Member Services Desk

Weekly Market Update

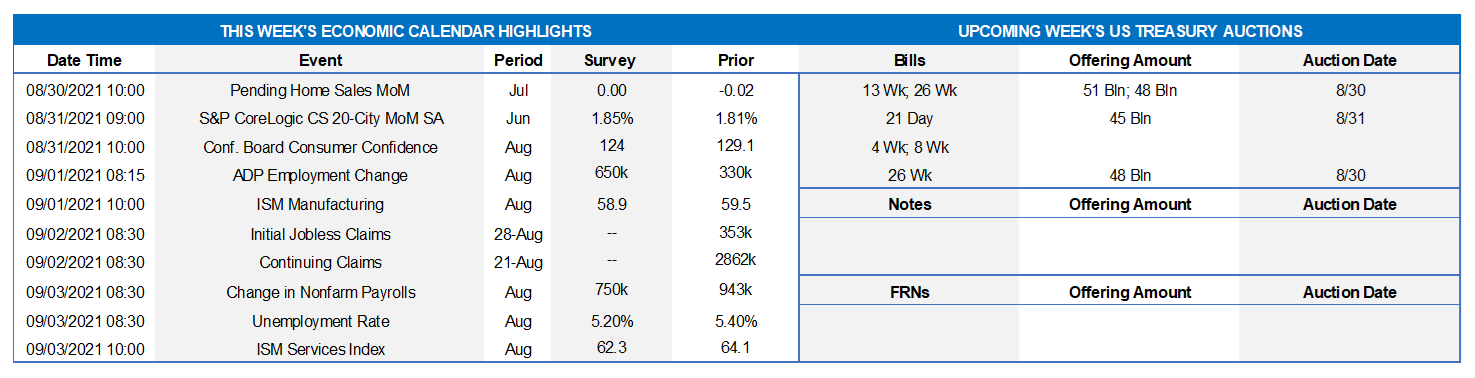

This MSD Weekly Market Update reflects information for the week of August 30, 2021.

Economist Views

Click to expand the below image.

With the annual Jackson Hole economic symposium in the rear-view mirror, the focus of market participants will return to the economic release calendar. The number of dwellings in contract likely moved modestly higher in July, while home prices remained on a tear at the end of the spring. Rosier assessments of labor market conditions and income prospects probably propelled the Conference Board Consumer Confidence Index to the highest level since the pandemic struck. The Institute for Supply Management is expected to report that both manufacturing and service-producing activity expanded in August, albeit at slower paces than in July. Employment soundings for August are projected to remain solid. On the lecture circuit, Atlanta Federal Reserve Bank President Raphael Bostic will make a pair of public appearances to discuss social issues.

Pending Home Sales: Still constrained by the dearth of dwellings on the market nationwide, contract signings probably edged .2% higher in July, after the 1.9% decline recorded in June. That estimate, if realized, would be consistent with a .8% dip in existing home sales to a seasonally adjusted annual rate of 5.94mn in the National Association of Realtors’ August report.

S&P CoreLogic Case-Shiller (SPCLCS) 20-City Home Price Index: Home prices probably continued apace in June across the twenty major metropolitan areas canvassed by SPCLCS. Indeed, the 1.8% increase anticipated by the Street, after a similar rise in May, would place home selling prices a hefty 18.5% above their prior-year level.

Conference Board Consumer Confidence: Weekly sentiment soundings suggest that the Conference Board’s consumer confidence gauge climbed to 135.2 in August from 129.1 in the previous month. At odds with the surprisingly downbeat University of Michigan survey, that projection would be less than one-half point shy of the 132.6 posted in February 2020 before the pandemic struck. As always, pay attention to the so-called labor differential – the percentage of survey respondents regarding jobs are plentiful less than those believing they are hard to get – for clues to the likely change in the civilian jobless rate in August.

ADP National Employment Report: ADP Employer Service’s update on private sector hiring in August could color expectations heading into the official government report on Friday. The Street expects 700K net new jobs to be created, more than double the 330K positions added in July. Given last month’s sizable downside miss from the Bureau of Labor Statistics’ 703K count, ADP’s July estimate will likely be marked higher in this report.

ISM Manufacturing Index: Factory activity likely expanded for a 15th straight month in August. Available Federal Reserve bank surveys suggest that the Institute for Supply Management’s Purchasing Managers Index likely retreated to 57% from 59.5% in the previous month.

Employment Situation Report: The 967K drop in the number of persons collecting unemployment insurance benefits under all administered programs since the BLS’ July canvassing period suggests that nonfarm payrolls may have expanded by 725K in August, after the prior month’s hefty 943K job gain. The dramatic decline in the state insured unemployment rate over the latest four weeks hints that the civilian jobless rate may have moved below the 5% mark from 5.4% in July. Given the current sensitivity to inflation data, average hourly earnings will undoubtedly receive considerable scrutiny in the upcoming report.

ISM Services Index: District Federal Reserve Bank surveys imply that the ISM’s service-producing activity gauge retreated to 60% in August from the record high 64.1% recorded in July.

Federal Reserve:

- Sept. 1 Atlanta Fed President Bostic to take part in a virtual moderated Q&A on “Bringing About an Inclusive Economy.”

- Sept. 2 Atlanta Fed President Bostic to take part in a virtual moderated Q&A on creating economic opportunity.

Click to expand the below images.

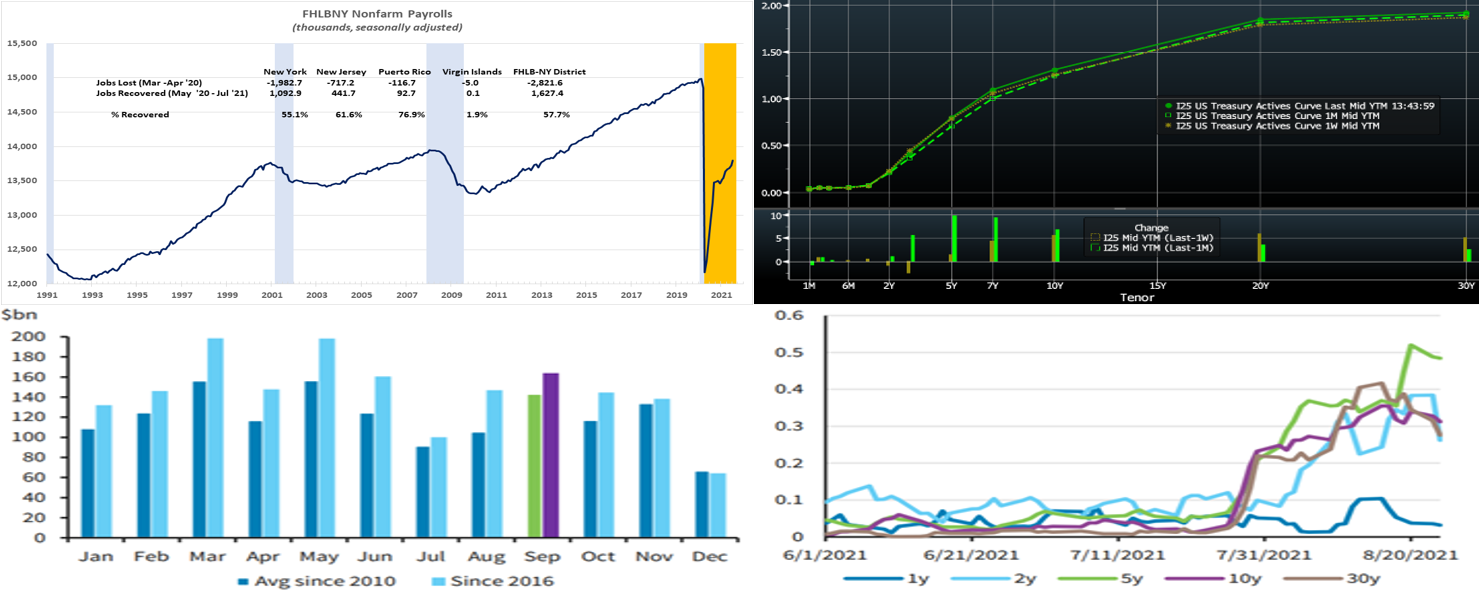

CHART 1 UPPER LEFT

Source: BLS; National Bureau of Economic Research; FHLB-NY. Note: Blue-shaded areas denote recession. Orange-shaded area denotes current expansion. The employment recovery in the FHLB-NY district continues. New York, New Jersey, Puerto Rico and the Virgin Islands added 71.7K in July, after a 39.1K increase in June. Paring nonfarm headcounts in our coverage area by a whopping 2.8mn, the pandemic erased almost three decades of job gains. Since the recession trough of April 2020, the FHLB-NY coverage area has recovered 1.6mn, or 57.7%, of the 2.8mn positions lost. With economic activity in the District concentrated in service-producing industries that were hit hardest by the public healthcare crisis, the local employment recovery has lagged well behind the remainder of the Nation. Indeed, through last month, the U.S. has recouped 16.7mn, or 74.5%, of the 22.4mn COVID-19-related job losses.

CHART 2 UPPER RIGHT

Source: Bloomberg. Note: top pane is yield (%), bottom pane is change (bps). The curve ended steeper on the week, with front-end yields a bit lower but longer yields higher. After trading higher most of the week mostly owing to numerous Fed officials expressing their support for tapering to begin soon, yields subsequently retraced some of the move on Friday morning when Fed Chair Powell, in his Jackson Hole symposium address, declared that tapering could begin this year but that it would not necessarily signal for subsequent rate hikes. His delicate wording was dubbed a “dovish taper” by market pundits. Week-over-week as of midday Friday, yields out to 3-year were a few bps lower, whereas the rest of the curve closed 2 to 6 bps higher in steepening fashion. The market still appears to be in somewhat of a late summer stalemate between the onset of a Fed taper and improving jobs data on the one side, but the persistent COVID-Delta variant threat and weaker global economic data on the other side. The market will closely follow the upcoming week’s jobs data for a better guide on the economy and Fed policy timelines, while also monitoring vaccination rates and booster shots and their potential to curb the variant’s impact on the economy.

CHART 3 LOWER LEFT

Source: Haver Analytics; Barclays Research. As seen here, corporate bond issuance in the month of September is traditionally elevated compared to surrounding months. Indeed, other than springtime, it tends to be one of the busiest months of the year, as domestic and particularly European investors return from summer vacations and business slowdowns. With the topic of the Fed’s tapering of securities purchases front and center, issuers will likely be eager to obtain funding sooner rather than later. The increased fixed income supply may, all else equal, add an element of upward pressure on the curve in the month ahead.

CHART 4 LOWER RIGHT

Source: DTCC SDR; Barclays Research. Depicted here is the ratio (LHS, 5-day rolling average of new trades), over the last few months, of aggregate SOFR swap notional to that of Libor swap notional. As covered in our July 30th edition, on July 26th the derivatives market adopted a “SOFR First” initiative for inter-dealer trades to encourage increased volumes. SOFR First is part of a series of developments in the transition to SOFR and has been welcomed/endorsed by relevant regulatory bodies and Reference Rate working groups. The upward momentum of SOFR trades has been sustained over the past month, with the 5-year tenor hovering near 50% and serving as the standout. Members are encouraged to explore our SOFR product suite (https://www.fhlbny.com/business-lines/credit-products/sofr-arc) and to contact the desk with any questions and/or feedback.

FHLBNY Advance Rates Observations

Front-End Rates

Short-end advance rates finished unchanged out to 2-month and a bp lower thereafter on the week. Money Market Funds’ AUM increased by ~$4.2bn this past week, thereby infusing demand for short paper and the Fed’s RRP. The overall supply/demand paradigm persists in suppressing rate levels, as the GSEs continue to invest large sums into money markets, the TGA continues its decline, and short-maturity paper is in short supply. The Fed’s RRP facility continues to experience strong demand.

UST issuance overall is now net positive supply in that more is being issued than what the Fed is buying in its programs. However, with short UST rates at rock-bottom levels and the Fed on hold, rates are likely to persist in a near-term sideways pattern. Importantly, weekly net T-bill issuance has been lower since 2020 and negative in recent months, and Treasury intends to shift issuance out the curve. Moreover, the looming federal debt ceiling may further constrain issuance. Further legislative packages and related borrowing may lead to an eventual increase of T-bill auction sizes and positive net supply, but for now overall market supply/demand dynamics should keep short rates in check from large moves to the upside

Term Rates

The advance rate curve steepened from a week prior. Rates out to 5-year were 3 bps lower to 1 bp higher in steepening fashion, while the 6 to 10-year sector closed 3 to 6 bps higher in steepening fashion. Please note that these moves may not precisely match the charts below, owing to timing differences and the late-morning move in rates on Friday. Kindly refer to the previous section for further color on relevant market dynamics.

On the UST supply front, this week brings a reprieve in auctions. Per the color on the previous section, corporate issuance may accelerate this week, although the real surge is more likely to be post-Labor Day. The market will monitor economic data and any additional Fed officials’ pronouncements regarding the taper of bond purchases.

Product Enhancement Alert: FHLBNY this past week announced an enhancement to the Callable Adjustable Rate Credit Advance (“Callable ARC”). The product features a 1-time call/cancel option (member’s option) to extinguish funding early at no cost via two distinct option structures, thereby giving members flexibility in meeting the demands of a fluctuating balance sheet. Given the shorter-term nature of the current borrowing environment, the minimum term for the Callable ARC has been lowered to 4-month (from the previous 7-month) for our 1-month-left-to-maturity call option (SOFR or 1-month Libor index available) to better meet our members’ needs. Meanwhile, the 3-year Non-Call 2-year product for SOFR continues to be offered to members for their longer-term needs.

New Product Alert: In order to satisfy member needs and provide greater product flexibility to match bond and derivative market conventions, FHLB-NY now offers SOFR-linked advances based on SOFR-index compounding. Note that this product is in addition to SOFR-linked advances based on SOFR-index averaging which have been offered since November 2018.

The Symmetrical Prepayment Advance Feature

With rates at or near multi-year lows, it is a compelling juncture to use the SPA feature on term advances. This feature allows member to capture, at prepayment, changes in the Fair Value of the advance which are favorable to the member. Contact us to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.

Special Member Alert

The FHLBNY recently announced a newly expanded and flexible Disaster Relief Funding (DRF) advance program which offers discounted rate advances with maturities 1-mo and greater. Additionally, we have announced that PPP loans will be accepted as eligible collateral. Please contact us with any questions.