Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week of April 04, 2022.

Economist Views

Click to expand the below image.

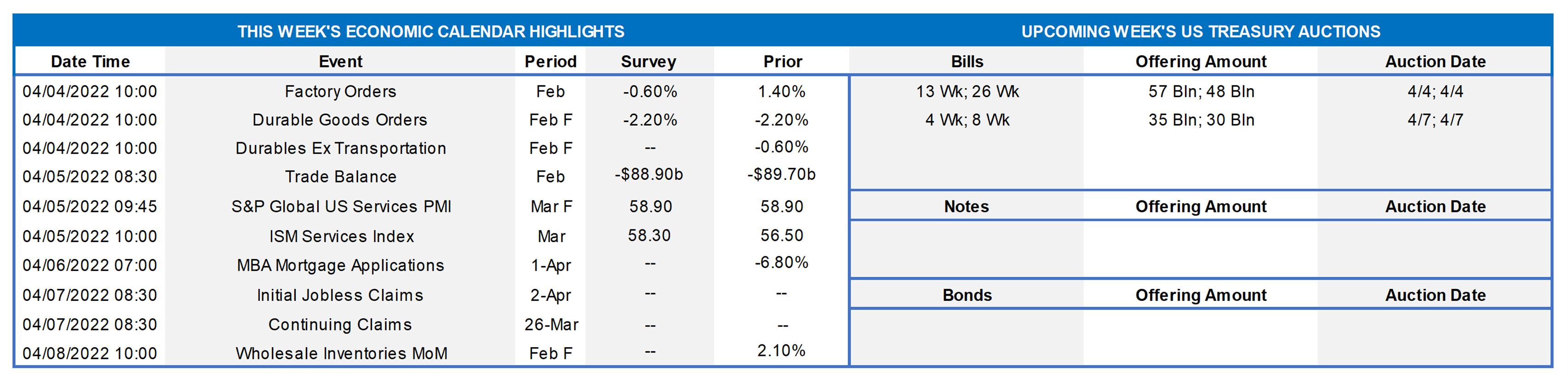

Keeping an eye on overseas developments, market participants will face an extremely quiet economic release calendar this week. The highlight likely will be the ISM’s update on service-producing activity in March. Half a dozen Federal Reserve officials will also be on the lecture circuit to discuss a wide range of topics. The release of the minutes from the March 15-16 Federal Open Market Committee meeting will be closely scrutinized for central bank officials’ latest thoughts on monetary policy.

Factory Orders: Triggered by a contraction in durable goods bookings, factory orders likely dipped by .6% in February, erasing a portion of January’s 1.4% gain.

International Trade Balance: The already reported narrowing of the merchandise deficit in February suggests that the total shortfall on international trade in goods and services closed to $88.7bn from $89.7bn in January.

ISM Services Index: District Federal Reserve Bank canvasses suggest that the Institute for Supply Management’s barometer of non-manufacturing business activity climbed to a three-month high of 61 in March from 56.5 in February.

Jobless Claims: With available positions eclipsing the jobless by a wide margin, initial and continuing state unemployment insurance claims probably moved lower in their respective reporting periods.

Consumer Credit: Consumer installment credit is expected to have jumped by $16.6bn in February, following a comparatively modest $6.8bn takedown in the previous month.

Federal Reserve Appearances:

- Apr. 5 Federal Reserve Governor Brainard to take part in a discussion on the unequal impacts of inflation.

- Apr. 5 NY Fed President Williams to participate in a moderated virtual discussion on health and the economy.

- Apr. 6 Philadelphia Fed President Harker to discuss the outlook before the Delaware State Chamber of Commerce.

- Apr. 6 Minutes of March 15-16 Federal Open Market Committee Meeting to be released.

- Apr. 7 St. Louis Fed President Bullard to discuss the economy and monetary policy at a University of Missouri event.

- Apr. 7 Atlanta Fed President Bostic and Chicago Fed President Evans to take part in an event on economic mobility and inclusive full employment, hosted by the Chicago Fed.

- Apr. 7 NY Fed President Williams to make remarks at an event on expanding opportunities and investing.

Click to expand the below image.

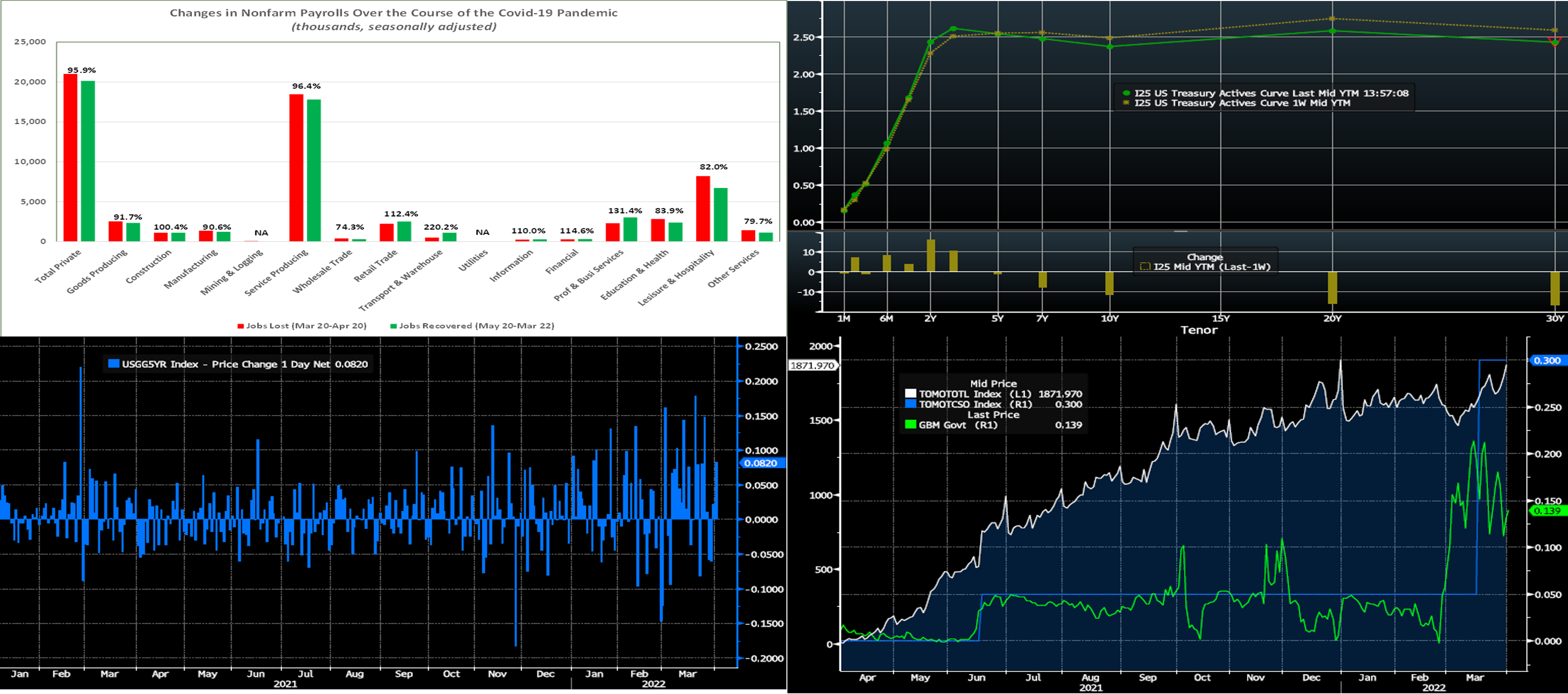

CHART 1 UPPER LEFT

Source: Bureau of Labor Statistics; FHLBNY. This past Friday’s release of the March employment situation report revealed that labor market conditions tightened further. Nonfarm payrolls expanded by 431K, while the unemployment rate declined to 3.6% – just one tick above Federal Reserve officials’ year-end forecast. As seen here, to date 20.4mn, or 92.8%, of the 22mn nonfarm jobs lost over the March-April 2020 span have been recovered. Moreover, headcounts in many private-service producing industries are now well above those of the prior business-cycle peak. Meanwhile, the drop in the unemployment rate to 3.6% is just one tick above that expected by Fed officials to prevail over the final quarter of this year. Additionally, average hourly earnings reaccelerated. With this report in hand, FOMC members likely will feel more comfortable opting for a 50 bps hike in the federal funds target range at the May 3-4 meeting.

CHART 2 UPPER RIGHT

Source: Bloomberg. Note: Top pane is yield (%), bottom pane is change (bps). The UST yield curve notably flattened week-over-week, with shorter yields rising, the 5-year roughly unchanged, and the longer sector yields progressively lower out the curve. Much of the move occurred on Friday in reaction to the strong jobs report. The market now prices for ~80% chance of a 50 bps hike at the May 4 FOMC meeting; for the rest of 2022, it prices for ~217 bps of cumulative hikes from the current level. Fed Governors, meanwhile, have voiced support for potential 50 bps hikes at upcoming meetings. The dramatic flattening of the curve has resulted in various inversions. For instance, the 2-year/10-year slope was ~-5 bps as of Friday afternoon. The 2-year/30-year inverted Friday but subsequently traded on top of each other. The Russian invasion of Ukraine is still in the news but not leading to any doubt that the Fed will march onwards with rate hikes. Given limited economic data this upcoming week, market focus will remain on Ukraine developments and any Fed-speak which might impact pricing of Fed hikes.

CHART 3 LOWER LEFT

Source: Bloomberg. In the past month, we have frequently cited and/or shown charts on the rise in market volatility and rate movements. Perhaps this chart is a simpler view of the dynamic. Here is shown, since January 2020, the 1-day yield changes (RHS, %) of the 5-year UST. The past two months reflect a clear increase in the number and extent of changes in daily moves. Such moves may present opportunities to enter transactions at more optimal levels; please call the desk for any intraday updates on levels and market information.

CHART 4 LOWER RIGHT

Source: Bloomberg. In the current volatile Fed-hike cycle environment, and especially before quarter-end, investors placed greater amounts of funds in very short instruments. Indeed, money market funds (MMF) have been maintaining extremely short durations of below 1-month, and MMF AUM grew by ~$38bn in the week leading into quarter-end. Here can be seen elements of this dynamic. The Fed’s RRP (white, LHS, $bn) over the past month, partly owing to MMFs, moved near its record high and hit ~$1.87trn on Thursday. And the fact that the RRP rate (blue, RHS, %) currently yields more than the 1-month T-bill (green, RHS, %) has attracted funds to the RRP. Note, Many investor types do not have access to the RRP and so must resort to buying the lower yielding T-bills. Post quarter-end on Friday, the RRP notably dipped from its day-prior level to ~$1.67trn.

FHLBNY Advance Rates Observations

Front-End Rates

- Short-end Advance rates finished higher by 9 to 11 bps week-over-week. While the market continued to experience “safety flows” into very short instruments, the market’s more aggressive pricing of forthcoming Fed hikes have served to push advance rates higher. As of midday Friday, the market priced for ~80% probability of a 50 bps hike at the May 4 FOMC. This pricing and the fact that maturities are crossing further into the timeline of the Fed hiking cycle, were causal factors in the rate moves.

- At this stage, all maturities cross into upcoming FOMC meetings, thereby making them highly responsive to the market’s moves and pricing of the Fed.

Term Rates

- The advance rates curve generally mimicked the UST curve week-over-week and flattened from the week prior. Kindly refer to the previous section for relevant market color. Note that our advance curve is notably flat 3-year and longer, with the 3-year/10-year slope ~+8 bps. Many points in-between are flat or even slightly inverted. This condition may provide a compelling opportunity to extend liability duration at little to no coupon increase.

- On the UST term supply front, this upcoming week brings a reprieve. Markets and rates remain highly prone to move on Ukraine news and Fed-speak. A lighter schedule of economic data is on offer this week. Given market volatility, members should monitor conditions for potentially more optimal timing on transactions. Please call the Member Service Desk for information on market dynamics, rate levels, or products.

Product Alert: FHLBNY is pleased to announce enhancements to our Advance Rebate Program, which provides members an opportunity to receive a cash rebate when prepaying an eligible advance and rebooking a new advance within a 30-day period. Rebate-eligible advances now must have a minimum of 6-months (reduced from 1-year) remaining. Moreover, the potential cash rebate has been increased. This program can be suitable for those wishing to extend their liability duration and/or potentially improve net interest margin. Please call the Member Service Desk at (212) 441-6600 for more information.

Forward Start Advance (FSA): For members with upcoming borrowing or refunding plans, consider the FSA as a method to opportunistically “lock in” rates before advance settlement date. Please call the Member Service Desk at (212) 441-6600 for more information.

The Symmetrical Prepayment Advance Feature

With rates at or near multi-year lows, it is a compelling juncture to use the SPA feature on term advances. This feature allows member to capture, at prepayment, changes in the Fair Value of the advance which are favorable to the member. Contact us to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.