Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week of March 8, 2021

Economist Views

With no Federal Reserve officials scheduled to make a public appearance and only a handful of comparatively minor economic reports slated to hit the tape, the attentions of market participants likely will be focused on progress towards passing the American Rescue Plan – the Biden Administration’s $1.9trn fiscal relief package. As of this writing, the Senate has begun debate on the bill ahead of the amendment-proposal stage. Republicans are planning to pitch a variety of measures, all almost certain to fail, to show their opposition to the Democrats’ policies. The upper chamber is likely to pass the legislation over the weekend, with the House requiring a second vote on the package to agree to the Senate’s changes. Democratic leaders hope to achieve final passage before March 13 when supplemental unemployment benefits cease.

NFIB Small Business Optimism Index: A record level of available positions at small firms, combined with plans to add workers and boost compensation, suggest that the NFIB’s sentiment barometer rebounded in February, completely reversing January’s reported decline.

Consumer Price Index: Firmer retail energy prices, along with anticipated increases in core goods and services costs, probably pushed the Consumer Price Index (CPI) 0.4% higher last month, after a 0.3% rise in January. Excluding projected movements in food and energy costs during the reference period, the core CPI likely climbed by 0.2%, following no change over the prior two months. Those forecasts, if accurate, would place the overall and core CPIs 1.7% and 1.3% above their respective year-ago levels – both well below the Federal Reserve’s desired 2% target.

JOLTS Job Openings: A reported rebound in online job postings suggests that the Bureau of Labor Statistics’ count of available positions probably climbed by 200K to an 11-month high of 6.845mn in January.

Michigan Consumer Sentiment Index: Weekly consumer confidence surveys suggest that the University of Michigan’s barometer probably rebounded sharply in early March to a 12-month high reading of 82.8.

Federal Reserve: No appearances scheduled.

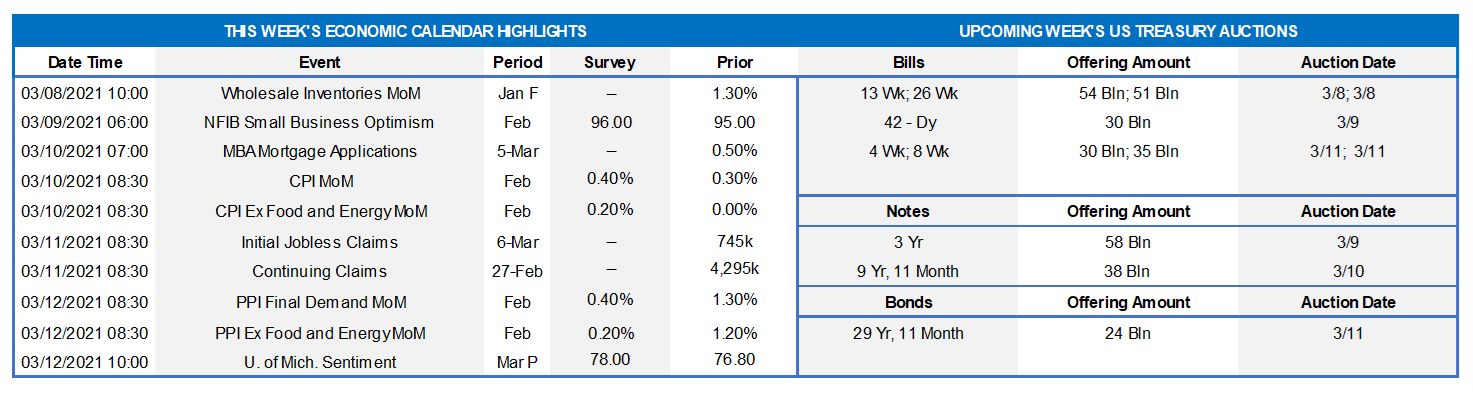

CHART 1 – UPPER LEFT

Source: BLS, FHLBNY. As impressive as February’s employment situation report was, last month’s figures likely understated the true health of the labor market. Indeed, a “black-box warning” accompanying the release highlighted that severe winter storms occurred during the Bureau of Labor Statistics’ canvassing period. A whopping 897K persons were unable to work, due to inclement weather conditions – well above the 289K historical average for February. Moreover, an additional 1.9mn employees who normally work full-time could only work part-time. Looking ahead, a return to more normal weather conditions could provide a significant lift to net job creation in March.

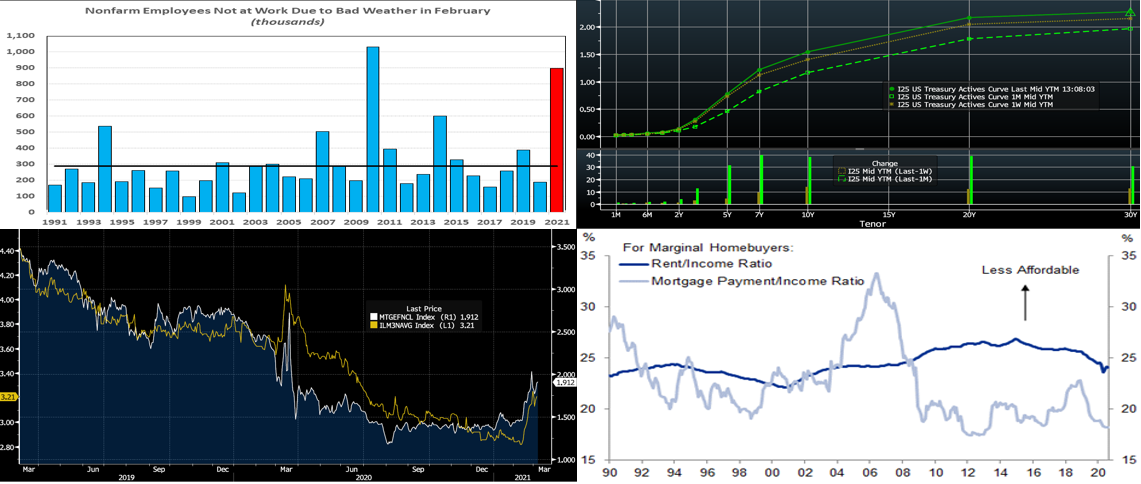

CHART 2 – UPPER RIGHT

Source: Bloomberg. Note: top pane is yield (%), bottom pane is change (bps). The UST curve continued its march higher and steeper week-over-week, led by the 7 to 10-year sector. Shorter maturities finished modestly changed, but the 5 through 10-year sector was ~4 to 12 bps higher, in progressive fashion. The market has repriced for a potential earlier Fed hike via the recent rise in 2 to 3-year yields. The upward and steeper move in rates should prove welcome for many financial institutions’ NIM. While the Covid-19 situation has plateaued at still concerningly high levels, the notable upward trend in vaccinations has boosted economic projections. A further round of relief legislation remains “in the works” but potentially very near at hand, along with the attendant/expected UST supply to finance it. Recent economic data, including even the freshly released February Employment Situation report, have outperformed consensus forecasts. The market also eagerly awaits a regulatory decision on an extension past 3/31 of the exemption of banks’ UST holdings from the Supplemental Leverage Ratio calculation; if not extended, then bank demand for UST’s could decrease. These dynamics continue to underpin the “bear steepening” and have led to a market strategist scramble to adjust their rate forecasts higher.

CHART 3 – LOWER LEFT

Source: Bloomberg. Charted here is the MBS Current Coupon (RHS, computed yield of a par-priced Agency MBS) vs. the Bankrate.com 30-year mortgage rate (the rate a homeowner obtains) index. The bond market sell-off has pushed these rates notably higher. As mentioned above, this move may prove helpful to financial institutions’ interest income and margins. Despite the move higher in the past month, these rates are still well below those of 2019.

CHART 4 – LOWER RIGHT

Source: Goldman Sachs Research. The move higher in mortgage rates may put a dent in the housing sector but is unlikely to de-rail what has been a strong area of the economy. Rates remain low from a longer-term perspective, and an improving jobs market may offset rate impacts. As seen here, the mortgage payment to income ratio resides in a non-worrisome zone.

FHLBNY Advance Rates Observations

Front-End Rates

Short-end advance rates finished unchanged to a bp lower, week-over-week. T-bill issuance was its usual market feature, but net supply has slowed and thereby allowed for easier market absorption. Money market funds’ AUM increased by ~$18.5bn this past week, led by Government-Only funds, thereby infusing demand for short paper. From a bigger-picture vantage point, an overall moderation in market supply of short paper, in tandem with high cash levels in the market, is expected to keep short-end rates relatively steady and under downward pressure in the year’s first half.

UST issuance overall is now net positive supply in that more is being issued than what the Fed is buying in its programs. However, with short UST rates at rock-bottom levels and the Fed on hold for a long period, rates are likely to persist in a near-term sideways to softer pattern. Importantly, weekly net T-bill issuance has been lower since last summer and even negative at times in recent weeks/months, and Treasury has announced plans to shift issuance out the curve. Even with a new relief package and related borrowing, these market supply/demand and Treasury issuance dynamics should keep short rates in check on the upside.

Term Rates

On the week, medium and longer-term Advance rates were unchanged to ~12 bps higher, with the 7 to 10-year sector of the curve leading the way. Please refer to the previous section for further color on relevant market dynamics.

On the UST supply front, this week brings 3/10/30-year UST auctions. Recent auction sizes have been of record size and another contributor to the curve’s moves, as buyers have demanded higher yields. Focus this week will remain on Covid-19 and fiscal legislation developments.

New Product Alert: In order to satisfy member needs and provide greater product flexibility to match bond and derivative market conventions, FHLB-NY now offers SOFR-linked advances based on SOFR-index compounding. Note that this product is in addition to SOFR-linked advances based on SOFR-index averaging which have been offered since November 2018.

The Symmetrical Prepayment Advance Feature

With rates at or near multi-year lows, it is a compelling juncture to use the SPA feature on term advances. This feature allows member to capture, at prepayment, changes in the Fair Value of the advance which are favorable to the member. Contact us to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the

MSD Team.

Special Member Alert

The FHLBNY recently announced a newly expanded and flexible Disaster Relief Funding (DRF) advance program which offers discounted rate advances with maturities 1-mo and greater. Additionally, we have announced that PPP loans will be accepted as eligible collateral. Please contact us with any questions.