the avalanche of corporate debt issuance to start the month, the move was impressive and mostly spurred by the above-mentioned data releases and the market’s more aggressive pricing of potential Fed cuts. In terms of market-implied pricing of the Fed, the market prices a 124% chance, up of a 25 bps cut in September; in other words, that is a ~24% chance of a 50 bps cut. For end-2024, the market now prices for Fed Funds at 4.26%, approximately the same as last week, which equates to a bit over four 25-bps cuts. Relative to last week, the market also priced cuts in the 2025-and-out zone a tad more aggressively, and this dynamic further served to prompt the move lower in term yields.

CHART 4 LOWER RIGHT

Source: Bloomberg. As seen here, Money Market Fund (MMF) Assets under Management (AUM) have recently climbed to even higher record levels (RHS, $trn). AUM stands ~$6.26trn, with Government-only funds, at $5.079trn, comprising the bulk of the total. Despite a potential Fed-easing cycle close at hand, it appears likely that MMFs will continue to be a competitive force vs. bank deposits until the rate gap between the products narrows; at this juncture, a meaningful narrowing will likely take time to unfold.

FHLBNY Advance Rates Observations

Front-End Rates

- Short-end rates were mostly lower, relative to a week ago, owing to the pending Fed ease out to the 3-month maturity by a measure of 6-25bps. Meanwhile, longer tenors are moving further into the timeline of expected Fed cuts and so have, in turn, declined by 2- to 8 bps. Moreover, Money Market Fund AUM remains robust, thereby underpinning demand for short paper. Net T-bill issuance should decline in the weeks ahead and possibly help spreads on our paper.

- The market’s focus will remain on economic data, particularly given the Fed’s blackout period preceding this month’s FOMC meeting.

Term Rates

- The longer-term curve, generally mirroring moves in USTs and swaps, was lower by 3 to 11 bps from a week ago. Kindly refer to the previous section for color on market dynamics and changes. Shorter-tenor putable advances remain of interest on dips in market rates. We encourage members to engage with the Member Service Desk for current rate levels and market dynamics.

- On the UST term supply front, the upcoming week serves a limited slate of 10-year TIPs and 20-year auctions. Note that UST auctions usually occur at 1pm and can occasionally spur volatility around that time. Please contact the Member Service Desk for further information on market dynamics, rate levels, or products. Note that our “800 number” is again ready for use at 1-800-546-5101 option 1.

Small Business Recovery Grant (SBRG) Program: Starting July 29, 2024, the FHLB-NY will offer $5mn in grant funding under the 2024 SBRG Program. This program provides grant funds to benefit FHLB-NY members’ small businesses, including farms and non-profit customers. Via the program, members will be able to provide grants of up to $10,000 to qualifying small businesses that have faced challenges due to rates, inflation, supply-chain constraints, and/or rising energy costs. Funding will be limited to $50,000 per member.

The FHLBNY is pleased to announce the 2024 0% Development Advance (ZDA) Program, now available with a new streamlined submission process. This program provides members with subsidized funding in the form of interest rate credits to assist in originating loans or purchasing loans/investments that meet the eligibility criteria under the Business Development Advance (BDA), Climate Development Advance (CDA), Infrastructure Development Advance (IDA), or Tribal Development Advance (TDA). Please contact the Member Service Desk for information and/or visit our ZDA information page.

Price Incentives for Advances Executed Before Noon: In effect as of Tuesday, September 5, 2023, the FHLBNY is pleased to now offer price incentives for advances executed before Noon each business day. These pricing incentives offer an opportunity to provide economic value to our members, while improving cash and liquidity management for the FHLBNY. For further details, kindly refer to the Bulletin.

The Symmetrical Prepayment Advance Feature

For those anticipating term funding needs, and with rates on an uptrend, it can be an appropriate juncture to consider our SPA feature. This feature allows the member to capture, at prepayment, changes in the fair value of the advance which are favorable to the member. Contact Member Services Desk to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.