Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week ending January 17, 2025.

Economist Views

Click to expand the below image.

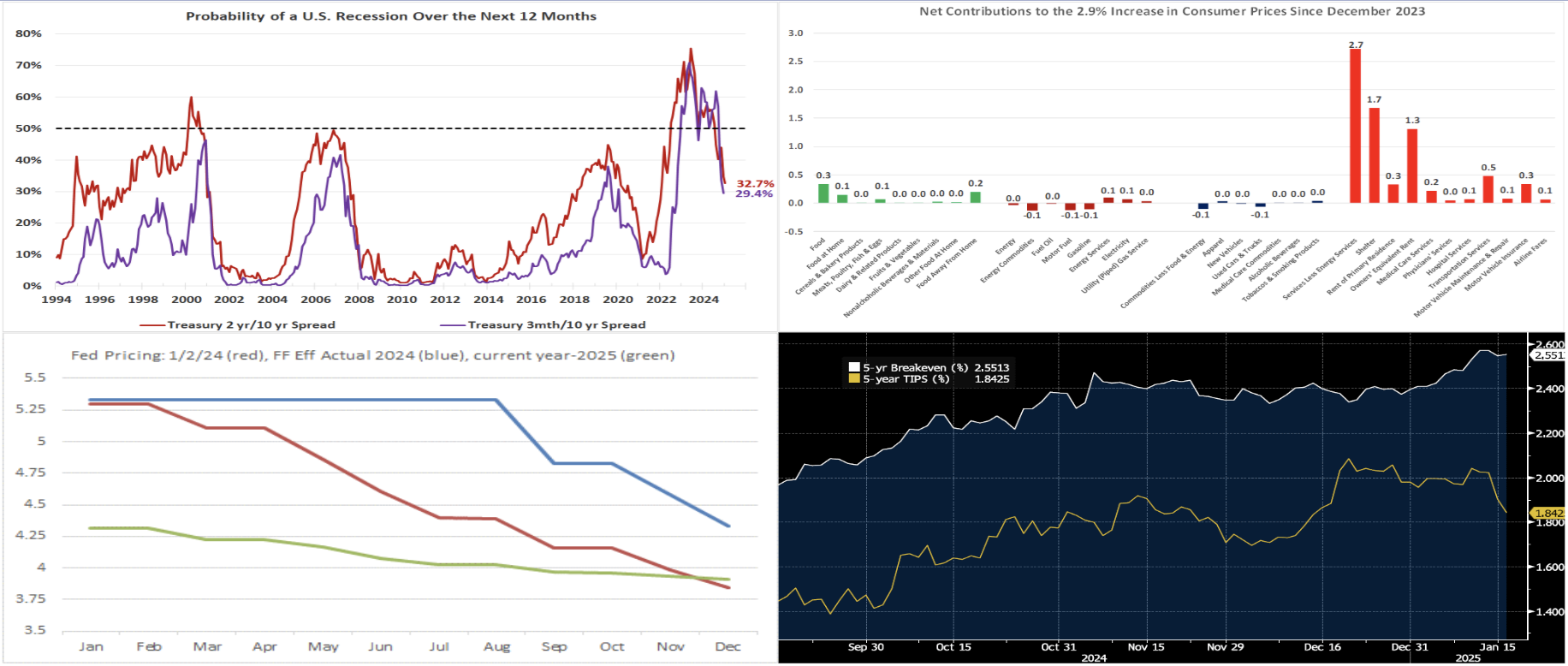

Index of Leading Economic Indicators: The Conference Board’s gauge of prospective economic activity is expected to have dipped by .1% in December, after the surprising .3% increase witnessed in November. There remains little evidence that the economy is in any danger of faltering. Indeed, a model constructed by the Federal Reserve Bank of St. Louis estimated that the probability that the economy was in recession in November at a negligible 1.3%.

Jobless Claims: While labor market conditions likely remained healthy nationwide during the period ending January 18, the tragic wildfires in California probably will make it exceedingly difficult to assess this week’s update on initial claims for jobless benefits.

University of Michigan Sentiment Index: Rising inflation concerns probably weighed on consumer confidence in the latter half of the month, paring the final January estimate to 72.8 from the preliminary 73.2 sounding.

Existing Home Sales: Rising home-purchase contract signings over the October-November span suggest that existing home sales climbed by 1.7% to a nine-month high seasonally adjusted annual rate of 4.22mn in December. With the number of available homes on the market likely to drop by 12% to a nine-month low of 1.17mn on a not seasonally adjusted basis during the reference period, the supply at the estimated sales pace would move five ticks lower to 3.3 months.

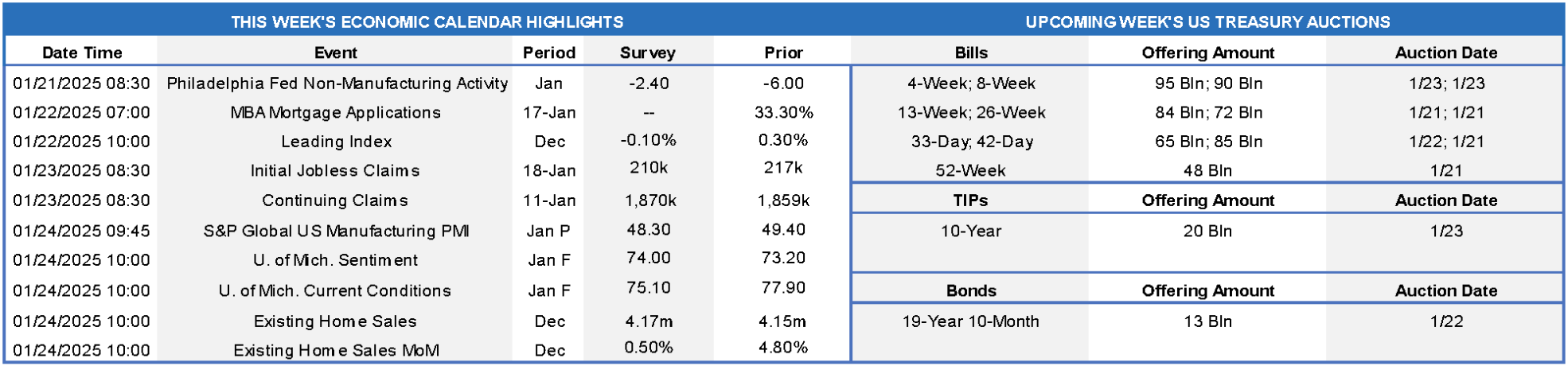

CHART 1 UPPER LEFT

Source: Bloomberg; Federal Reserve Bank of NY; FHLB-NY. Future recession probabilities estimated from models based on closely followed UST yield curve spreads remain elevated but have moved markedly lower in response to the steepening of the yield curve since August. Based on the current gap between 2- and 10-year rates, Bloomberg Economics places the chances of a recession in 2025 at 33.3%, down from 44.9% at that time. According to the NY Fed, the evaporation of the yield curve inversion from the 3-month to the 10-year produces an even lower probability estimate of 29.4%. Importantly, however, due to the balance-sheet management and quantitative monetary policy conducted by the Fed since the global pandemic, both models may be far less dependable than in the past.

CHART 2 UPPER RIGHT

Source: Bureau of Labor Statistics; FHLB-NY. This past week’s data point highlight was the consumer price index (CPI) data. It is instructive to look (enlarge chart for a clearer view) at the factors driving consumer price inflation over the course of 2024. All but a fraction of the 2.9% increase in the headline CPI since December 2023 was attributable to higher non-energy services costs, primarily those for shelter and transportation services. Retail food and energy costs, which were a major focus of voters in the 2024 election, actually had a limited impact on consumer inflation last year. Looking ahead, available data suggest that more success in stemming shelter cost increases may be in store during the first half of 2025.

CHART 3 LOWER LEFT

Source: Bloomberg. Top pane is yield (LHS, %); bottom pane is change (LHS, bps). As of Thursday afternoon, the UST term curve was lower by 2 to 8 bps from a week ago, with the 5-year-and-out zone leading the way. The main catalyst for the decline was the week’s somewhat softer-than-feared CPI data, which sparked a relief rally in bonds from the previous week’s trend. The market largely shrugged off Thursday’s sturdy retail sales report, thereby keeping the week’s lower yields intact. As of Thursday afternoon, the market prices end-2025 fed funds ~3.91%, the same as a week ago, which equates to less than two 25-bps Fed cuts. The market’s end-2026 forward is ~3.915%, a few bps lower than a week ago.

CHART 4 LOWER RIGHT

Source: Bloomberg. Term yields have undergone a pronounced backup since last Autumn. Factors contributing to the move have included stubborn inflation metrics, a looming change in federal government Administration and its potential impacts, such as tariff and tax policy, and related concerns about federal budget deficits and potentially higher UST issuance needs going forward. Essentially, a rising term premium, owing to these uncertainties, has been priced into the curve. Shown here is the trend of the 5-year Treasury Inflation Protected note (“TIPS”) yield (Gold, RHS, %), aka “real yield,” and the 5-year Breakeven inflation rate (White, RHS, %), which equates to the standard UST yield less the real yield. As is evident, both measures have notably risen over recent months to similar degrees, but with the latter rising more prominently since the turn of the year. In this regard, this past Wednesday’s more tempered CPI reading was welcome news to bonds and prompted significant “relief”, at least for the time being, from the upward trend in yields. However, as seen here, the yield decline has been clearly led by the real yield, not inflation. Likely further data to reinforce/prove a disinflation trend is needed to prompt a decline in the Breakeven.

FHLBNY Advance Rates Observations

Front-End Rates

- Short-end rates, as of midday Thursday, were minimally changed from a week ago; the 5 and 6-month were 3 bps higher to mark the biggest move in the short-end. Net T-bill supply is expected to move into positive territory, after being negative throughout December, in the next few weeks; this trend placed mild upward pressure on some bill yields. Investor demand for short paper, however, has generally remained sturdy, and robust Money Market Fund AUM levels have supported short-end paper.

- With the Fed in blackout mode, the market will focus on the limited data flow in the holiday-shortened week ahead. The market will also monitor potential announcements from the new incoming federal Administration.

Term Rates

- The longer-term curve, generally mirroring moves in USTs and swaps, is lower by 2 to 9 bps from a week ago, led by the 5-year-out tenors. Kindly refer to the previous section for color on market dynamics and changes. We encourage members to engage with the Member Services Desk for current rate levels and market dynamics.

- On the UST term supply front, the upcoming week serves a 20-year nominal and a 10-year TIPS auction. Note that UST auctions usually occur at 1 pm and can occasionally spur volatility around that time. Please contact the Member Services Desk for further information on market dynamics, rate levels, or products.

Price Incentives for Advances Executed Before Noon: In effect as of Tuesday, September 5, 2023, the FHLBNY is pleased to now offer price incentives for advances executed before Noon each business day. These pricing incentives offer an opportunity to provide economic value to our members, while improving cash and liquidity management for the FHLBNY. For further details, kindly refer to the Bulletin.

Looking for more information on the above topics? We’d love to speak with you!

Archives

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.