Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week of June 13, 2022.

Economist Views

Click to expand the below image.

The Federal Open Market Committee (FOMC) meeting is the marquee event of the week. Despite the continued uncertainty caused by the Russia-Ukraine war, the FOMC is universally expected to raise the federal funds rate target range by 50 bps to 1.25 -1.5% and indicate that ongoing increases likely will be appropriate in the coming months. Market-based expectations of prospective interest-rate increases were little changed over the past month before rising markedly this past Friday post-CPI release and remain well ahead of those of Federal Reserve officials in mid-March, thereby implying major upward adjustments to the so-called “dot plot” of policymakers’ federal funds rate projections.

The post-meeting communiqué probably will acknowledge the spring rebound in overall economic activity and reiterate that labor-market conditions are strong. The policy statement is also expected to repeat that inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher energy prices, and broader price pressures and note that the FOMC is highly attentive to inflation risks. The statement may also highlight that financial conditions have become considerably less accommodative.

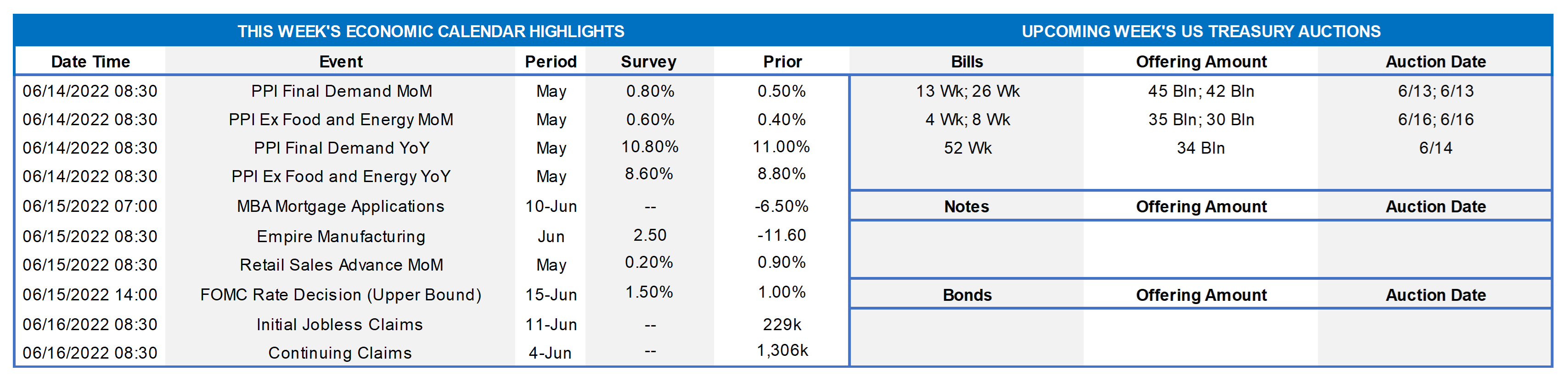

NFIB Small Business Optimism Index: 6/14 – Concerns about inflation and continuing difficulty finding workers probably weighed on sentiment in May, leaving the NFIB’s confidence at a 2-year low of 92.

Producer Price Index: Widespread increases in goods and services costs probably pushed the PPI .8% higher in May, after a .5% rise in April. That result, if realized, would place prices paid by firms a whopping 10.8% above those recorded 12 months ago.

Empire State Manufacturing Survey: The manufacturing expansion in NYS likely resumed in June, following a surprising contraction in May. The net percentage of survey respondents experiencing a pickup in general business conditions is expected to rebound to 3% from the stunningly weak -11.6% posted the previous month.

Retail & Food Services Sales: Capped by a projected pullback in auto purchases, retail and food services sales probably edged .2% higher in May, following a .9% increase in April. Net of a projected 2.3% decline in auto-dealership revenues, retail sales are expected to have climbed by .8% during the reference period, eclipsing the .6% prior-month gain. As always, market participants will pay particular attention to so-called control sales excluding auto, building materials and gasoline purchases. Barring any prior-month revisions, the .5% increase anticipated by the Street would leave core purchases over the April-May span 8.2% annualized above their January-March average, almost matching the 8.8% winter-quarter gain.

NAHB Housing Market Index: 6/15 – Homebuilders’ appraisals of current and prospective sales likely eroded further in June in response to waning demand, due to surging ask-prices and mortgage rates. The Street expects the HMI to edge one point lower to a two-year low of 68 in the June report yet remain well above the 50-point mark associated with neutral market conditions.

Housing Starts & Building Permits: 6/16 – A reported jump in total hours worked by construction employees last month suggests that the number of housing units started and building permits issued may have risen above the respective seasonally adjusted annual rates of 1.72mn and 1.82mn posted in April.

Industrial Production: 6/17 – Production at factories, mines and utilities is expected to have risen by .5% in May, after the surprising 1.1% jump recorded in April. With output likely eclipsing additions to productive capacity during the reference period, the overall operating rate likely rose by .3 percentage point to 79.3% – the highest level since November 2018.

Federal Reserve Appearances:

- Jun. 15 Federal Reserve Interest Rate Decision

- Jun. 15 Federal Reserve Chair Jerome Powell to hold post-FOMC-meeting press conference.

Click to expand the below image.

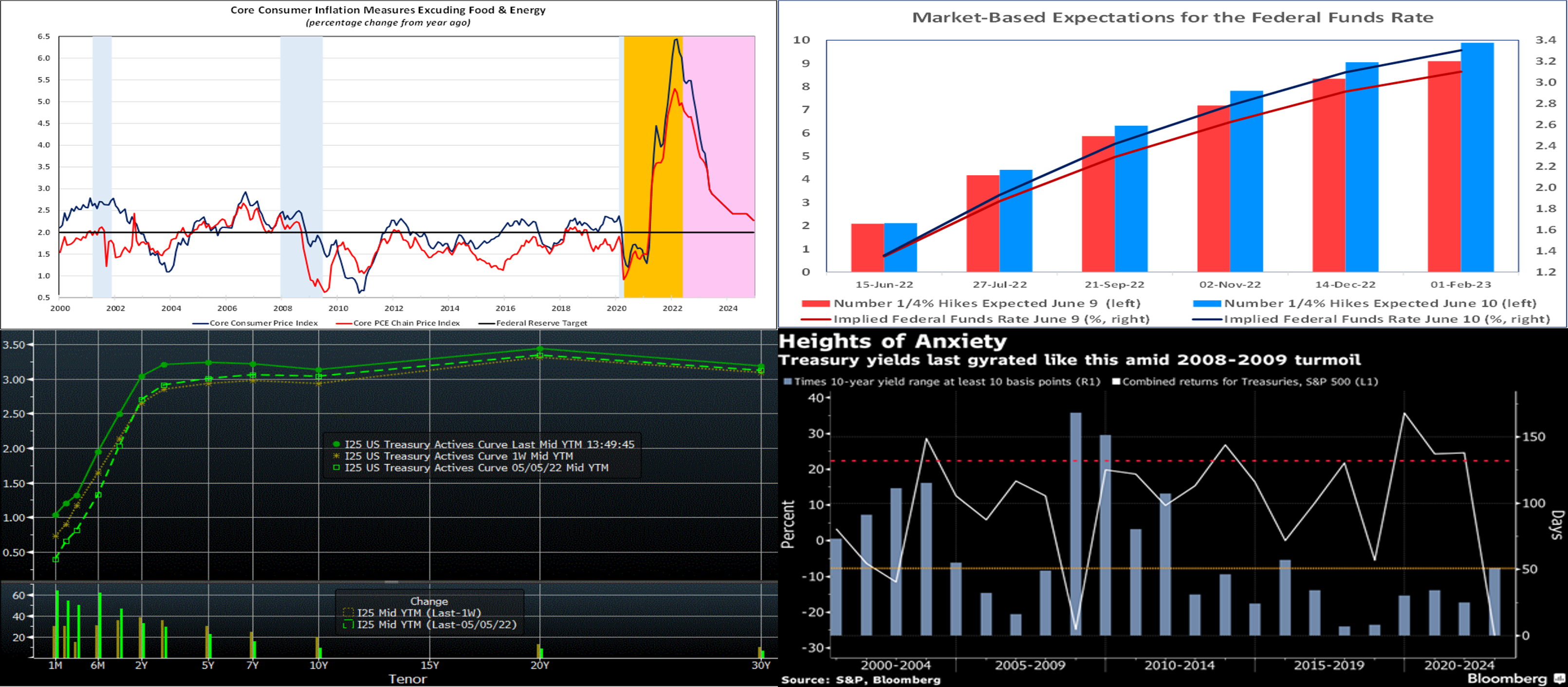

CHART 1 UPPER LEFT

Source: BLS, BEA, NBER, FHLBNY. Notes: Blue-shaded areas denote recession, orange area current economic expansion, pink area forecasts. Key consumer inflation metrics excluding food and energy costs likely will remain well above the Fed’s desired 2% target for an extended period. Barring a significant unforeseen moderation, it will take a considerable amount of time for recent outsized consumer price hikes to work their way through year-to-year growth calculations. In the communiqué following the upcoming FOMC meeting, policymakers probably will reiterate that inflation remains elevated due to supply and demand imbalances related to the pandemic, firmer energy costs and broader price pressures. The FOMC will likely note once again that the Russian invasion of Ukraine and related events are creating additional upward pressure on inflation that will likely weigh on economic activity, while COVID-related lockdowns in China are exacerbating supply chain disruptions. The FOMC will likely state that it is highly attentive to inflation risks.

CHART 2 UPPER RIGHT

Source: Bloomberg, FHLB-NY. Here we are reminded of “what a difference a day makes” as well as why we highlight the importance of certain economic data and market impacts. The market, post-CPI release Friday morning, dramatically repriced (via Fed Funds futures, OIS rates, UST and swap yields) the pace of Fed hikes from the day prior. The market now prices for 50 bps hikes for each of the FOMC June/July/September meetings. The market even prices for a slight (~25%) chance of a 75 bps hike for this week’s meeting; indeed, at least one dealer on Friday boldly raised their call to a 75 bps hike. Peak Fed Funds effective is now priced to be ~3.6% in mid-2023.

CHART 3 LOWER LEFT

Source: Bloomberg. Note: Top pane is yield (%), bottom pane is change (bps). As of Friday afternoon, yields were notably higher across the curve from the week prior, in a “bear flattening” move led by shorter maturities. While the 10-year UST was ~20 bps higher, the 2-year UST was nearly 40 bps higher! And the 5-year/30-year slope inverted to ~ -5 bps. The curve has more than retraced the declines experienced in some previous weeks and is now clearly higher and flatter than post the May 4 FOMC meeting. The week’s move was predominantly driven by the higher-than-consensus CPI data on Friday which sparked a dramatic bond market selloff and re-pricing upwards of Fed hikes. Also contributing to higher yields was mid-week news that the ECB plans a rate hike next month, its first in a decade, thereby serving as a reminder of the global and still challenging nature of inflationary forces. The market’s focus will turn squarely to this upcoming week’s FOMC meeting.

CHART 4 LOWER RIGHT

Source: Bloomberg, S&P. As noted in previous editions, market volatility and day-to-day and intraday yield moves have increased this year. As seen here in a bar chart of the number of times that the 10-year UST yield has traded/changed at least 10 bps in a day, 2022 is well outpacing the trend of the past 7 to 8 years. This past Friday’s large yield move will add to the count for 2022. We encourage members to engage with the desk for information on potential market-moving events or data.

FHLBNY Advance Rates Observations

Front-End Rates

- Short-end Advance rates finished higher by 10 to 27 bps week-over-week, generally with a steepening pattern. Short-end markets remain volatile, thereby leading to dynamic intraday and day-to-day moves in rates. While there are large amounts of cash chasing limited supply in the front-end, the pricing of Fed hikes continues to pressure yields higher. As of this past Friday midday, post the influential CPI report, the market priced for a cumulative 113.5 bps of hikes for the next two FOMC meetings on June 15th and July 27th. And a 50 bps hike is then priced for the Sept. 21st meeting. This pricing, and the fact that maturities are crossing further into the timeline of the Fed hiking cycle, contributed to the rate moves.

- Given the Fed tightening posture and upcoming FOMC meetings, rates will remain highly responsive to the market’s moves and pricing of the Fed.

Term Rates

- Longer-term rates finished dramatically higher, week-over-week, mirroring the move in the UST market. While 1 and 2-year were ~38 bps higher, the 5-year was ~31 and 10-year ~18 bps higher on the week. Kindly refer to the previous section for further color on relevant market dynamics.

- On the UST term supply front, this upcoming week is devoid of auctions. Perhaps yields will steady or subside a bit from Friday afternoon levels, especially if Monday’s PPI data is softer than expected, but the clear focus of the week will be the June 15th FOMC result. Please call the desk for information on market dynamics, rate levels, or products.

Product Alert: FHLBNY is pleased to announce enhancements to our Advance Rebate Program, which provides members an opportunity to receive a cash rebate when prepaying an eligible advance and rebooking a new advance within a 30-day period. Rebate-eligible advances now must have a minimum of 6-months (reduced from 1-year) remaining. Moreover, the potential cash rebate has been increased. This program can be suitable for those wishing to extend their liability duration and/or potentially improve net interest margin. Please call the Member Service Desk at (212) 441-6600 for more information.

Forward Start Advance (FSA): For members with upcoming borrowing or refunding plans, consider the FSA as a method to opportunistically “lock in” rates before advance settlement date. Please call the Member Service Desk at (212) 441-6600 for more information.

The Symmetrical Prepayment Advance Feature

With rates at or near multi-year lows, it is a compelling juncture to use the SPA feature on term advances. This feature allows member to capture, at prepayment, changes in the Fair Value of the advance which are favorable to the member. Contact us to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.