Member Services Desk

Weekly Market Update

Economist Views

S&P CoreLogic Case-Shiller (SPCLCS) 20-City Home Price Index: Home prices likely accelerated across the twenty major metropolitan areas canvassed by SPCLCS. Indeed, the 1.8% jump anticipated by the Street in April, following March’s 1.6% rise, would place home selling prices a hefty 14.8% above their prior-year level.

Conference Board Consumer Confidence: Sizeable improvements in weekly sentiment soundings suggest that this index probably climbed to 120.5 in June from 117.2 in May. That projection, if realized, would mark the most upbeat reading since the 132.6 posted in February 2020 before the pandemic. Pay attention to the so-called labor differential – the percentage of survey respondents feeling that jobs are plentiful less than those believing they are hard to get – for clues to the likely change in the unemployment rate this month.

ADP National Employment Report: ADP Employer Service’s update on private sector hiring in June will color expectations leading into the official government report on Friday. Sharp reductions in both initial and continuing jobless claims since the May canvassing period hint that June’s private-sector job gain may have topped the 1mn mark, marginally eclipsing the 978K prior-month jump.

Pending Home Sales: Constrained by limited supply, contract signings probably were unchanged in May, after a 4.4% drop in April. If realized, the estimated pullback over the latest two months, if realized, would be consistent with a 1.7% decline in existing home sales to a 12-month low seasonally adjusted annual rate of 5.7mn in the National Association of Realtors’ June report.

Construction Spending: The value of new construction put-in-place likely climbed by .5% in May, boosting the cumulative rise since February to 1.7%.

ISM Manufacturing Purchasing Managers’ Index: The nationwide manufacturing expansion probably entered its second year in June. Available district Federal Reserve Bank surveys suggest that the Institute for Supply Management’s (ISM) factory activity gauge moved marginally higher to 61.5% from 61.2% in May.

Unit Motor Vehicle Sales: Buoyed by improving labor market conditions and stimulus checks, motor vehicle purchases likely moved back above a seasonally adjusted annual rate of 17mn in June.

Employment Situation Report: The BLS’ update will be the marquee event of the week. Growth is expected to have quickened, with the consensus anticipating a hefty 700K net new positions to be added after May’s solid 559K gain. The decline in the number of persons receiving regular state unemployment insurance benefits since the May period suggests that the jobless rate likely moved two ticks lower to 5.6%. Average hourly earnings will undoubtedly receive considerable attention in the upcoming report, following the larger-than-expected increases recorded in April and May.

Federal Reserve Appearances:

- June 28: Richmond Fed President Barkin to discuss inflation risks at a virtual event hosted by the Rotary Club of Atlanta.

- June 28: NY Fed President Williams to participate in a panel discussion sponsored by the Bank for International Settlements.

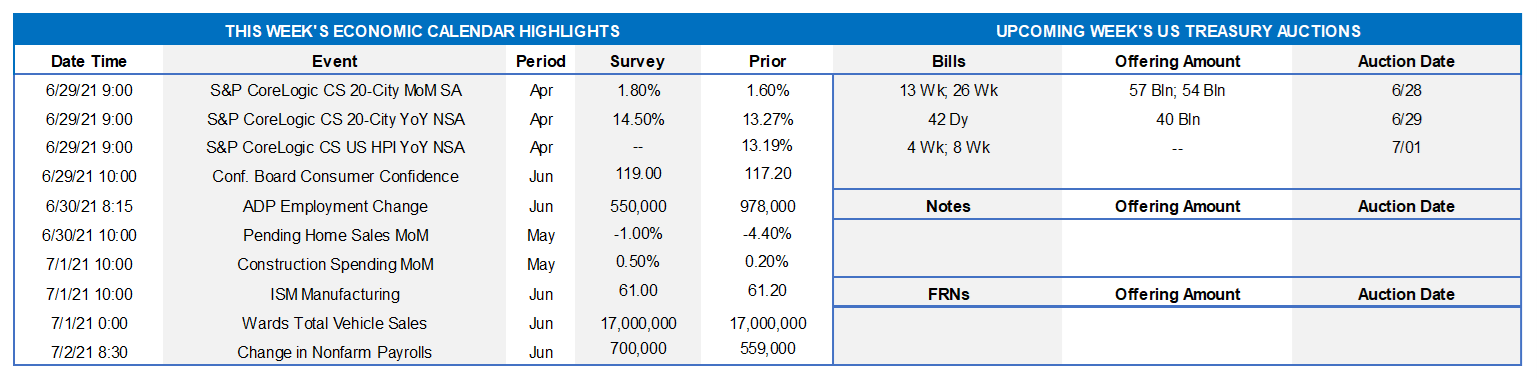

Source: BLS; NBER; FHLBNY. The Bureau of Labor Statistics reported that the FHLB-NY district added 26K jobs in May, after a revised 32K gain in April. Since the pandemic low plumbed in April 2020, 1.57mn, or 54.1%, of the 2.82mn jobs lost to the healthcare crisis have been recovered. Due to the heavy concentration of service-producing firms in our coverage area, the District’s jobs recovery has lagged well behind the remainder of the Nation. Hiring across New York, New Jersey, Puerto Rico and the Virgin Islands will undoubtedly quicken in coming months, however, as COVID-19 immunizations are completed, social-contact restrictions are eased further, and businesses reopen.

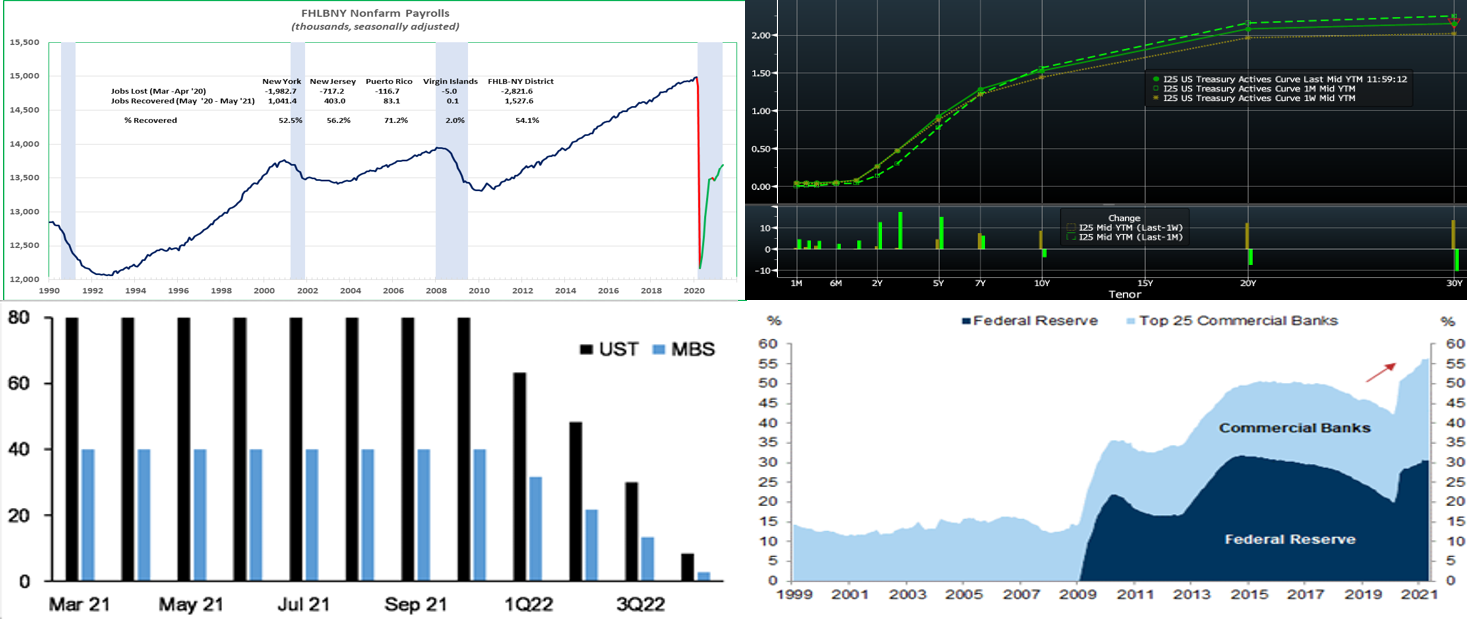

CHART 2 UPPER RIGHT

Source: Bloomberg. Note: top pane is yield (%), bottom pane is change (bps). Following last week’s mildly hawkish FOMC outcome and notable “bear flattener” reaction in rates, markets this week settled down and reversed some of the post-FOMC move. The reversal indicated that a contributor to last week’s volatile markets were likely unwinds of well-populated “steepener” trades. As of midday Friday, UST yields were unchanged through 4-year, while yields 5 to 30-year were 3 to 12 bps higher in progressive fashion out the curve. The market, at this stage post-FOMC, has re-priced the curve for an earlier Fed hike liftoff and now, especially for the sub-5-year sector, awaits further catalysts. The late-week news of a potential bipartisan infrastructure deal (and accompanying market expectations of bond issuance to finance it) likely added to upward pressure on long-end rates. This upcoming week participants will closely monitor “Fed-speak” and also Friday’s jobs report for fresh clues on the direction of the economy and rates.

CHART 3 LOWER LEFT

Source: FRB-NY; JP Morgan. Displayed here are the median expectations of Fed purchases (in $bn) of UST’s and Agency MBS from the Fed’s April Survey of Primary Dealers. Median dealer expectations were for the Fed tapering asset purchases in early 2022 and completing asset purchases by year-end ‘22. Post last week’s FOMC, however, Chair Powell indicated that “talk of talking about tapering of asset purchases” had indeed occurred. Dealers and the market have subsequently adjusted their taper timeline expectations for a possible earlier start in the final quarter of this year. The taper is widely regarded as the initial step in the removal of accommodation and the precursor to any hikes in official rates.

CHART 4 LOWER RIGHT

Source: FRB; Goldman Sachs Research. Shown here is the share of outstanding MBS owned by the Federal Reserve and US commercial banks. Over 55% of outstanding Agency MBS is owned by the Fed and larger US commercial banks, as the former continues to buy as part of its economic support program, while the latter continues to add securities to earn some margin in a liquidity-flush environment in which loan demand is still recovering from the pandemic period. For financial institutions, an earlier Fed taper timeline may be welcome in that MBS spreads and yields may become more attractive with the programmatic Fed buying gradually removed from the market supply/demand dynamic.

FHLBNY Advance Rates Observations

Front-End Rates

- Short-end Advance rates finished unchanged to 1 bps higher week-over-week. Money Market Funds’ AUM declined by ~$31bn on the week, somewhat sapping demand for paper, albeit some of that decline appears to be funds going directly to the RRP post the Fed’s rate adjustment last week. The overall supply/demand paradigm persists, however, as the GSEs continue to invest larger sums into money markets, the TGA continues its decline, and short-maturity paper is in short supply. In a more recent development, state and local governments are receiving federal disbursements from the most recent relief bill and are parking funds in short-term investment “placeholders”. For any members experiencing such municipal deposit inflows, consider our Refundable Municipal Letter of Credit product; please call the desk to discuss.

- UST issuance overall is now net positive supply in that more is being issued than what the Fed is buying in its programs. However, with short UST rates at rock-bottom levels and the Fed on hold for a long period, rates are likely to persist in a near-term sideways pattern. Importantly, weekly net T-bill issuance has been lower since 2020 and negative in recent months, and Treasury intends to shift issuance out the curve. Further legislative packages and related borrowing may lead to an eventual increase of T-bill auction sizes and positive net supply, but for now overall market supply/demand dynamics should keep short rates in check from large moves to the upside.

Term Rates

- On the week, medium and longer-term Advance rates “bear steepened” and reversed some of the prior week’s move. While the 4-year-and-in sector was unchanged, the 5 to 10-year sector was 3.5 to 8 bps higher in progressive fashion. Kindly refer to the previous section for further color on relevant market dynamics.

- On the UST supply front, this week brings a reprieve. The market will apply close attention to this week’s jobs report as well as Fed speeches/interviews for guidance on rates.

New Product Alert: In order to satisfy member needs and provide greater product flexibility to match bond and derivative market conventions, FHLB-NY now offers SOFR-linked advances based on SOFR-index compounding. Note that this product is in addition to SOFR-linked advances based on SOFR-index averaging which have been offered since November 2018.

The Symmetrical Prepayment Advance Feature

With rates at or near multi-year lows, it is a compelling juncture to use the SPA feature on term advances. This feature allows member to capture, at prepayment, changes in the Fair Value of the advance which are favorable to the member. Contact us to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.

Special Member Alert

The FHLBNY recently announced a newly expanded and flexible Disaster Relief Funding (DRF) advance program which offers discounted rate advances with maturities 1-mo and greater. Additionally, we have announced that PPP loans will be accepted as eligible collateral. Please contact us with any questions.