Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week ending April 4, 2025.

Economist Views

Click to expand the below image.

Having weathered the Bureau of Labor Statistics’ update on labor-market conditions last month, the attention of market participants will turn once again to the inflation side of the Federal Reserve’s dual mandate. Reflecting growing anxiety about government economic policy decisions, both small business and consumer confidence gauges are expected to portray further deteriorations from their prior-period soundings. A quintet of Federal Reserve officials, including three current FOMC voters, are scheduled to make public appearances in the upcoming week. And clearly the markets will monitor tariff policy developments.

Consumer Installment Credit: Consumer installment credit likely expanded by $15bn in February, after an $18.1bn takedown in January.

NFIB Small Business Optimism Index: Echoing the erosions in closely followed consumer sentiment gauges, the National Federation of Independent Business’ confidence gauge probably slipped from 100.7 in February to a five-month low of 98.5 in March.

Consumer Price Index (CPI): Capped by a projected drop in seasonally adjusted gasoline costs, the Consumer Price Index (CPI) likely edged just .1% higher in March – the smallest rise in eight months. By contrast, the core subindex excluding volatile food and energy costs probably quickened during the reference period, climbing by .3%, after a surprisingly modest .2% uptick in February. Those projections, if realized, would leave the overall and core CPIs 2.6% and 3.0% above their respective year-ago levels, both above the central bank’s desired 2% target.

Jobless Claims: Labor market conditions probably were little changed during the filing period ending April 5, with initial claims for unemployment insurance benefits remaining in a historically low 220K-230K range. The total number of persons receiving regular state benefits probably registered below 1.9mn once again during the week ended March 28, suggesting that recent job-losers can find new positions. Keep an eye on separate federal worker figures for signs that layoffs announced by the Department of Government Efficiency have taken place.

Michigan Sentiment Index: Growing concerns about current and prospective conditions probably left the University of Michigan’s consumer confidence gauge four points lower at 53 in early April – the weakest reading since July 2022.

Federal Reserve Appearances:

- Apr. 9 Richmond Fed President Tom Barkin to speak at the Economic Club of Washington DC.

- Apr. 9 Minutes of the March 18-19 Federal Open Market Committee meeting to be released.

- Apr. 10 Chicago Fed President Austan Goolsbee to speak at the Economic Club of New York.

- Apr. 10 Philadelphia Fed President Patrick Harker to speak on fintech at an event at the Philadelphia Fed.

- Apr. 11 St. Louis Fed President Musalem to speak on US economy and monetary policy at an event in Hot Springs, Arkansas.

- Apr. 11 NY Fed President Williams to give keynote remarks on the economic outlook and monetary policy in Puerto Rico.

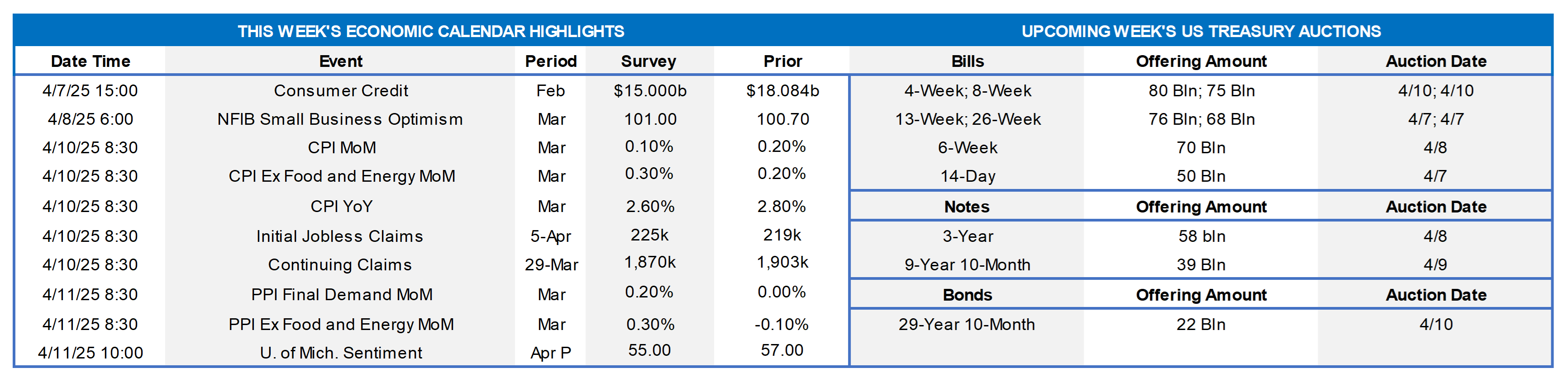

CHART 1 UPPER LEFT and CHART 2 UPPER RIGHT

Source: Bloomberg; Bureau of Economic Analysis; Institute for Supply Management (ISM); National Bureau of Economic Research; FHLB-NY. Note: Blue shaded areas denote recessions. The threat of widespread tariff impositions on foreign products, per this week’s ISM Manufacturing report, has had a noticeable impact on the behavior of both firms and consumers. While manufacturing activity contracted for the first time in three months in March, inventory building resumed at firms for the first time since last August. Indeed, the inventory diffusion index jumped by 3.5 points to 53.4 – the highest reading since October 2022. With new orders for manufactured goods contracting at the fastest pace in two years during the reference period, the most plausible explanation is attempts by firms to build stocks ahead of impending levies. Meanwhile, undoubtedly spurred by fears of inevitable tariff-induced price hikes, unit motor vehicle purchases leaped by 11.1% to a four-year high seasonally adjusted annual rate of 17.8mn in March. This “front-loading” activity and looming tariff levies may portend weaker growth ahead; indeed, many economists have been marking GDP forecasts lower. Also of note was that the prices-paid component of the ISM index shot higher. The ongoing trade war likely will leave its fingerprints on additional reports as we progress through the economic release calendar.

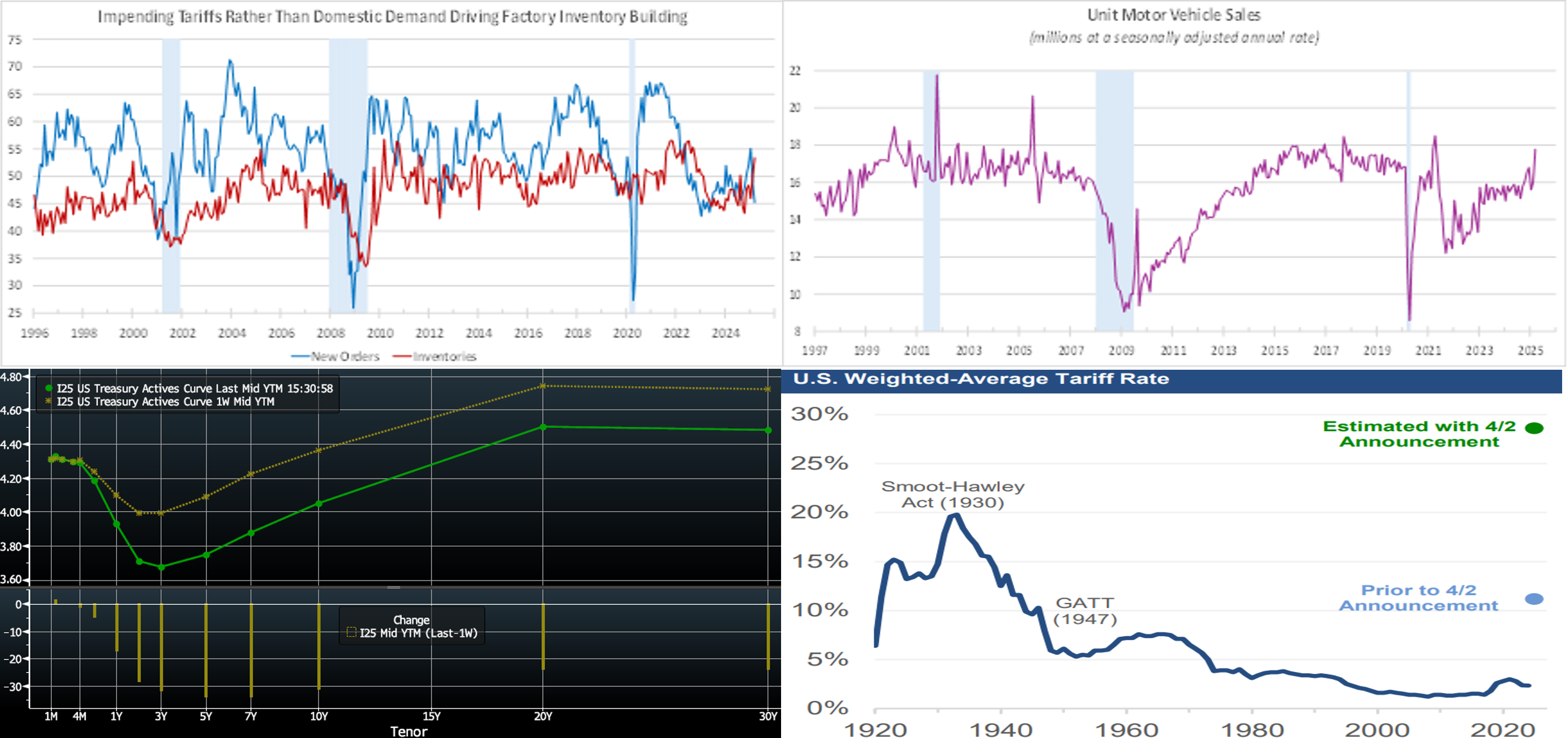

CHART 3 LOWER LEFT

Source: Bloomberg. Top pane is yield (LHS, %); bottom pane is change (LHS, bps). As of Thursday afternoon, the UST term curve was sharply lower from a week ago in a “risk-off/flight-to-quality” move, led by the belly of the curve. The 2-year fell ~28 bps, 5-year declined ~33 bps, and 10-year fell ~31 bps. Economic data was generally on the weaker side of expectations, but the clear catalyst for the market dynamics was late Wednesday’s tariff policy announcements from the Administration. For more color on that topic, see below. As of Thursday afternoon, the market prices end-2025 fed funds ~3.41%, or 29.5 bps lower than a week ago and which equates to ~3.7 25-bps Fed cuts. The market’s end-2026 forward is ~3.055%, or 41 bps lower than a week ago. These were notable re-pricings, to say the least!

CHART 4 LOWER RIGHT

Source: Bloomberg; Census Bureau; International Trade Commission; Evercore ISI. Shown here is a historical view of tariffs and how the fresh tariff announcements compare, according to analysis from Evercore ISI, a banking and research firm. Other analysts generally view the impact similarly, albeit in the lower-20’s% range rather than the ~29% seen here. Naturally, tariff implementation can be complicated and fluid, especially now. The important takeaway is that the levies are much higher than most economists or markets anticipated. Hence, the initial reaction has been severe, with stocks, rates, and GDP forecasts all declining sharply and the market now pricing in a chance of four 25-bps rate cuts later this year. In terms of rate cuts, the Fed could be in a bind, given the potential upward inflationary impact of tariffs. Note that the 1930 Smoot-Hawley Act is widely considered a major contributor to the Great Depression, and so there is historical precedent for the market’s anxiety over tariff policy. Also of note is that imports as a share of GDP were ~4% in 1930; they are now ~13% of GDP, reflecting the much more prominent role of imports in the modern economy.

FHLBNY Advance Rates Observations

Front-End Rates

- Short-end rates, as of Thursday afternoon, were mixed vs. the week prior. The 2-month-and-in zone was 1 to 7 bps higher, with the shortest tenors leading the way. Lingering upward pressure post-month-end contributed to the rise in the shortest tenors, with Overnight higher by 7 bps from a week ago. The 4- to 6-month sector was lower by 1 to 5 bps in progressive fashion, with 6-month leading the move. The market’s repricing of potential Fed cuts later in 2025 spurred the move lower in these tenors. Robust record Money Market Fund AUM levels continue to underpin demand for short-end paper. Also helpful is that net T-bill supply has been negative in recent weeks, owing to debt ceiling dynamics. But with the April 15th tax date quickly approaching, MMFs and bank deposits may be susceptible to withdrawals in the near-term.

- The market will focus on economic data and further trade policy news

Term Rates

- The longer-term curve, generally mirroring moves in USTs and swaps, was sharply lower from the prior week. The 2-year fell by ~29 bps, 5-year by ~33 bps, and 10-year by ~30 bps. Kindly refer to the previous section for color on market dynamics and changes. The rates decline particularly sparked interest in our putable advance product. We encourage members to engage with the Member Services Desk for current rate levels and market dynamics.

- On the UST term supply front, the upcoming week serves a slate of 3/10/30-year auctions. Note that UST auctions usually occur at 1pm and can occasionally spur volatility around that time. Please contact the Member Services Desk for further information on market dynamics, rate levels, or products.

Price Incentives for Advances Executed Before Noon: In effect as of Tuesday, September 5, 2023, the FHLBNY is pleased to now offer price incentives for advances executed before Noon each business day. These pricing incentives offer an opportunity to provide economic value to our members, while improving cash and liquidity management for the FHLBNY. For further details, kindly refer to the Bulletin.

Looking for more information on the above topics? We’d love to speak with you!

Archives

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.