Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week ending March 3, 2023.

Economist Views

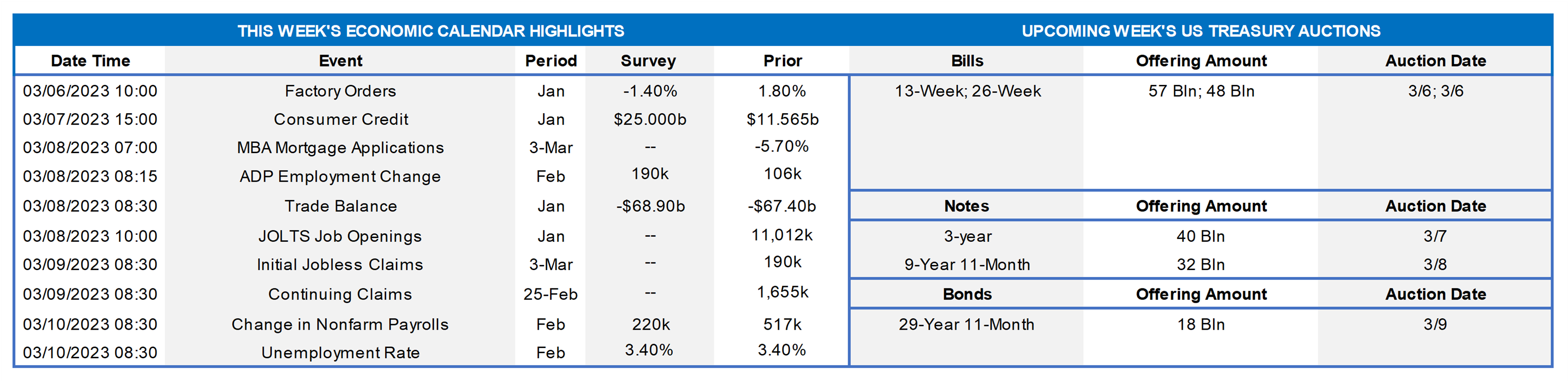

Click to expand the below image.

Federal Reserve Chair Jerome Powell’s Semi-Annual Monetary Policy Report to the Congress will be the marquee event this week. Given the significant increases in market expectations of prospective federal funds rate hikes since last month’s Federal Open Market Committee meeting, traders and investors will be interested to see if policymakers share their concerns, potentially signally alterations to the closely followed “dot plot” to be released after the March 22 gathering. On the data front, the February employment report will be the key release. The Bureau of Labor Statistics is expected to report that the hiring environment remained exceptionally tight last month.

Factory Orders: An aircraft-led drop in durable goods bookings probably pared total factory orders by 1.8% in January, erasing a likely revised 1.6% end-of-year gain.

Consumer Credit: Consumer installment credit growth is expected to have accelerated in January, jumping by $25bn after the comparatively modest $11.6bn takedown recorded in December.

International Trade Balance: Reflecting an already reported widening of the merchandise gap, the total shortfall on international trade in goods and services likely climbed to $68.9bn in January from $67.4bn in the previous month.

JOLTS Job Openings: A falloff in online help-wanted postings suggests that nationwide job openings contracted by 170K to 1.084mn in January, reversing a portion of the 572K leap witnessed in December. At an estimated 5.15mn, the excess of available positions would represent 1.9 jobs per unemployed person.

Jobless Claims: New claims for unemployment insurance benefits probably remained below the 200K mark for a seventh straight week during the period ended February 24. Keep an eye on continuing claims, which have clocked in below the 1.7mn mark since mid-December, for any signs that recently furloughed employees may be having a more challenging time finding work.

Employment Situation Report: Labor market conditions likely remained exceptionally tight in February. Indeed, nonagricultural establishments probably added 285K net new workers, following the 517K surge witnessed in the prior month. The civilian unemployment rate is expected to hold steady at the half-century low of 3.4% in January. An extended 5-week interval between the January and February canvassing periods points to a .5% rise in average hourly earnings during the reference period, placing nominal compensation 4.9% above the $31.63 per hour recorded a year ago.

Federal Reserve Appearances:

- Mar. 7 Federal Reserve Chair Powel to present the Semi-Annual Monetary Policy Report to the Senate Banking Committee.

- Mar. 8 Fed Chair Powel to present the Semi-Annual Monetary Policy Report to the House Financial Services Committee.

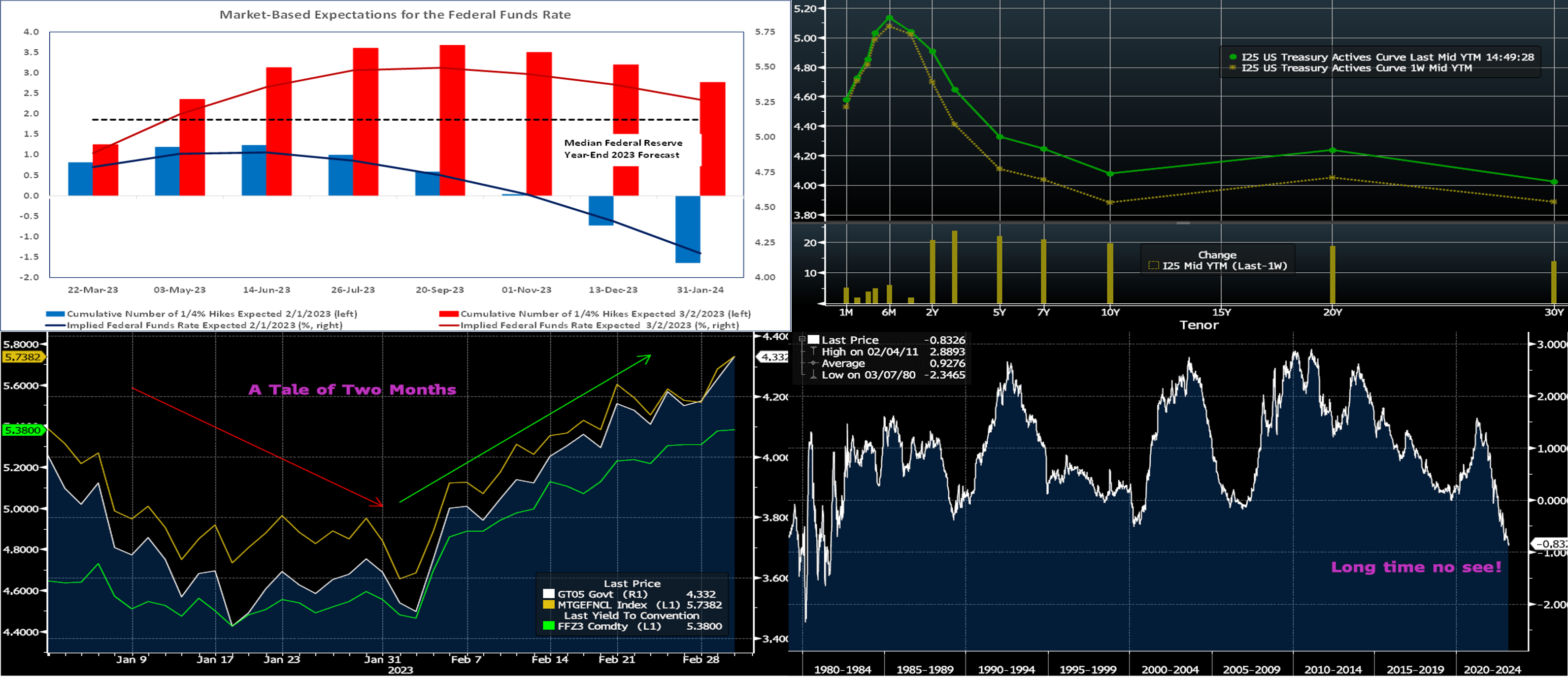

CHART 1 UPPER LEFT

Source: Bloomberg; Board of Governors of the Federal Reserve System; FHLB-NY. Tight labor market conditions and disappointing progress in reining in consumer inflation have propelled market-based expectations of prospective federal funds rate levels markedly higher since the Federal Open Market Committee’s February 1 meeting. At the time of that gathering, the market was anticipating the equivalent of ~1¼ 25 bps increases, with the federal funds target topping out at approximately 4.9% and rate cuts commencing in September. Futures markets are now pricing in a little over 3½ such moves that will lift the federal funds rate target to nearly 5½%, thereby eclipsing the 5.125% median projection in the Federal Reserve’s December dot plot. The Fed’s “dot plot” looks prone to receive an upward revision at the March 22 FOMC meeting.

CHART 2 UPPER RIGHT

Source: Bloomberg. Top pane is yield (LHS, %), bottom pane is change (bps). As of Thursday afternoon, UST term yields pushed higher yet again, week-over-week, as the 2 to 10-year sector was up by 20 to 23 bps. Economic data was again on the stronger side of expectations; for instance, both ISM Manufacturing Prices Paid and unit labor costs reflected persisting inflationary embers, while the latest jobless claims figures again reflected a resilient labor backdrop. Meanwhile, inflation data from the Eurozone was stronger than expected. Consequently, the market further re-priced higher and longer than the prospective path of Fed hikes. For the March 22nd FOMC, the market prices a 100% probability of a 25 bps hike, with ~25% chance of a 50 bps hike. The market’s pricing for end-2023 is now ~5.33%, up from last week’s 5.17%. The market has also priced higher/later the peak rate to ~5.45-5.50% for this September, up from ~5.35% as well as a month later compared to a week ago.

CHART 3 LOWER LEFT

Source: Bloomberg. If Charles Dickens were to write a summation of 2023 markets thus far, it would likely be titled “A Tale of Two Months”! Here can be seen the dramatic course reversal in markets from January to now, as the market progressively re-priced higher and longer its expectations for the Fed-hiking cycle. For instance, the December 2023 Fed Funds futures contract rate (LHS, green, %) declined from ~4.65% to ~4.50% in January but has since rebounded and more to ~5.38% as of this writing. The 5-year UST (RHS, white, %) fell from ~4.01% to ~3.50% in January but has since climbed persistently higher to now ~4.33%. The 30-year Agency MBS Current Coupon (imputed yield of a par-priced MBS, LHS, beige, %), meanwhile, fell from ~5.40% to ~4.70% in January but is now ~5.74%. Upcoming economic data will be key to the future direction of yields. While much milder than a month ago, the market still prices for a Fed easing cycle in 2024; at this juncture, it appears likely that some softer data, and soon, will be necessary to keep this pricing intact.

CHART 4 LOWER RIGHT

Source: Bloomberg. This chart may prove interesting or surprising to history buffs and those who have been “around the block a few times.” The market re-pricing covered above has naturally driven 2-year yields higher, and, consequently, the yield curve flatter. The UST 2-year/10-year curve (RHS, %) has reached its lowest and most inverted level, ~83 bps, in decades.

FHLBNY Advance Rates Observations

Front-End Rates

- Short-end rates were mixed, week-over-week. While very short rates dipped a few bps, 1-month-and-out tenors increased 3 to 7 bps in steepening fashion. The move higher was essentially further upwardly revised pricing of the Fed’s hiking path. Please see the previous section for more specific Fed-pricing color.

- Given the Fed’s ongoing tightening and data-dependent posture, rates will be most responsive to Fed-speak and the data calendar. Friday’s jobs report will be a key release.

Term Rates

- The longer-term curve moved 12 to 25 bps higher week-over-week, as of Thursday afternoon, generally mirroring moves in USTs and swaps. The rise was led by the 2 to 10-year sector which was all over 20 bps higher. Kindly refer to the previous section for relevant market color. The advance curve remains inverted out to 5-year, thereby offering opportunities to extend in advance duration at lower coupon cost.

- On the UST term supply front, this upcoming week serves 3/10/30-year auctions. Data releases will be prominent, especially Friday’s jobs data. Kindly call the Member Services Desks for information on market dynamics, rate levels, or products.

Product Alert: FHLBNY is pleased to announce the reintroduction, after a temporary suspension owing to Libor-cessation, of the Putable Advance, Fixed-Rate with SOFR Cap Advance, and ARC with SOFR Cap/Floor Advance. The Callable Advance continues to be offered. This expansion of the product menu will provide members with more options and flexibility for the management of funding and/or hedging needs.

Forward Start Advance (FSA): For members with upcoming borrowing or refunding plans, consider the FSA as a method to opportunistically “lock in” rates before advance settlement date. Please contact the Member Services Desk at (212) 441-6600 for more information.

The Symmetrical Prepayment Advance Feature

For those anticipating term funding needs, and with rates on an uptrend, it can be an appropriate juncture to consider our SPA feature. This feature allows the member to capture, at prepayment, changes in the fair value of the advance which are favorable to the member. Contact Member Services Desk to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.