Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week of March 7, 2022

Economist Views

Click to expand the below image.

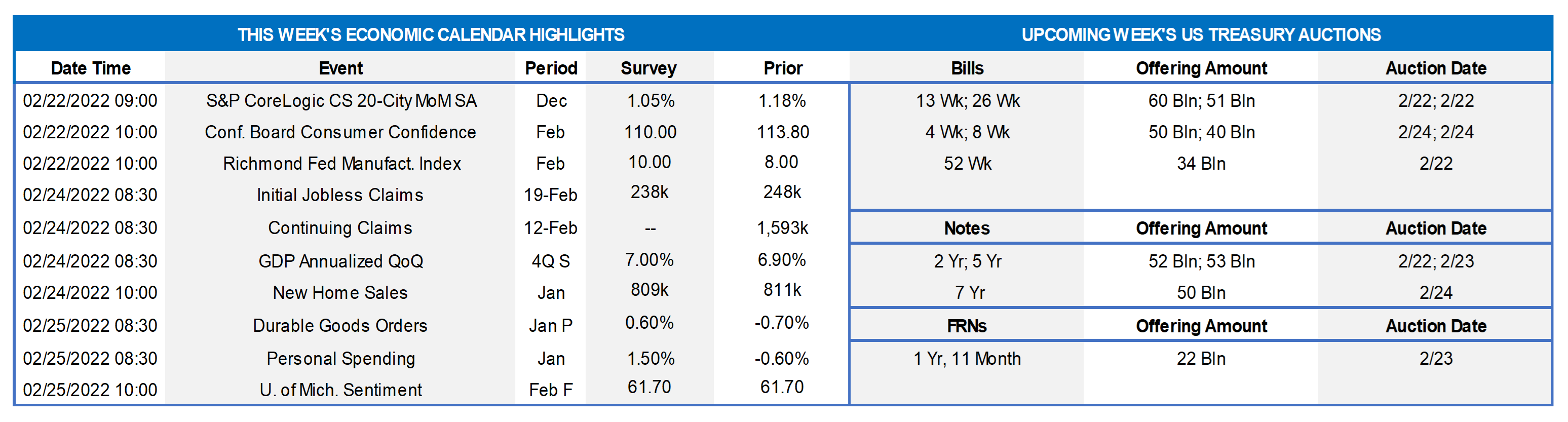

Developments in the Russia-Ukraine crisis will remain top of mind for market participants, with each news item impacting expectations for the prospective path of U.S. monetary policy. The economic release calendar will be far less crowded this week. Reflecting a pickup in energy prices, the Consumer Price Index is expected to post its largest one-month increase since October. The Bureau of Labor Statistics’ update on job openings at the beginning of the year likely will reveal that available positions remained at a record high. Federal Reserve officials will be silent, observing the traditional blackout period ahead of the upcoming Federal Open Market Committee meeting.

Consumer Credit: Consumers are expected to have added $24bn of installment liabilities in January, after an $18.9bn takedown in the final month of 2021.

NFIB Small Business Optimism Index: Echoing already reported upbeat Institute for Supply Management reports, the National Federation of Independent Business’ barometer probably climbed from January’s 97.1 reading.

International Trade Balance: A record merchandise gap likely boosted the combined shortfall on international trade in goods and services to $87.1bn in January, after an $80.7bn deficit in the previous month.

JOLTS Job Openings: Available online help-wanted data suggest that total job openings were little changed from the 10.9mn recorded in December. Given the rise in civilian unemployment in January, that result would leave the two months ago gap between available positions and the jobless slightly narrower at 4.4mn.

Jobless Claims: Initial and continuing state unemployment insurance claims probably moved lower in their respective reporting periods, as the impact of the Omicron variant subsides.

Consumer Price Index: Buoyed by higher retail energy costs, the Consumer Price Index (CPI) likely jumped by .8% in February, after a .6% increase in the previous month. Anticipated pullbacks in airline fares and used motor vehicle costs probably capped the rise in the core CPI excluding volatile food and energy prices at .5% during the reference period, following a .6% prior-month gain. Those forecasts, if realized, would place the overall and core CPIs 7.9% and 6.4% above their respective year-ago levels, both well above the Federal Reserve’s 2% target.

Michigan Sentiment Index: The University of Michigan’s survey will provide a glimpse at consumers’ reactions to the Russian invasion of Ukraine.

Federal Reserve Appearances: None. Federal Reserve officials will be observing the traditional blackout period before the March 15-16 FOMC meeting.

Click to expand the below image.

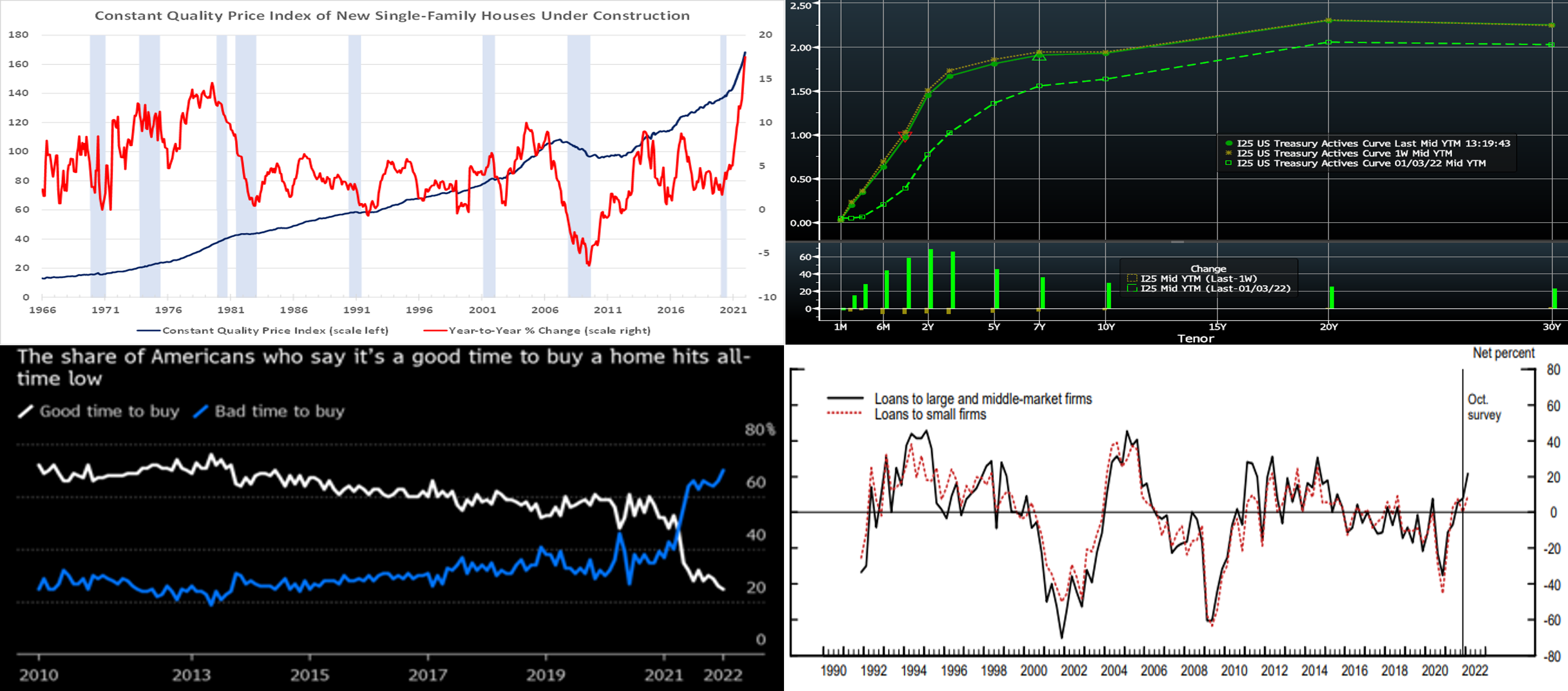

CHART 1 UPPER LEFT

Source: Bureau of Labor Statistics; FHLBNY. The February employment situation report, released this past Friday morning, was yet another positive surprise. Hiring once again eclipsed market expectations by a wide margin last month. To date 19.9mn, or 90.4%, of the 22mn nonfarm jobs lost over the March-April 2020 timespan have been recovered. Moreover, headcounts in many private-service producing industries are now well above their February 2020 levels. The decline in the unemployment rate, meanwhile, has placed it roughly one-quarter percentage point above the 3.5% anticipated by Fed policymakers at the end of this year. Wages stalled, but the timing of the establishment survey likely was the cause of the tepid result. Uncertainty surrounding the impact of the Russia-Ukraine crisis on the domestic economy suggest that the FOMC will opt for a modest 25 bps hike in the Fed funds target range at the March 15-16 meeting; the yield curve, as of midday Friday, likewise priced for a 25 bps increase.

CHART 2 UPPER RIGHT

Source: Bloomberg. Note: Top pane is yield (%), bottom pane is change (bps). As of Friday afternoon, the UST yield curve finished lower, led by the 5 to 7-year section of the curve. While the 2-year was ~8 bps lower, the 5 and 10-year were ~23 bps lower. Yields hit even lower levels earlier in the week (see Chart 4 below), as the Russian invasion of Ukraine continued to dominate the news and influence market dynamics. The Ukraine situation remains fluid, but, as cited above, the Fed is still expected to opt for a 25 bps hike this month. As of Friday afternoon, the market priced for a 96% chance of a 25 bps hike in March and for a cumulative 5.7 hikes of 25bps in 2022. Yields remain higher than at the start of the year but more so in the shorter than longer end. Market volatility, both day-to-day and intraday, remains high. Members should monitor conditions for potentially more optimal transaction timing. Market focus this upcoming week will remain on Ukraine developments and economic data.

CHART 3 LOWER LEFT

Source: Bloomberg. Market volatility, both in actual rate moves and that implied by options market pricing, has soared in the past month, as reflected here in the notable increase in the MOVE index, a yield curve weighted index of the normalized implied volatility on 1-month expiry options on 2/5/10/30-year USTs. The market’s expectation of a soon-to-come Fed hiking cycle was an initial impetus to higher levels of volatility, but the Russian invasion of Ukraine added a potent and volatile dynamic to the mix.

CHART 4 LOWER RIGHT

Source: Bloomberg. Staying on the above topic, volatility can often create opportunity. Portrayed here, clearly evidencing the market’s volatility, is the UST 3-year in 30-minute intervals over the past week. Note that on Tuesday afternoon, the yield had plunged to 1.435%, over 30 bps lower than where (~1.76%) it closed the prior week. Members with upcoming borrowing or refunding plans can monitor such moves for potential opportunities to secure funding at more advantageous rates. Please recall that our Advance rates move with the market and that our Daily Rate Sheet is an early-morning snapshot in time. Also note that we offer forward start advances which can offer flexibility on settlement date. Please contact the desk for further information on rates and products.

FHLBNY Advance Rates Observations

Front-End Rates

- In another volatile week, short-end Advance rates closed mixed and flatter from the week prior. While rates out to 3-month were 5 to 6 bps higher, the 4-month was unchanged, and those for 5 and 6-month were 6 bps lower. The market’s pricing this past week of a somewhat less aggressive tightening cycle over 2022 enabled the longer tenors to dip from the prior week’s levels. As reflected in still lofty balances of MMF AUM and the Fed’s RRP, cash and liquidity in the markets remain ample, but short-term rates are now highly subject to the Fed and the market’s pricing thereof, with also the Ukraine crisis continuing to be of potential impact.

- At this stage, most maturities cross into upcoming FOMC meetings, thereby making them highly responsive to the market’s moves and pricing of the Fed.

Term Rates

- The advance rates curve generally mimicked the UST curve week-over-week and finished lower and flatter from the week prior. While the 1-year was unchanged, the 2-year was ~11 bps lower, 5-year was ~25 bps lower, and 10-year ~28 bps lower. Kindly refer to the previous section for relevant market color.

- On the UST supply front, this week serves up 3/10/30-year auctions. Markets and rates are highly prone to move on Ukraine news. Given market volatility, members should monitor conditions for potentially more optimal timing on transactions. Please call the desk for information on market dynamics, rate levels, or products.

Product Alert: FHLBNY is pleased to announce enhancements to our Advance Rebate Program, which provides members an opportunity to receive a cash rebate when prepaying an eligible advance and rebooking a new advance within a 30-day period. Rebate-eligible advances now must have a minimum of 6-months (reduced from 1-year) remaining. Moreover, the potential cash rebate has been increased. This program can be suitable for those wishing to extend their liability duration and/or potentially improve net interest margin. Please call the Member Service Desk at (212) 441-6600 for more information.

Forward Start Advance (FSA): For members with upcoming borrowing or refunding plans, consider the FSA as a method to opportunistically “lock in” rates before advance settlement date. Please call the Member Service Desk at (212) 441-6600 for more information..

The Symmetrical Prepayment Advance Feature

With rates at or near multi-year lows, it is a compelling juncture to use the SPA feature on term advances. This feature allows member to capture, at prepayment, changes in the Fair Value of the advance which are favorable to the member. Contact us to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.