Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week ending March 7, 2025.

Economist Views

Click to expand the below image.

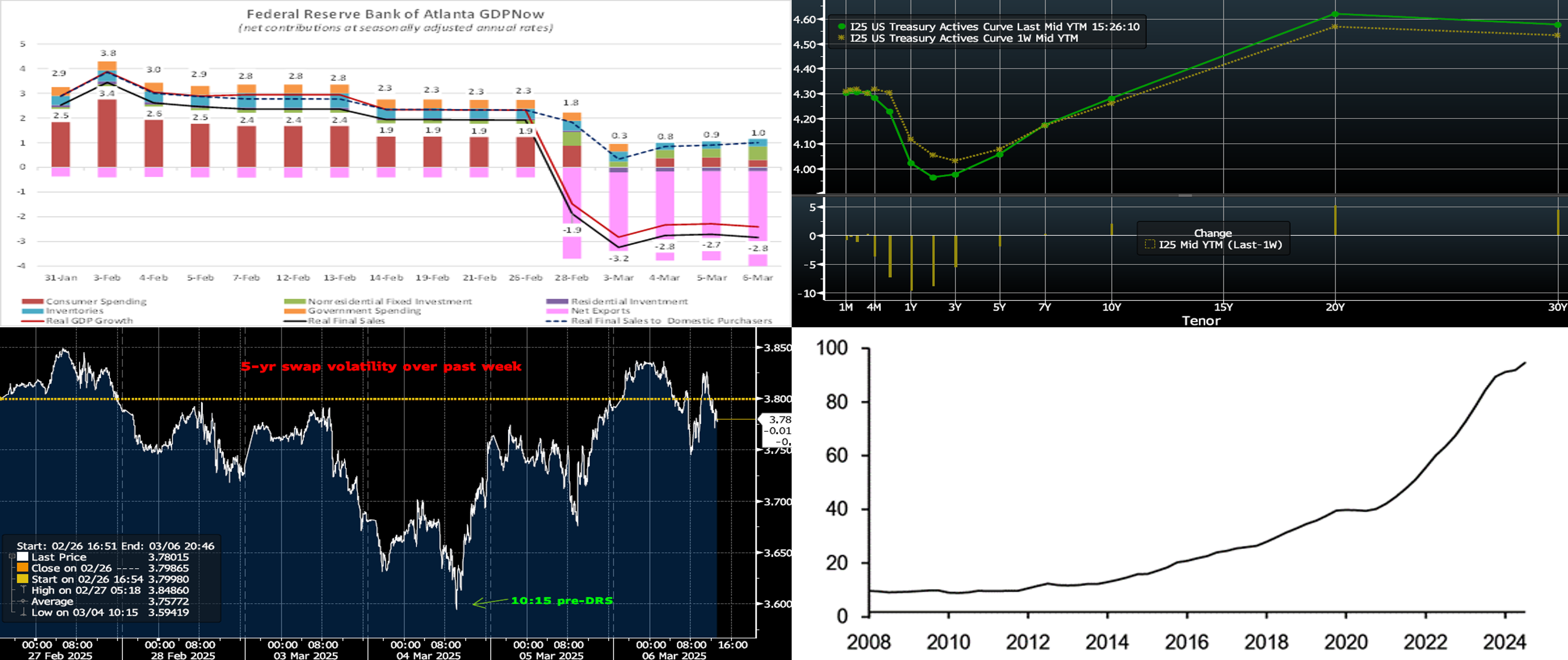

With the Bureau of Labor Statistics update on the employment situation in February in the rear-view mirror, the market’s focus in the upcoming week will turn to the inflation side of the Federal Reserve’s dual mandate. Headline consumer price inflation probably slowed marginally last month. Capped by stable retail energy costs, the CPI likely climbed by .3% during the reference period, following the larger-than-expected .5% hike witnessed in January. Excluding volatile food and energy costs, the core CPI probably continued apace, rising by .4% for a second consecutive month. Those projections, if realized, would leave the overall and core CPIs 2.9% and 3.3% above their year-ago levels, both well above the central bank’s desired 2% target. Amid heightened economic policy uncertainty, both small business and consumer confidence gauges are expected to portray sizable deteriorations from their prior-period soundings. Job openings nationwide are expected to have been little changed in January, while updates on initial and continuing jobless claims should remain in recent ranges. All will be quiet on the Federal Reserve front, as policymakers observe the traditional blackout period ahead of the upcoming FOMC meeting.

NFIB Small Business Optimism Index: Echoing reported sharp declines in consumer confidence gauges, the National Federation of Independent Business’ sentiment barometer likely tumbled by ten points to a five-month low of 92.8 in February.

JOLTS Job Openings: A reported uptick in online help-wanted postings suggests that nationwide job openings rose by a modest 20K to 7.62mn in January, reversing little of the 556K falloff witnessed in December. At an estimated 770K during the reference period, the excess of vacant positions nationwide would represent 1.11 jobs per unemployed person.

Jobless Claims: Labor market conditions likely remained healthy during the filing period ending March 8, with initial claims for unemployment insurance benefits remaining in a historically low 215K-230K band. The total number of persons receiving regular state benefits probably registered below 1.9mn once again during the week ended February 28.

Michigan Sentiment Index: Consumers’ appraisals of current and prospective economic conditions likely deteriorated further in early March, leaving the University of Michigan’s barometer 7.2 points lower at 57.5 – the weakest reading since November 2022.

Federal Reserve Appearances: Federal Reserve officials to observe the external communications blackout period ahead of the March 18-19 FOMC meeting.

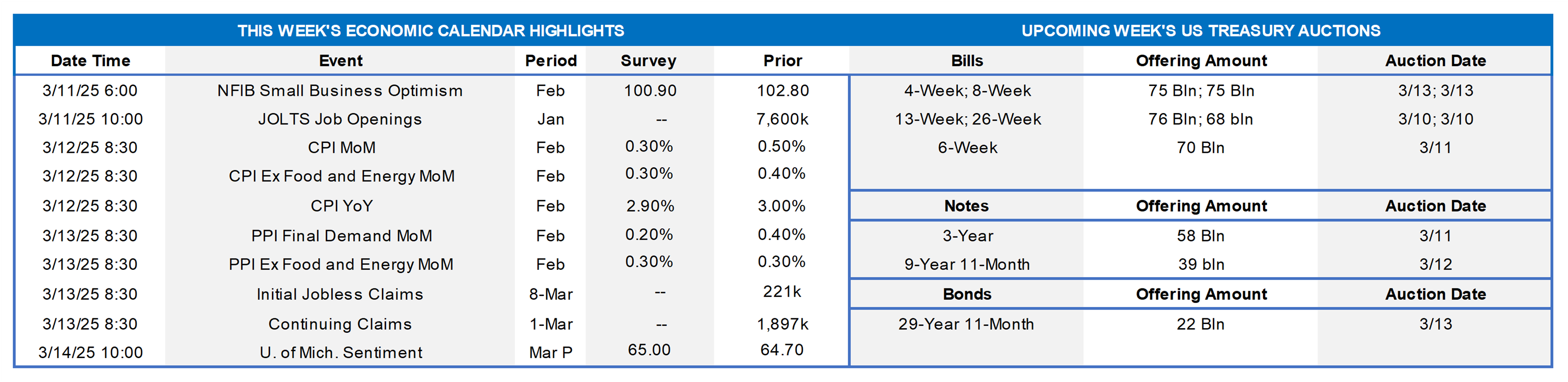

CHART 1 UPPER LEFT

Source: Federal Reserve Bank of Atlanta; FHLB-NY. Fears of an impending sharp slowdown in real aggregate economic activity during Q1 are growing. The Atlanta Fed’s tracking estimate, or GDPNow, which stood as high as 3.4% annualized at the beginning of February has done a complete about-face and currently calls for a 2.8% annualized decline in real GDP in Q1. While the dramatic change in signs has been largely attributable to a massive tariff-induced deterioration in the international trade deficit, other areas have weakened significantly, especially ever-dominant consumer spending. A more accurate assessment of the slowdown in demand telegraphed by data releases over the past month is provided by real final sales to domestic purchasers (RFSDP) or GDP less the change in business inventories with the signs on exports and imports reversed. The Atlanta Fed’s implied estimate of RFSDP, which stood as high as 3.8% annualized on February 3, has been trimmed to show a more modest 1% gain.

CHART 2 UPPER RIGHT

Source: Bloomberg. Top pane is yield (LHS, %); bottom pane is change (LHS, bps). As of Thursday close, the UST term curve was steeper, with shorter tenor yields 5-year-and-under declining but longer ones rising, The 2-year fell ~8bps, whereas the 10-year rose by ~3 bps. It was a volatile week, per our subsequent chart and note. Economic data was generally mixed, with Friday morning’s jobs report being a potential market-mover. The market has notably re-priced 2025 Fed-easing expectations in the past two weeks. As of Thursday afternoon, the market prices end-2025 fed funds ~3.60%, or 13 bps lower than a week ago and which equates to just shy of three 25-bps Fed cuts. The market’s end-2026 forward is ~3.5%, or 4 bps lower than a week ago.

CHART 3 LOWER LEFT

Source: Bloomberg. While the saga continues albeit somewhat calmer on account of implementation delays, the White House Administration’s tariff announcements this past Tuesday sparked significant market volatility. Indeed, as can be seen here in the form of the 5-year swap (RHS, %), yields plunged in initial reaction to the news and to the selloff in stocks. Indeed, the 5-year swap fell to just shy of 3.60% mid-morning before subsequently retracing higher. The move prompted some opportunistic borrowers to take advantage of term and putable advances at more advantageous levels. As a reminder, note that our rates track market levels and that we are open and ready for borrowings well before the Daily Rate Sheet (DRS) hits members’ inboxes and when rates may have changed. We encourage members to call the desk for rate and/or market updates and thereby potentially achieve more advantageous funding levels.

CHART 4 LOWER RIGHT

Source: JP Morgan. Portrayed here is a multi-year trend of insurance industry residential mortgage loan holdings (LHS, “1-to-4” loans, $bn). These holdings have experienced a steady and notable increase in the last few years and are approaching $100bn. Indeed, holdings have doubled since 2021 and were at $94bn late last year. Helping to boost demand has been an increase in investment capacity from annuity sales, partly driven by a higher rates complex in the past few years relative to the decade prior. Indeed, the Life Insurance Marketing & Research Association’s U.S. Individual Annuity Sales Survey recently reported a third year of record-high annuity sales. Insurance company membership in the FHLB-system continues to grow and provide diversity to the system’s membership profile, with the system’s insurance company advance balances ~$160bn at the end of 2024.

FHLBNY Advance Rates Observations

Front-End Rates

- Short-end rates, as of Thursday afternoon relative to a week prior, were marginally higher in the shortest tenors but lower past 3-month. The 5 and 6-month tenors declined by 6 and 8 bps, respectively, as the market priced higher chances and degree of potential Fed easing this year. Robust Money Market Fund AUM levels, reaching another record high over $7trn this week, continue to support short-end paper. Also helpful is that net T-bill supply is expected to turn negative in the month ahead, owing to debt ceiling dynamics.

- With the Fed in blackout mode, the market will monitor economic data in the upcoming week.

Term Rates

- The longer-term curve, generally mirroring moves in USTs and swaps, notably steepened from the week prior. The 2-year declined ~10 bps, the 5-year was unchanged, and the 10-year rose by ~4 bps. The 2 and 3-year are currently the lowest points on the curve. Kindly refer to the previous section for color on market dynamics and changes. We encourage members to engage with the Member Services Desk for current rate levels and market dynamics.

- On the UST term supply front, the upcoming week serves a heavy slate of 3/10/30-year auctions. Note that UST auctions usually occur at 1 p.m. and can occasionally spur volatility around that time. Please contact the Member Services Desk for further information on market dynamics, rate levels, or products.

Price Incentives for Advances Executed Before Noon: In effect as of Tuesday, September 5, 2023, the FHLBNY is pleased to now offer price incentives for advances executed before Noon each business day. These pricing incentives offer an opportunity to provide economic value to our members, while improving cash and liquidity management for the FHLBNY. For further details, kindly refer to the Bulletin.

Looking for more information on the above topics? We’d love to speak with you!

Archives

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.