Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week ending February 7, 2025.

Economist Views

Click to expand the below image.

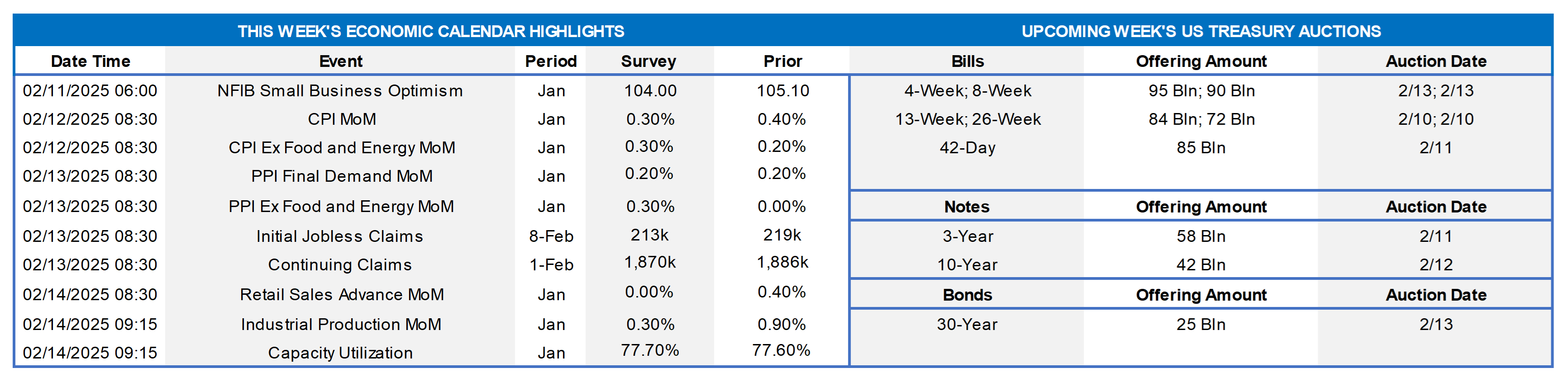

Having digested the Bureau of Labor Statistics’ employment situation report for January, the market will turn its focus to the inflation side of the Federal Reserve’s dual mandate on Wednesday, especially with Fed Chair Powell slated to give the semi-annual Monetary Policy Report to the US House Committee on Financial Services ninety minutes later. Beginning-of-the-year consumer inflation readings are expected to be mixed, while Mr. Powell will likely reiterate statements made after the January FOMC meeting. As always, Powell may provide some useful nuggets during the Q & A session. Reports on retail sales and industrial production will allow economists to update their tracking estimates for Q1 real GDP growth. The median Street projection currently calls for a 2.1% annualized advance during the winter, with available Federal Reserve district bank nowcasts centered at a double-trend 3.5% clip.

NFIB Small Business Optimism Index: Echoing data from larger firms, the barometer likely improved for a fifth consecutive month in January, climbing to 107 – the best reading since October 2018.

Consumer Prices: Capped by stable gas pump prices, the Consumer Price Index (CPI) likely climbed by .3% in January, after a .4% hike in December. By contrast, residual seasonality at the beginning of the New Year probably propelled the core CPI, excluding volatile food and energy items, .3% higher during the reference period, following a .2% prior month rise. Those projections, if realized, would leave the overall and core CPIs 2.8% and 3.2% above their respective January 2024 readings. As usual, the upcoming report will include annual revisions to the seasonally adjusted CPI series going back to January 2020.

Jobless Claims: Labor market conditions likely remained healthy during the filing period ending February 8, with initial claims for unemployment insurance benefits staying in a historically low 205K-225K band. The total number of persons receiving regular state benefits probably registered below 1.9mn once again during the week ended February 1.

Retail & Food Services Sales: A tug of war between lower vehicle purchases and stepped-up outlays on other goods probably left sales unchanged in January, after a .4% uptick in December. Tipped off by the already reported dip in unit motor vehicle sales, auto-dealer revenues likely retreated by 1.2% during the reference period, erasing a portion of the impressive 6.7% gain over the final four months of 2024. Net of a projected 1.2% decline in vehicle purchases, retail sales likely edged .3% higher last month, following a .4% increase at yearend. As always, economists will pay close attention to so-called “control” sales excluding auto, building materials, and gas purchases in the report for clues to the pace of consumer spending during the current quarter. Barring any prior-month revisions, a .3% increase would place core purchases a healthy 2.3% annualized above their October-December average, after a solid 5.5% annualized Q4 advance.

Industrial Production & Capacity Utilization: Output at the nation’s factories, mines, and utilities is expected to have edged .3% higher in January, after a stronger-than-expected .9% rise in December. With output gains projected to outpace additions to productive capacity during the reference period, the overall operating rate likely moved one tick higher to 77.7% – the highest reading since last August.

Federal Reserve Appearances:

- Feb. 11 Cleveland Fed President Beth Hammack to give a speech on the economic outlook at an event in Kentucky.

- Feb. 11 New York Fed President Williams to participate at an event hosted by the Pace University Economics Society.

- Feb. 12 Fed Chair Powell to deliver the Semi-Annual Monetary Policy Report to the House Financial Services Committee.

- Feb. 12 Atlanta Fed President Raphael Bostic to speak on the economic outlook at an event at the Atlanta Fed.

CHART 1 UPPER LEFT and CHART 2 UPPER RIGHT

Source: Federal Reserve Board; National Bureau of Economic Research; FHLB-NY. Note: Blue-shaded areas denote recessions. The Fed’s January 2025 Senior Loan Officer Opinion Survey on Bank Lending Practices, or SLOOS, addressed changes in the standards and terms on and demand for bank loans to businesses and households over the past three months. Commercial banks continued to tighten credit standards across most loan categories in Q4, although the degree of firming eased from last summer. Demand soundings were mixed. Banks reported stronger demand for C&I loans to large and middle-market companies, while demand for C&I loans to small firms also improved. Indeed, the net percentage of banks experiencing increased demand for loans from large and medium companies jumped from -21.3% to +9.4%, while that for small firms improved markedly from -18.6% to +3.2% – the first readings in positive territory since the July 2022 SLOOS. Demand for CRE borrowings remained soft across the board but less so in the latest canvas compared to 2024-Q3.

CHART 3 LOWER LEFT

Source: Bloomberg. Top pane is yield (LHS, %); bottom pane is change (LHS, bps). As of Thursday afternoon, the UST term curve “bull flattened” from a week ago, with the 2-year unchanged, 5-year ~5 bps lower, and 10-year ~8 bps lower. The 30-year dropped by a notable 12 bps. After beginning the week with tariff news, the UST market settled mid-week, with yields pushing lower after a weaker-than-expected ISM Services Index report on Wednesday morning. Also on Wednesday, the Treasury announced unchanged amounts of upcoming longer-tenor debt issuance; this news helped assuage concerns of increased supply and potential upward pressure on term yields. Overall, the past few weeks have attracted UST demand after the relentless upward move in yields since Autumn. The market will face a big test, however, in the Friday jobs report released just after this writing. As of Thursday afternoon, the market prices end-2025 fed funds ~3.89%, or 4 bps higher than a week ago, which equates to slightly less than two 25-bps Fed cuts. The market’s end-2026 forward is ~3.81%, which is ~4 bps lower than a week ago.

CHART 4 LOWER RIGHT

Source: Bloomberg. Shown here are the 2,5, and 10-year Inflation Breakeven levels derived from Treasury Inflation Protected Securities (TIPS). As a reminder, the Breakeven equates to the standard UST yield less the yield on TIPS, and it provides a barometer of the market’s view of prospective inflation levels. Given that the Breakeven measures have been rising since Q4 and well past the stated 2% inflation target, perhaps it is of little wonder that the Fed last week paused on another rate cut. Adding fuel to inflation concerns this past week was the White House announcement of tariffs on Canada and Mexico. Early-week Breakeven levels reached levels 5 to 9 bps higher than seen here, with the 2-year hitting 3.09%, before subsequently subsiding after the announcement of a delay in tariff enforcement. Nonetheless, with the 2-year Breakeven remaining over 3% at Wednesday’s market close, the market still seemingly prices for significant nearer-term inflation risk.

FHLBNY Advance Rates Observations

Front-End Rates

- Short-end rates, as of Thursday afternoon, were modestly higher from a week ago, with tenors up by a bp on average. As detailed on the previous slide, the markets this week priced a bit less of Fed-ease potential for 2025. Investor demand for short paper, meanwhile, has generally remained sturdy along with robust Money Market Fund AUM levels supporting our short-end paper.

- The market will closely watch the inflation data and Fedspeak calendar in the upcoming week.

Term Rates

- The longer-term curve, generally mirroring moves in USTs and swaps, was flatter from last Thursday afternoon. While the 2-year was ~2 bps higher, the 5 and 10-year were lower by 5 and 10 bps, respectively. Kindly refer to the previous section for color on market dynamics and changes. We encourage members to engage with the Member Services Desk for current rate levels and market dynamics.

- On the UST term supply front, the upcoming week serves 3/10/30-year auctions. Note that UST auctions usually occur at 1pm and can occasionally spur volatility around that time. Please contact the Member Services Desk for further information on market dynamics, rate levels, or products.

Price Incentives for Advances Executed Before Noon: In effect as of Tuesday, September 5, 2023, the FHLBNY is pleased to now offer price incentives for advances executed before Noon each business day. These pricing incentives offer an opportunity to provide economic value to our members, while improving cash and liquidity management for the FHLBNY. For further details, kindly refer to the Bulletin.

The Symmetrical Prepayment Advance Feature

For those anticipating term funding needs, and with rates on an uptrend, it can be an appropriate juncture to consider our SPA feature. This feature allows the member to capture, at prepayment, changes in the fair value of the advance which are favorable to the member. Contact Member Services Desk to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Archives

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.