Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week of March 14, 2022.

Economist Views

Click to expand the below image.

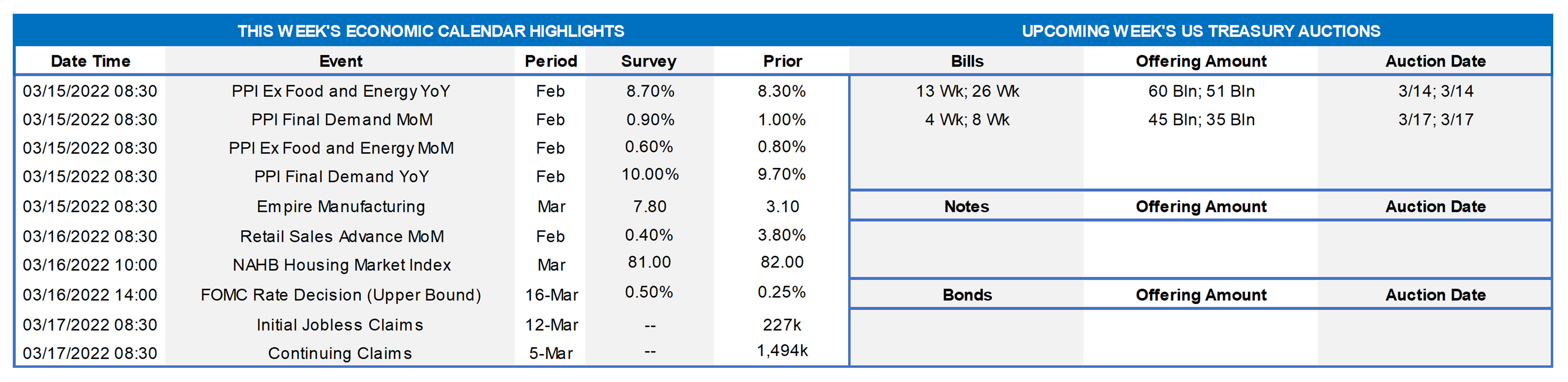

The markets’ attention will be split between the military conflict in Ukraine and the Federal Open Market Committee (FOMC) meeting this week. The FOMC is universally expected to raise the federal funds rate target range upper-bound from .25% to .50%. The post-meeting communiqué likely will reiterate that labor-market conditions are tightening, as well as that the pandemic-related supply and demand imbalances and the reopening of the economy continue to contribute to elevated levels of inflation. Policymakers probably will also acknowledge that financial conditions have become considerably less accommodative in the wake of the Russia-Ukraine crisis. The statement can be expected to recognize that risks to the economic outlook remain, not only from the public healthcare crisis but also from overseas developments. The cessation of the Fed’s asset-purchase program likely will be noted too, and an updated Summary of Economic Projections will be released.

Producer Prices: Capped by an anticipated slowdown in core costs excluding food, energy and services, the Producer Price Index (PPI) for final demand probably climbed by .9% in February, after a 1% jump in the previous month. That projection, if realized, would leave the headline PPI a record 10% above the level posted in February 2021.

Empire State Manufacturing Index: Manufacturing activity in New York State likely expanded at an accelerated pace in March. The net percentage of survey respondents experiencing a pickup in general business conditions is expected to climb to 7.8% from 3.1% in February.

Retail & Food Services Sales: A tug of war between weaker motor vehicle purchases and stronger non-automotive spending probably left retail and foods services sales .3% higher in February, after a 3.8% jump in January. Net of a 1.7% decline in auto-dealership revenues, retail sales are expected to have climbed by .8% during the reference period, following a solid 3.3% prior-month increase. As always, market participants will pay particular attention to so-called control sales excluding auto, building materials and gasoline purchases. Barring any prior-month revisions, the .6% gain anticipated by the Street would leave core purchases over the first two months of the year 9.2% annualized above their October-December average, after a 6.5% Q4 gain.

NAHB Housing Market Index: Home-builders’ appraisals of market conditions probably remained upbeat in March, with the index dipping by one point to 81, still well above the neutral 50-point mark.

Housing Starts & Building Permits: While the Street expects new housing starts to rebound to a seasonally adjusted annual rate of 1.7mn in February from 1.64mn in the preceding month, unusually dry weather conditions across the country suggest that an upside surprise could be in the offing. By contrast, the number of building permits issued likely dipped by 1.5% to 1.87mn during the reference period but remained 8.2% above the 1.73mn recorded a year ago.

Industrial Production: To be released on the 17th, production at the Nation’s factories, mines and utilities probably expanded by .5% in February, after a natural gas-led 1.4% jump in January. With output likely eclipsing additions to productive capacity during the reference period, the overall operating rate likely rose by .3 percentage point to 77.9% – the highest level since March 2019.

Existing Home Sales: To be released on the 18th, the contraction in purchase-contract signings witnessed over the December-January span suggests that closings retreated by 3.9% to a SAAR of 6.25mn in February. With normal seasonal patterns pointing to no change in the number of homes on the market from January’s record low 910K, the stock of unsold homes will likely register at just 1.7 months’ supply.

Federal Reserve Appearances:

- Mar. 16 Federal Open Market Committee statement to be released.

- Mar. 16 Federal Reserve Chair Jerome Powell to hold post-meeting press conference.

- Mar. 18 Richmond Fed President Barkin to discuss the economic outlook with the Maryland Bankers Association.

Click to expand the below image.

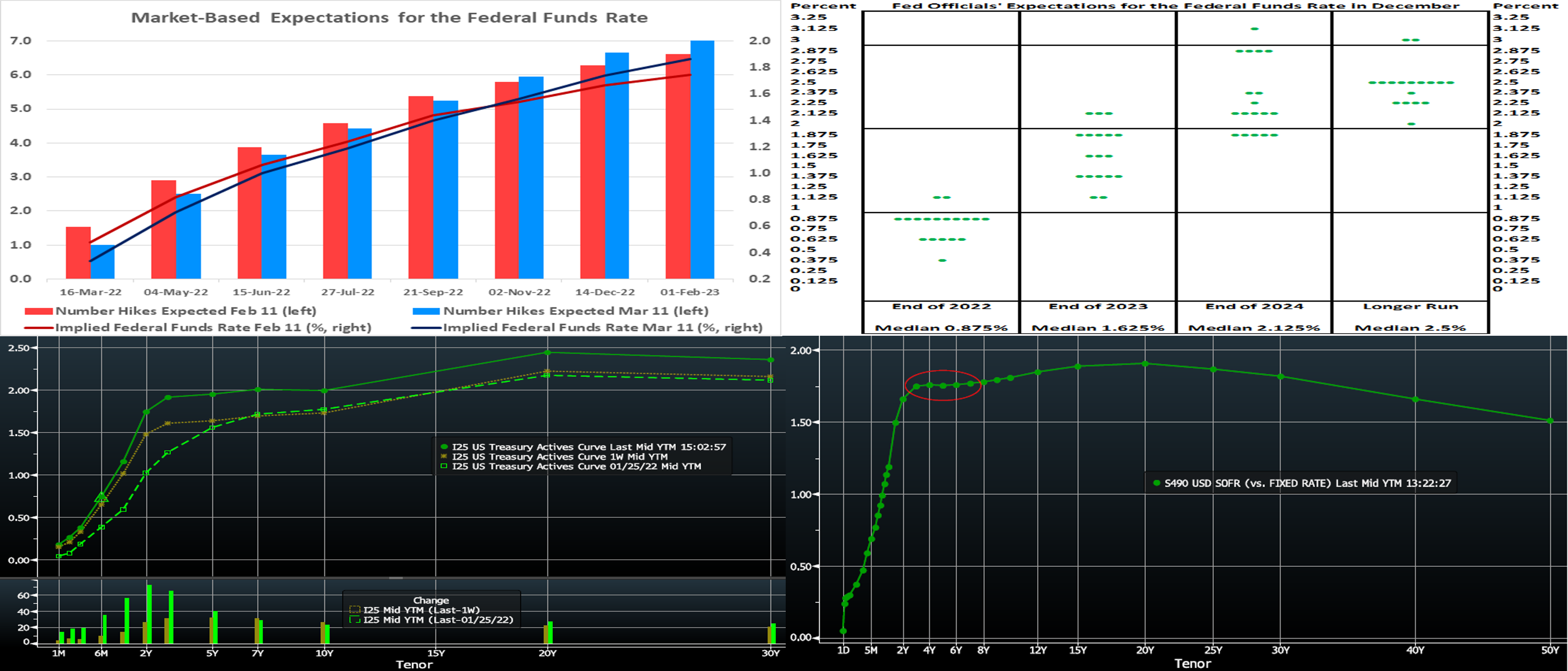

CHART 1 UPPER LEFT

Source: Bloomberg; Federal Reserve Board; FHLB-NY. Despite the heightened uncertainty caused by the Russian invasion of Ukraine, the FOMC is universally expected to raise the upper bound of federal funds rate target range by one-quarter percentage point from .25 to .50% at this week’s meeting. Market-based expectations of prospective near-term interest-rate increases have receded over the past four weeks but remain well ahead of those of Federal Reserve officials in mid-December, thereby implying some potential major upward adjustments to the so-called “dot plot” of policymakers’ projections of the policy rate.

CHART 2 UPPER RIGHT

Source: Bloomberg. Following on the above, shown here is the Fed’s December “dot plot”. Its end of 2022 median target rate of .875% is clearly well below that being currently priced by the market. Fed-speak since the December meeting has undergone a more hawkish evolution, and so these nearer-term dots appear prone to upward adjustment. Of interest in the Fed’s fresh “dot plot” will be its expectation of the “longer run” rate. While it was a median of 2.5% in December, the market has persistently priced (via fed funds futures and OIS curve) at lower levels, perhaps out of anticipation of inflationary forces ebbing once Fed hikes are underway and the economy adjusts post-pandemic.

CHART 3 LOWER LEFT

Source: Bloomberg. Note: Top pane is yield (%), bottom pane is change (bps). After dipping in the week prior, the UST yield curve steadily marched higher in the past week, led by the 3 to 7-year section of the curve. This sector, as of Friday afternoon, was ~30 bps higher than the week prior. The Russian invasion of Ukraine continued to dominate the news, but volatility and moves moderated somewhat from the extreme levels of the two preceding weeks, as stocks traded somewhat steadier and oil prices declined from early-week highs. The Ukraine situation remains fluid, but, as cited above, the Fed is still expected to opt for a 25 bps hike this week. As of Friday afternoon, the market priced for a 100% chance of a 25 bps hike this week and for a cumulative 6.6 hikes of 25bps in 2022. As seen in the chart, yields are higher than before the last FOMC, most notably in the 1 to 3-year sector. Market volatility, both day-to-day and intraday, remains high. Members should monitor conditions for potentially more optimal transaction timing. Market focus this upcoming week will remain on Ukraine developments and especially on the FOMC meeting.

CHART 4 LOWER RIGHT

Source: Bloomberg. In order to relay several points, portrayed here is the SOFR swaps curve as of this past Friday afternoon. First, please note that FHLB-NY offers SOFR swaps as well as SOFR ARC (Adjustable Rate Credit, i.e. floating rate) advances. Due to Libor cessation, products linked to Libor are no longer offered. Second, following on color from above, the near-term steepness of this curve reflects the market’s pricing of a Fed hiking cycle in the next two years. Third, note the extreme flatness in the curve from 3-year to longer tenors. The 3 to 7-year yields (noted by the red oval) are literally on top of each other. Our advance curve is somewhat similar and may provide opportunities to members. For instance (subject to market changes), a member can extend from 4-year to 5-year for no or minimal increase in the rate. Please contact the desk for further information and/or updates on rates and products.

FHLBNY Advance Rates Observations

Front-End Rates

- In a relatively less volatile week, short-end Advance rates finished mostly higher and the curve steeper from the week prior. While 1-month was a bp higher, 3-month was 4 bps higher and 6-month 11 bps higher. The market priced slightly more aggressive Fed hikes for 2022 compared to last week; this pricing and the fact that maturities are crossing further into the timeline of the expected Fed hiking cycle, were causal factors in the rate moves. Moreover, a dip of ~$30bn in MMF AUM this past week and a current trend towards low duration in front of the FOMC may have sapped demand in the longer money market tenors.

- At this stage, all maturities cross into upcoming FOMC meetings, thereby making them highly responsive to the market’s moves and pricing of the Fed.

Term Rates

- The advance rates curve generally mimicked the UST curve week-over-week and finished notably higher from the week prior. While the 1-year was ~14 bps higher, the 3-year was ~30 bps higher, 5-year was ~34 bps higher, and 10-year ~32 bps higher. Kindly refer to the previous section for relevant market color.

- On the UST supply front, this week serves a reprieve from auctions. Markets and rates remain highly prone to move on Ukraine news, with this week the all-important FOMC added to the mix. Given market volatility, members should monitor conditions for potentially more optimal timing on transactions. Please call the desk for information on market dynamics, rate levels, or products.

Product Alert: FHLBNY is pleased to announce enhancements to our Advance Rebate Program, which provides members an opportunity to receive a cash rebate when prepaying an eligible advance and rebooking a new advance within a 30-day period. Rebate-eligible advances now must have a minimum of 6-months (reduced from 1-year) remaining. Moreover, the potential cash rebate has been increased. This program can be suitable for those wishing to extend their liability duration and/or potentially improve net interest margin. Please call the Member Service Desk at (212) 441-6600 for more information.

Forward Start Advance (FSA): For members with upcoming borrowing or refunding plans, consider the FSA as a method to opportunistically “lock in” rates before advance settlement date. Please call the Member Service Desk at (212) 441-6600 for more information..

The Symmetrical Prepayment Advance Feature

With rates at or near multi-year lows, it is a compelling juncture to use the SPA feature on term advances. This feature allows member to capture, at prepayment, changes in the Fair Value of the advance which are favorable to the member. Contact us to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.