Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week of March 21, 2022.

Economist Views

Click to expand the below image.

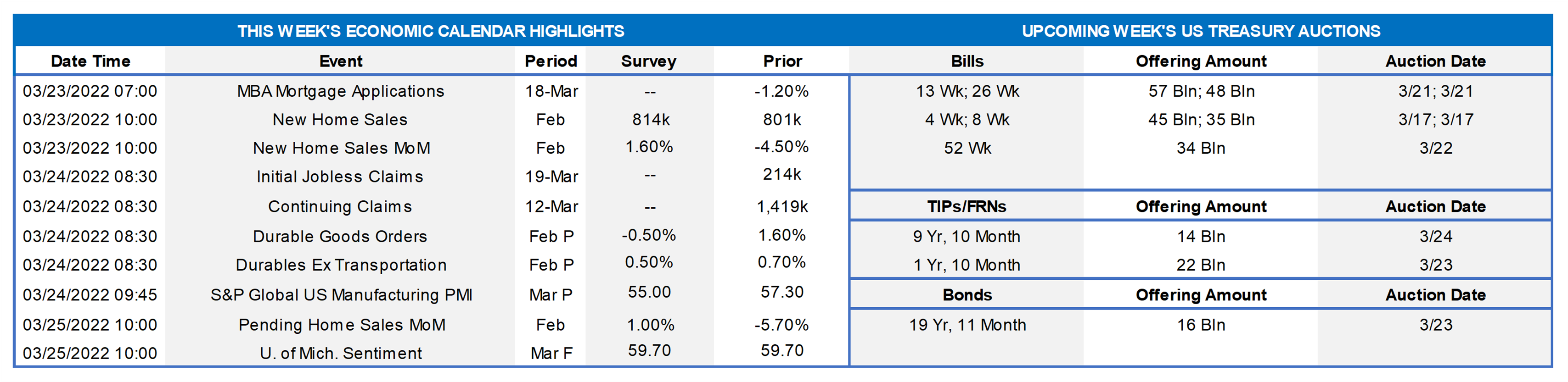

The attention of market participants this week will once again be divided between the war in Ukraine and domestic developments. The economic report calendar is unusually light, with soundings on new home sales, durable goods orders and home-contract signings. By contrast, Federal Reserve officials will make a dozen public appearances to discuss a variety of timely topics. Of particular interest will be Fed Chair Jerome Powell’s address to the annual meeting of the National Association for Business Economics on Monday.

New Home Sales: Contracts to buy a newly constructed home likely rebounded by 2.9% to a seasonally adjusted annual rate of 825K in February, reversing almost two thirds of January’s 4.5% decline.

Jobless Claims: Solid demand for workers and the waning adverse impact of the Omicron variant probably left initial and continuing state unemployment insurance claims lower in their respective reporting periods.

Durable Goods Orders: Trimmed by a projected decline in transportation equipment requisitions, durable goods orders probably dipped by .5% in February, reversing a portion of the 1.6% prior-month gain. Excluding the anticipated pullback in transport orders, “hard goods” bookings are expected to have edged .5% higher during the reference period, boosting the cumulative advance over the latest 12 months to 12.2%. February’s nondefense capital goods shipments excluding commercial jetliner deliveries will be watched closely to gauge the strength of business equipment spending during the winter quarter.

Pending Home Sales: Despite being constrained by the lack of available dwellings on the market, contracts to purchase a home likely climbed by 1.2% last month, recouping a portion of January’s 5.7% decline. The estimated pullback in pending home sales over the first two months of 2022, if realized, would be consistent with a 1.5% decline in existing home sales to a ten-month low seasonally adjusted annual rate of 5.93mn in the National Association of Realtors’ March report.

Michigan Sentiment Index: Recent soundings probably left the final March confidence sounding little changed from the 59.7 reading recorded in the University of Michigan’s preliminary report.

Federal Reserve Appearances:

- Mar. 21 Fed Chair Powell gives speech at the annual meeting of the National Association for Business Economics (NABE).

- Mar. 21 Atlanta Fed President Bostic to give speech at the annual NABE economic policy conference.

- Mar. 22 New York Fed Senior Vice President Nathaniel Wuerffel to speak about a post-Libor world at an ISDA webinar.

- Mar. 22 New York Fed President Williams to take part in a discussion hosted by the Bank for International Settlements.

- Mar. 22 San Francisco Fed President Daly to participate in a virtual discussion hosted at the Brookings Institution.

- Mar. 22 Cleveland Fed President Mester to discuss the economy and monetary policy at John Carroll University, Ohio.

- Mar. 23 San Francisco Fed President Daly to take part in a moderated discussion at the Bloomberg Equality Summit in NYC.

- Mar. 23 St. Louis Fed President Bullard to participate in a moderated discussion on the economic outlook.

- Mar. 24 Atlanta Fed President Bostic to take part in a discussion on increasing minority participation in economics.

- Mar. 25 San Francisco Fed President Daly to give opening remarks at bank’s Macroeconomic & Monetary Policy conference.

- Mar. 25 New York Fed President Williams to discuss monetary policy and financial stability at a Central Bank of Peru event.

- Mar. 25 Richmond Fed President Barkin to give speech on inflation at the Citadel Director’s Institute in Charleston, SC.

Click to expand the below image.

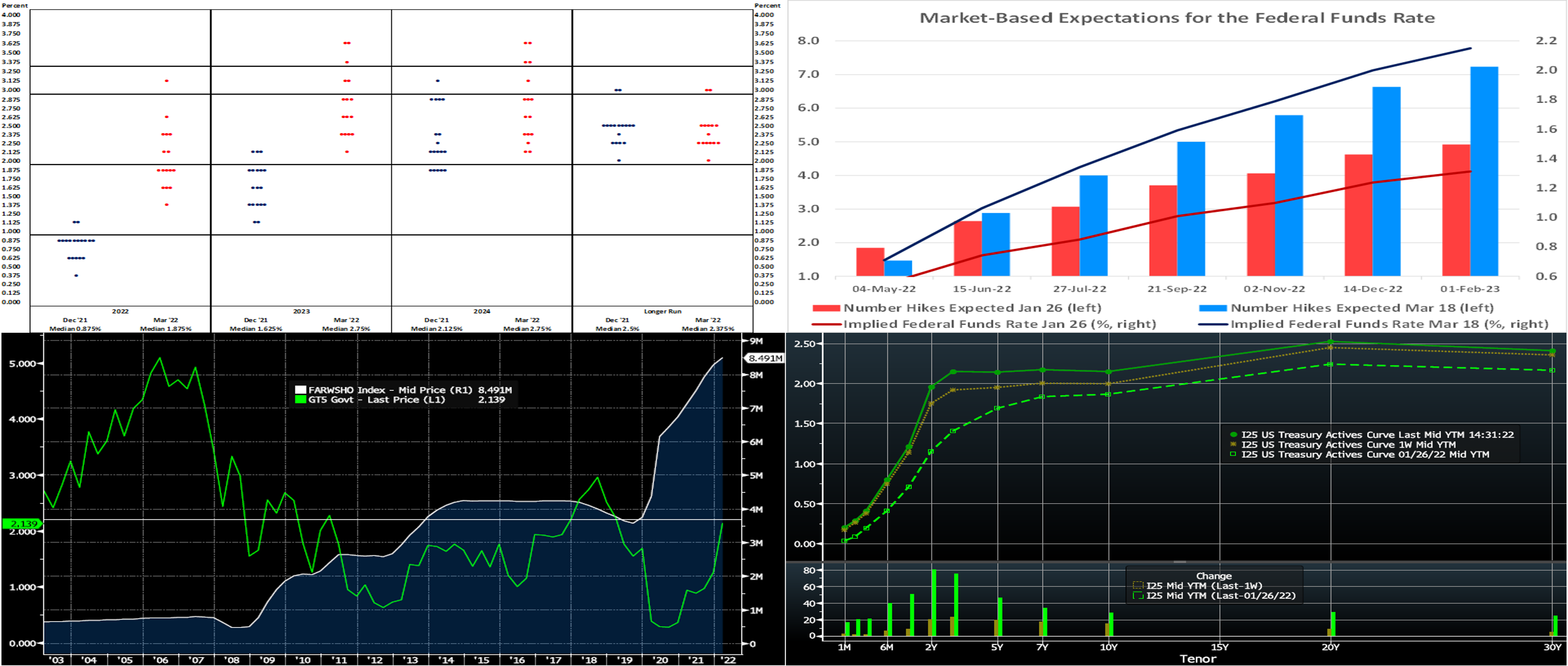

CHART 1 UPPER LEFT

Source: Federal Reserve Board; FHLBNY. As expected, the Federal Open Mark Committee (FOMC) raised the Federal Funds rate target range by ¼ percentage point to .25% to .5% and announced that it will soon begin to reduce the Central Bank’s holdings of USTs, Agency debt, and Agency MBS. The Fed also released an updated Summary of Economic Projections (SEP) and a fresh “dot plot”. Fed officials now anticipate increasing the Fed Funds target range by an additional 1½ percentage points over the remainder of this year to 1.75% to 2%, as per the median projection in this chart of 1.875% for year-end 2022. Meeting participants anticipated further rate increases over the course of 2023, with the median projection now at 2.75% for end-2023. While above the 2.125% forecast at the time of the December FOMC meeting, the median forecast for the end of 2024 of 2.75% implies that policymakers expect the completion of the tightening cycle sometime next year. With fewer Fed officials submitting projections than at the December meeting – 15 compared to 17 – the median longer-run Fed Funds rate projection was pared from 2.5% to 2.375%.

CHART 2 UPPER RIGHT

Source: Federal Reserve Board; FHLBNY. With yield curves now pricing another six to seven 25 bps hikes over the next nine months, market-based expectations are still slightly more aggressive than those of policymakers, as seen here. For the “longer-run”, however, the market still prices below the Fed’s longer-run projection, as evidenced by the 1-year 3-year forward OIS rate last trading ~1.95%, whereas the Fed’s longer-run dot is 2.375%. The market appears to expect an earlier and more aggressive hiking cycle to subsequently give way to a plateauing and possible easing in the policy rate, once inflation ebbs and economic growth slows and/or recession risks rise. The Fed’s longer-run dot, being lower than its end-2022 and end-2023 dots, also reflects this possibility. Indeed, the Fed short-circuited and reversed course on hiking cycles a few times in the last twenty years. Hence, current term yield curves are very flat or even slightly inverted at some points.

CHART 3 LOWER LEFT

Source: Bloomberg. Here is a longer-term view of the Fed’s securities portfolio (white, RHS, $trn) and the 5-year UST yield (green, LHS, %). After a massive pandemic-response operation (dubbed “QE” for Quantitative Easing) boosted holdings to ~$8.5trn, the Fed last week officially concluded tapering and is no longer growing the portfolio. This past week’s FOMC indicated that details on forthcoming reductions (roll-off) of the portfolio could be released at the May meeting. This development has been expected by the market, however; indeed, the 5-year yield has risen from ~.81 to ~2.14% in the last six months, a level that is slightly below the average of ~2.21% (horizontal line) over this longer-term timespan.

CHART 4 LOWER RIGHT

Source: Bloomberg. Note: Top pane is yield (%), bottom pane is change (bps). The UST yield curve again pushed higher in the past week, led by the 2 to 5-year sector, as the market digested the FOMC’s slightly more hawkish than expected outcome. As of Friday afternoon, the 3-year was ~23 bps higher, while the 2 and 5-year were each ~19bps higher on the week. The Russian invasion of Ukraine and FOMC meeting dominated the news, but volatility and moves moderated somewhat from the extreme levels of a few weeks ago. The S&P 500 recovered and rose ~5.5% on the week. As seen in the chart, yields are notably higher than post-January FOMC meeting, most notably in the 1 to 3-year sector where more aggressive Fed hikes have been priced into the curve. Market focus this upcoming week will remain on Ukraine developments while also turning to the myriad of scheduled Fed appearances for clues to future Fed moves.

FHLBNY Advance Rates Observations

Front-End Rates

- Short-end Advance rates finished higher by 3 to 4 bps from the week prior. The market priced slightly more aggressive Fed hikes for 2022 compared to last week; this pricing and the fact that maturities are crossing further into the timeline of the expected Fed hiking cycle, were causal factors in the rate moves. Moreover, a dip of ~$17bn in MMF AUM this past week and a current trend towards low duration with the Fed “in play” may have sapped demand in the longer money market tenors.

- At this stage, all maturities cross into upcoming FOMC meetings, thereby making them highly responsive to the market’s moves and pricing of the Fed.

Term Rates

- The advance rates curve generally mimicked the UST curve week-over-week and finished notably higher from the week prior. While the 1-year was ~14 bps higher, the 3-year was ~23 bps higher, 5-year was ~19 bps higher, and 10-year ~17 bps higher. Kindly refer to the previous section for relevant market color.

- On the UST supply front, this week brings a 20-year nominal and 2 and 10-year TIPS auctions. Markets and rates remain highly prone to move on Ukraine news and Fed-speak. Given market volatility, members should monitor conditions for potentially more optimal timing on transactions. Please call the desk for information on market dynamics, rate levels, or products.

Product Alert: FHLBNY is pleased to announce enhancements to our Advance Rebate Program, which provides members an opportunity to receive a cash rebate when prepaying an eligible advance and rebooking a new advance within a 30-day period. Rebate-eligible advances now must have a minimum of 6-months (reduced from 1-year) remaining. Moreover, the potential cash rebate has been increased. This program can be suitable for those wishing to extend their liability duration and/or potentially improve net interest margin. Please call the Member Service Desk at (212) 441-6600 for more information.

Forward Start Advance (FSA): For members with upcoming borrowing or refunding plans, consider the FSA as a method to opportunistically “lock in” rates before advance settlement date. Please call the Member Service Desk at (212) 441-6600 for more information.

The Symmetrical Prepayment Advance Feature

With rates at or near multi-year lows, it is a compelling juncture to use the SPA feature on term advances. This feature allows member to capture, at prepayment, changes in the Fair Value of the advance which are favorable to the member. Contact us to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.