Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week ending February 3, 2023.

Economist Views

Click to expand the below image.

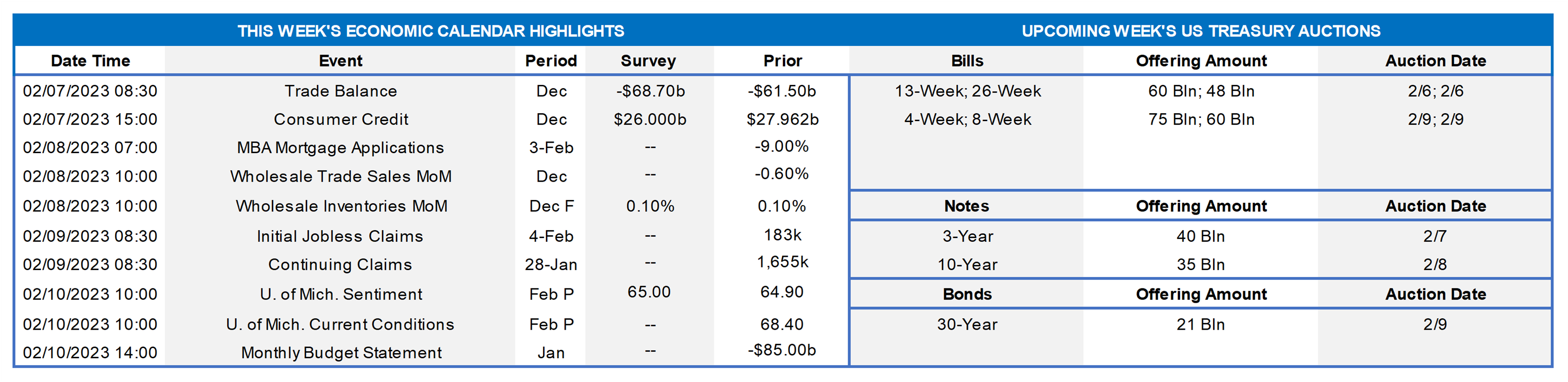

Having taken the Federal Open Market Committee’s latest rate hike in stride and post the latest monthly jobs report, market participants will face a very quiet data week. The upcoming report on unemployment insurance claims likely will reveal that labor market conditions remain extremely tight. Continued solid hiring, and signs that inflation is ebbing, probably buoyed consumers’ spirits in early February. Scheduled interviews of Federal Reserve Chair Jerome Powell and New York Fed President John Williams may provide some useful color on policymakers’ current thinking on the necessity of further rate increases.

Merchandise Trade Balance: The shortfall on international trade in goods is expected to widen from $61.5bn in November to $68.7bn in December, erasing almost half of the reported prior-month improvement.

Consumer Credit: Consumer installment credit likely expanded by $26bn in the final month of 2022, almost matching the $28bn takedown posted in November.

Jobless Claims: New claims for unemployment insurance benefits probably remained below the 200K mark for a fourth straight week during the period ended February 3. Keep an eye on continuing claims, which have been sticky at 1.66mn since the end of last year, for any signs that recently furloughed employees may be having a more difficult time finding work.

University of Michigan Sentiment Index: Rosier appraisals of current and prospective economic conditions probably propelled this gauge to 67.0 – the highest reading since January 2022.

Federal Reserve Appearances:

- Feb. 7 Federal Reserve Chair Jerome Powell will be interviewed by David Rubenstein at the Economic Club of Washington.

- Feb. 8 New York Fed President John Williams to be interviewed at a Wall Street Journal live event in New York.

- Feb. 10 Fed Gov. Waller and Philadelphia Fed President Harker to speak at a conference on digital money and decentralized finance, hosted by the Global Interdependence Center in La Jolla, CA.

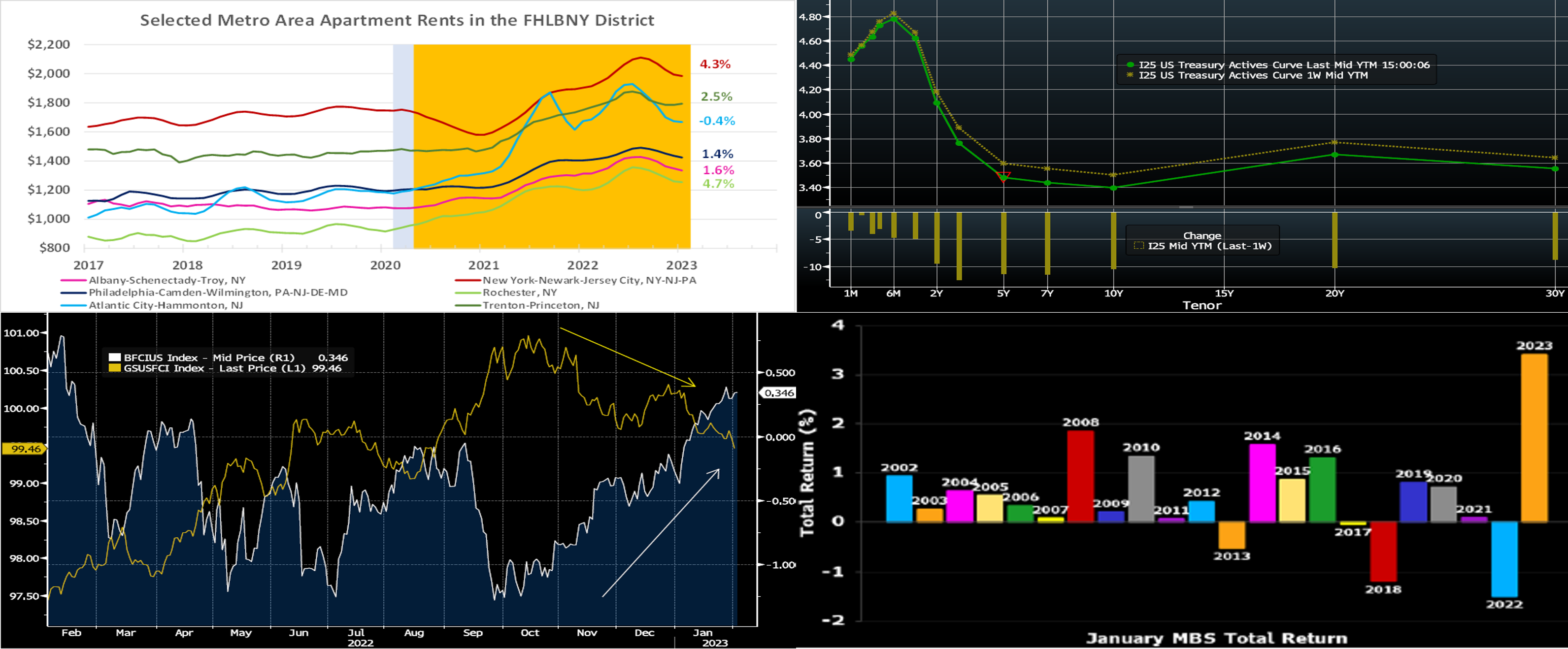

CHART 1 UPPER LEFT

Source: Apartment List; National Bureau of Economic Research; FHLB-NY. Notes: Blue-shaded areas denote recession, orange-shaded areas highlight the current economic expansion; percentage changes are from January 2022. Monthly apartment rents are rolling over nationally and across the FHLB-NY coverage area. Rental rates have fallen by roughly 7% on average from their summer peaks. Where steamy double-digit year-to-year jumps were once the norm, low single-digit increases and even modest declines have become more common since the latter half of 2022.

CHART 2 UPPER RIGHT

Source: Bloomberg. Top pane is yield (LHS, %), bottom pane is change (bps). UST term yields moved lower yet again week-over-week, led by the 3 to 7-year sector down 12 to 14 bps. The FOMC outcome was the expected 25 bps hike. While the statement declared that inflation remains elevated and that ongoing rate increases will be appropriate, the market apparently placed greater focus on the Q&A session and Chair Powell’s comment to the effect that the disinflation process had begun. As a result, yields traded notably downwards Wednesday afternoon and into the next day, likely assisted by short-covering from trading-types. The market, moreover, continues to price a Fed Funds path at clear odds with Fed statements and the latest “dot plot”. For the March 22 FOMC, the market now prices ~82% chance of a 25 bps hike. Thereafter in 2023, the market prices a peak rate at ~4.885% in June and subsequent declines to ~4.385% in December and ~4.16% at month-end January 2024; year-end 2024 is at 2.82%, as the market clearly prices an easing cycle ahead.

CHART 3 LOWER LEFT

Source: Bloomberg. During the FOMC Q&A, Chair Powell was specifically asked about policy course and thoughts regarding loosening financial conditions. While he replied that he thought conditions had tightened, various measures of financial conditions reflect a loosening of conditions in recent months. Shown here are Bloomberg’s (RHS, white) and Goldman Sachs’ U.S. Financial Conditions Indices (LHS, gold). Without “getting into the weeds,” these indices essentially aim to track and capture levels of financial stress and availability of credit in the market via input components such as equity valuations, credit spreads, option implied volatility levels, and interest rate levels. An upward move in Bloomberg’s index indicates loosening, while a downward move in Goldman’s index indicates the same; therefore, as seen here, both reflect a marked loosening since Fall 2022. This dynamic will prove interesting to monitor going forward and in relation to the market’s pricing of Fed cuts later this year; indeed, rate cuts could be questionable if loosening financial conditions persist, unless and until there is an overwhelmingly evident decline in inflation towards the Fed’s target.

CHART 4 LOWER RIGHT

Source: Bloomberg. The start of 2023 brought relief to MBS, as the sector posted its best total return performance in decades. Shown here are the January total returns (LHS, %) of the Bloomberg Agency MBS index over the past 20 years, with the past month clearly an upside highlight. After a brutal 2022 negative total return of ~11%, by far the worst in decades, this upward move should prove welcome relief for investors. It should also alleviate some of last year’s pressure on bank liquidity coverage ratios as well as Available-for-Sale investment portfolios and the accompanying impacts on AOCI and capital levels. The duration extension of MBS over the past year also should improve the convexity profile of the sector. For members who may still have a need/requirement to hedge an upward move in rates but fear a further move downward and potential prepay risk in their MBS portfolio, our callable advance product may be something to consider as a hedge.

FHLBNY Advance Rates Observations

Front-End Rates

- Short-end rates moved higher week-over-week, led by the very short tenors, which adjusted in tandem with the Fed’s 25 bps hike. Tenors 1-month-and-out were up a few bps. Please see the previous section for more specific Fed-pricing color.

- Given the Fed’s tightening and data-dependent posture, rates will be most responsive to this week’s data.

Term Rates

- The longer-term curve moved lower yet again week-over-week, led by the 7 to 12 bps decline in the 3 to 7-year zone, generally mirroring moves in USTs and swaps. Kindly refer to the previous section for relevant market color. The advance curve remains inverted out to 5-year, thereby offering opportunities to extend in advance duration for minimal or lower coupon cost.

- On the UST term supply front, this upcoming week serves 3/10/30-year auctions. Yields may back up a bit in anticipation of the supply. Corporate bond issuance is likely to maintain its early-year heady pace. Supply thus far this year has been easily absorbed, owing to strong fixed income demand. Kindly call the Member Services Desk for information on market dynamics, rate levels, or products.

Product Alert: FHLBNY is pleased to announce the reintroduction, after a temporary suspension owing to Libor-cessation, of the Putable Advance, Fixed-Rate with SOFR Cap Advance, and ARC with SOFR Cap/Floor Advance. The Callable Advance continues to be offered. This expansion of the product menu will provide members with more options and flexibility for the management of funding and/or hedging needs.

Forward Start Advance (FSA): For members with upcoming borrowing or refunding plans, consider the FSA as a method to opportunistically “lock in” rates before advance settlement date. Please contact the Member Services Desk at (212) 441-6600 for more information.

The Symmetrical Prepayment Advance Feature

For those anticipating term funding needs, and with rates on an uptrend, it can be an appropriate juncture to consider our SPA feature. This feature allows the member to capture, at prepayment, changes in the fair value of the advance which are favorable to the member. Contact Member Services Desk to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.