Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week of March 1, 2021

Economist Views

The first week of March will be bracketed by the usual reports: the Institute for Supply Management’s survey of factory activity and the Bureau of Labor Statistics’ update on the employment situation in February. Both reports are expected to show significant improvements from soundings taken in January. Motor vehicle sales probably dipped last month but remained above 16mn annualized for a third straight month. Over half a dozen Federal Reserve officials will make public appearances on a variety of topics this week. Enjoying pride of place, Federal Reserve Chair Jerome Powell’s discussion of the economic outlook on Thursday will be scrutinized closely for the central bank’s thoughts on the recent dramatic steepening of the Treasury yield curve.

ISM Manufacturing Purchasing Managers Index (PMI): The nationwide manufacturing expansion entered its ninth month in February, with the pace of activity likely accelerating from January’s reported clip. The Manufacturing PMI probably climbed to 60.0 last month from the 58.7 reading posted at the beginning of the year.

Motor Vehicle Sales: Light truck and passenger car sales are expected to record a seasonally adjusted annual rate of 16.35mn in February, down from 16.63mn in January and 16.83mn 12 months earlier.

ADP National Employment Report: ADP’s update on private sector hiring in February could color expectations prior to the official government report on Friday. Modest reductions in both initial and continuing jobless claims since the January canvassing period point to a 190K rise in private payrolls, after the 173K increase in the prior month.

ISM Services Purchasing Managers Index: Improvements in a variety of Federal Reserve district bank surveys, combined with the preliminary report from Markit Economics, suggest that the ISM’s gauge of service-producing activity probably topped the 60-point mark for the first time since November 2018.

Employment Situation Report: The BLS’ update on employment in February will be the marquee statistical event of the week. Payroll employment growth is expected to have accelerated sharply, with the consensus projecting 145K net new positions created after January’s tepid 49K gain. The steady decline in the state insured unemployment rate between the January and February canvassing periods hints that civilian jobless may have moved below the 6% mark for the first time since the shuttering of the economy last March. With the bulk of hiring likely to be concentrated in lower-paid, service-producing segments, average hourly earnings probably were little changed, following a 0.2% uptick in the prior month.

Federal Reserve:

Mar. 1: New York Fed President John Williams to make remarks at virtual conference sponsored by the Bank on culture.

Mar. 1: Fed Presidents Bostic (Atlanta), Mester (Cleveland) and Kashkari (Minneapolis) to discuss racism and the economy.

Mar. 2: Fed Governor Lael Brainard to take part in a virtual discussion sponsored by the Council on Foreign Relations.

Mar. 2: San Francisco Fed President Mary Daly to give a speech to the Economic Club of New York.

Mar. 3: Philadelphia Fed President Harker to participate in a virtual conference on an equitable workforce discovery.

Mar. 3: Chicago Fed President Evans to discuss economic outlook at virtual conference sponsored by CFA Society Chicago.

Mar. 3: Federal Reserve to release The Beige Book Summary of Commentary on Current Economic Conditions.

Mar. 4: Fed Chair Jerome Powell to discuss U.S. economy at a virtual event sponsored by the Wall Street Journal.

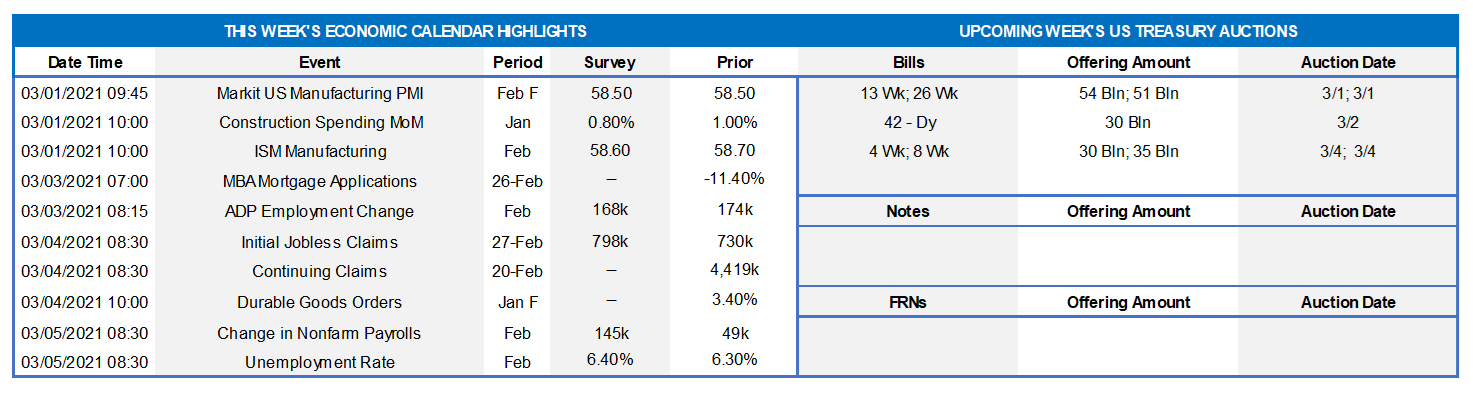

CHART 1 – UPPER LEFT

Source: Census Bureau, FRB St. Louis, FHLBNY. Note: Shaded blue areas denote recessions and orange denotes period with recession probability below 1%. The Census Bureau reported that durable goods orders jumped by 3.4% in January. More than triple the 1.1% gain anticipated by the Street, last month’s rise in hard goods bookings was the largest since the 11.8% leap posted last July. With the exceptions of modest dips in computers & electronic products, machinery, and motor vehicles, major segments experienced solid orders gains last month. Non-defense capital goods shipments excluding commercial jetliner deliveries – a key input into government statisticians’ estimates of business equipment spending in GDP – rose by 2.1%. The reading on core non-defense capital goods orders stood a healthy 12.3% annualized above last Fall’s average, hinting that business equipment spending likely will contribute almost 1.5% to current-quarter GDP growth.

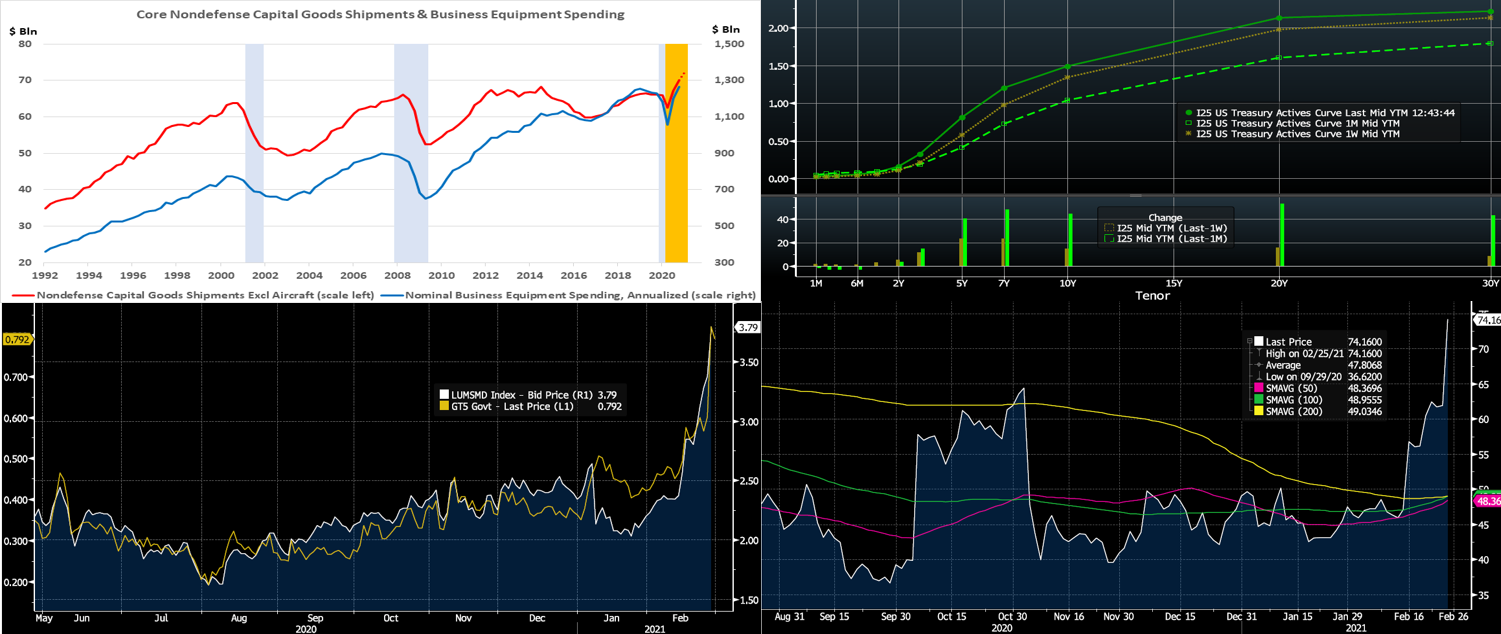

CHART 2 – UPPER RIGHT

Source: Bloomberg. Note: top pane is yield in percent, bottom pane in bps. The UST curve again marched notably higher and steeper week-over-week; unlike prior weeks, however, the move was led by the belly (5 to 7-year) sector. Shorter maturities finished modestly changed, but the 5 and 7-year were ~22 bps higher on the week. The market has now repriced for a potential earlier Fed hiking via the rise in 2 to 3-year yields on the week. This move in rates may prove welcome for many financial institutions’ NIM. A few factors fueled the rates backup. Covid-19 status improved via downward trends in infections/hospitalizations/deaths and an upward trend in vaccinations. A further round of relief legislation remains “in the works”, with the attendant/expected UST supply to finance it. Recent economic data in the aggregate again outperformed consensus forecasts. The market also eagerly awaits a regulatory decision on an extension past 3/31 of the exemption of banks’ UST holdings from the Supplemental Leverage Ratio calculation; if not extended, then bank demand for UST’s could decrease. Lastly, technical dynamics such as mortgage “convexity hedging” added some fuel to the move.

CHART 3 – LOWER LEFT

Source: Bloomberg. Depicted here is the Bloomberg Barclays MBS Index Modified Duration vs. the UST 5-year yield. Clearly, they move in tandem, as the MBS duration will increase when rates move higher, and spikes can occur if/when mortgage investors aim to manage/hedge this risk via subsequent short-sales of UST’s or pay-fixed swaps in the 5 to 10-year portion of the curve. This activity can spur an almost self-perpetuating dynamic for a short period and accelerate rate moves.

CHART 4 – LOWER RIGHT

Source: Bloomberg. Here is the ICE BofA MOVE index, a yield curve weighted index of the normalized implied volatility on 1-month UST options. The dramatic moves in rates, plus buyers of options to hedge higher rates or MBS, have pushed “vol” markedly higher. Note that spikes tend to settle and reverse. Indeed, as of Friday, rates and “vol” were reversing a chunk of the prior days’ increases.

FHLBNY Advance Rates Observations

Front-End Rates

Short-end advance rates finished a bp higher, week-over-week. T-bill issuance was its usual market feature, but net supply has slowed and thereby allowed for easier market absorption. Money market funds’ AUM increased by ~$11bn this past week, led by Government-Only funds, thereby infusing demand for short paper. From a bigger-picture vantage point, an overall moderation in market supply of short paper, in tandem with high cash levels in the market, is expected to keep short-end rates relatively steady and under downward pressure in the year’s first half.

Heavy T-Bill issuance will remain a theme; UST issuance overall is now net positive supply in that more is being issued than what the Fed is buying in its programs. However, with short UST rates at rock-bottom levels and the Fed on hold for a long period, rates are likely to persist in a near-term sideways to softer pattern. Importantly, weekly net T-bill issuance has been lower since last summer and even negative at times in recent months, and Treasury has announced plans to shift issuance out the curve. Even with a new relief package and related borrowing, these market supply/demand and Treasury issuance dynamics should keep short rates in check on the upside. Indeed, overnight repo traded sub-0% late-week.

Term Rates

On the week, medium and longer-term Advance rates were 4 to 22 bps higher, with the belly (5 to 7-year) of the curve leading the way. Please refer to the previous section for further color on relevant market dynamics.

On the UST supply front, the week brings a reprieve in UST auctions. Recent auction sizes have been of record size and another contributor to the curve’s moves; the past week’s 7-year auction, for instance, met with notably poor demand amid the bond market sell-off. Focus this week will remain on Covid-19 and fiscal legislation developments.

New Product Alert: In order to satisfy member needs and provide greater product flexibility to match bond and derivative market conventions, FHLB-NY now offers SOFR-linked advances based on SOFR-index compounding. Note that this product is in addition to SOFR-linked advances based on SOFR-index averaging which have been offered since November 2018.

The Symmetrical Prepayment Advance Feature

With rates at or near multi-year lows, it is a compelling juncture to use the SPA feature on term advances. This feature allows member to capture, at prepayment, changes in the Fair Value of the advance which are favorable to the member. Contact us to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the

MSD Team.

Special Member Alert

The FHLBNY recently announced a newly expanded and flexible Disaster Relief Funding (DRF) advance program which offers discounted rate advances with maturities 1-mo and greater. Additionally, we have announced that PPP loans will be accepted as eligible collateral. Please contact us with any questions.