Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week ending January 10, 2025

Economist Views

Click to expand the below image.

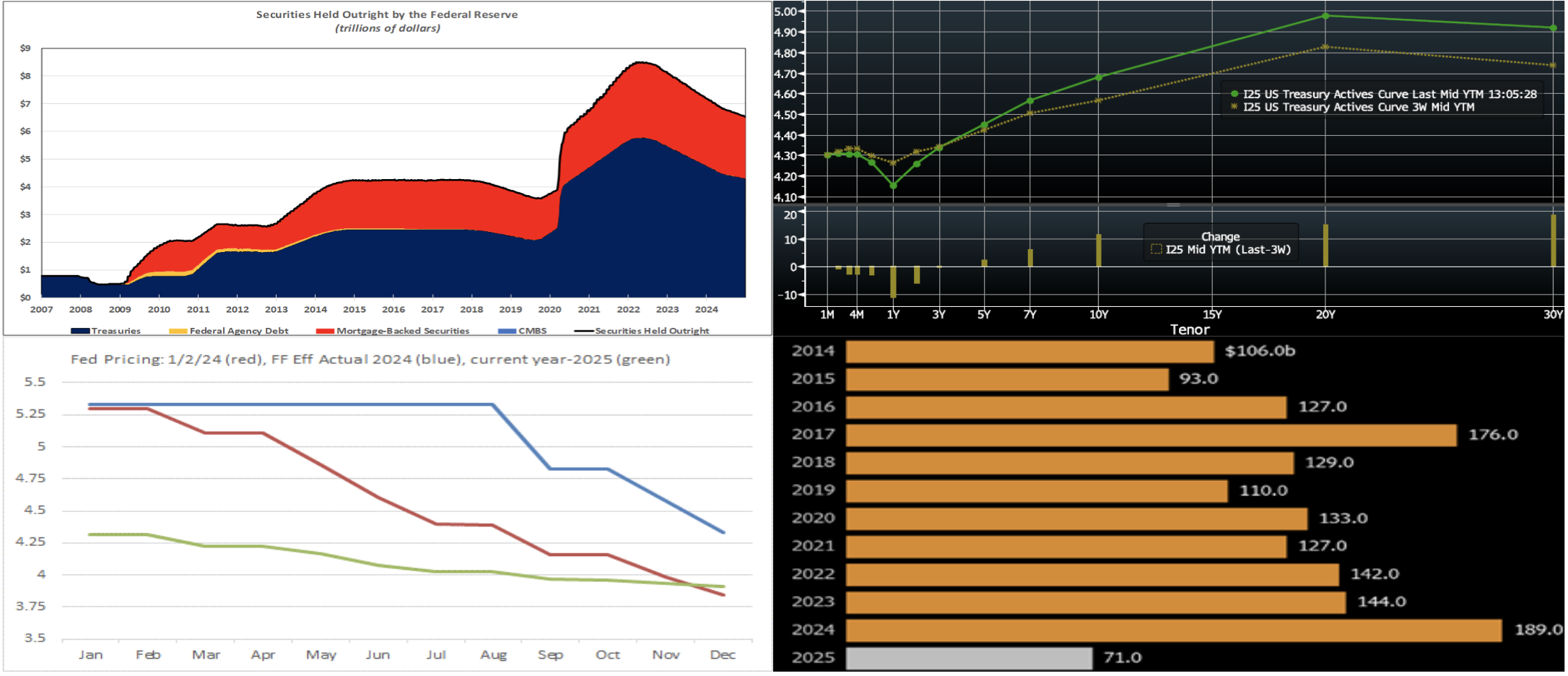

With the BLS update on the employment situation in the rear-view mirror, markets will contend with a busy data calendar this week. The marquee release likely will be the BLS’ consumer prices report. Little progress in returning consumer price inflation to the Federal Reserve’s desired 2% target likely will be in store. Other soundings will allow economists to refresh their tracking estimates for Q4 real GDP growth. At present, the median projection calls for an annualized advance of 2.3% during Q4, down from 3.1% in Q3. Reflecting hopes that forthcoming federal Administration changes may be a positive for the housing industry, builder sentiment probably improved at the beginning of 2025. A quartet of Fed officials are scheduled to make public appearances.

NFIB Small Business Optimism Index: Echoing recent improvements in purchasing manager surveys, the index may rise from its prior 101.7 to 102.5 – the rosiest reading since June 2021.

Producer Prices: Producer Price Index (PPI) for final demand likely rose by .4% for a second straight month. If realized, that would place the headline PPI measure 3.6% above its December 2023 level.

Empire State Manufacturing Survey: Manufacturing in NYS probably was little changed at the start of 2025, with equal percentages of respondents witnessing pickups and falloffs in business activity.

Consumer Prices: Prices probably rose by .3% in December, after a similar increase in the preceding month. Capped by anticipated decelerations in auto costs, core-CPI excluding food and energy items likely edged .2% higher – the smallest advance since last July. Those projections, if realized, would place the overall and core CPIs 2.8% and 3.2% above their respective December 2023 readings.

Retail & Food Services Sales: Paced by increases in auto-dealership revenues, sales likely climbed by .7% in December. Net of a projected 1.6% jump in autos, sales likely climbed by .5%, following a comparatively modest .2% prior month rise. Pay attention to so-called “control” sales, excluding auto, building materials, and gas purchases, for clues to the pace of consumer spending during Q4. Barring any prior-month revisions, a .4% increase would place core purchases over the Q4 span 4.6% annualized above their Q3 average, after a solid 6% annualized Q3 advance.

Jobless Claims: Labor market conditions likely remained healthy during the period ending January 11, with initial claims for unemployment insurance benefits staying in a historically low 215K-225K band. The total number of persons receiving regular state benefits probably clocked in below 1.9mn once again during the week ended January 4.

NAHB Housing Market Index: Rosier appraisals of current and future sales and a pickup in prospective buyer traffic likely pushed the gauge above the critical 50-point mark for the first time since April. Note the regional details in the January report; homebuilders in the Northeast have been far more confident than elsewhere, with their reading at a six-month high of 62 in December.

Housing Starts & Building Permits: New residential construction activity probably was somewhat mixed at yearend. While the number of new housing units started is expected to have risen by 2% to a seasonally adjusted annual rate of 1.32mn in December, building permits issued likely retreated by 2.4% to 1.46mn, reversing a portion of the 5.2% jump witnessed in November.

Industrial Production & Capacity Utilization: Output at US factories, mines, and utilities likely rose by .3% in December, erasing the .1% dip posted in November.

Federal Reserve:

- Jan. 14 Kansas City Fed President Schmid to speak on monetary policy and the outlook to the Central Exchange in Kansas City.

- Jan. 14 New York Fed President Williams to make opening remarks on An Economy That Works for All: Housing Affordability.

- Jan. 15 New York Fed President John Williams gives keynote remarks at the CBIA Economic Summit and Outlook 2025.

- Jan. 15 Chicago Fed President Austan Goolsbee to speak at the Midwest Economic Forecast Forum.

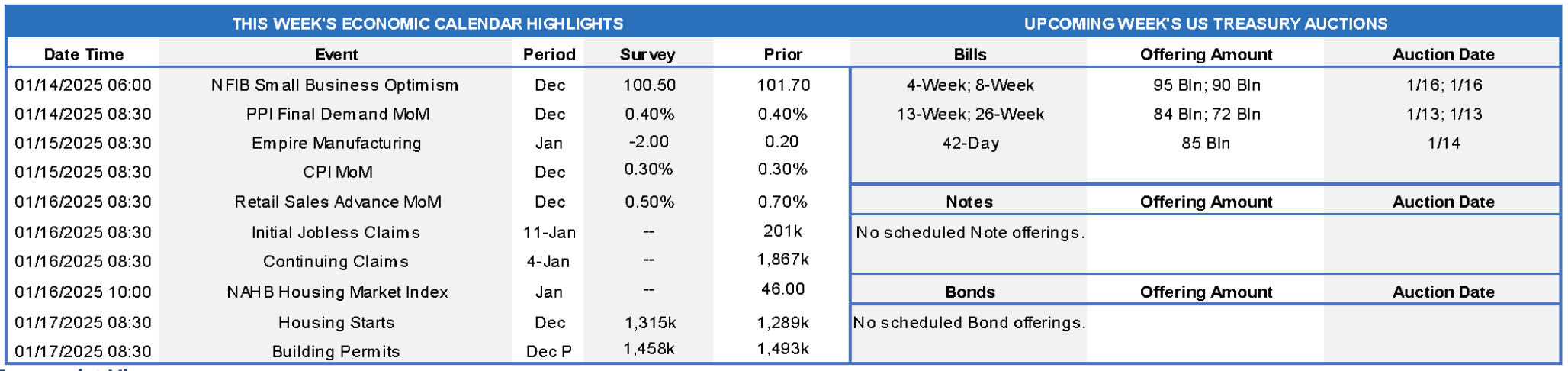

CHART 1 UPPER LEFT

Source: Board of Governors of the Federal Reserve System; FHLB-NY. The Federal Reserve has made significant progress in reducing the massive increase in the System Open Market Account (SOMA, the Fed’s securities holdings) triggered by the COVID-19 pandemic. From March 2020 through April 2022, Federal Reserve purchases of securities boosted the SOMA by $4.6trn to a record high $8.1trn. Since that time, roll-offs of maturing securities have pared the SOMA by almost $2trn to $6.5trn – a 43% reduction from the peak witnessed in the wake of the healthcare crisis. At its December FOMC, the Fed maintained the current monthly UST runoff cap of $25bn and Agency debt and Agency MBS cap of $35bn, with any runoff exceeding those caps to be reinvested in USTs. Market strategists, at this juncture, maintain varied opinions on the timing of any possible cessation of this runoff, aka “Quantitative Tightening,” depending on the evolution of bank reserves and money market liquidity conditions this year.

CHART 2 UPPER RIGHT

Source: Bloomberg. Top pane is yield (LHS, %), bottom pane is change (LHS, bps). As of Thursday afternoon, the UST term curve was notably steeper from the time of our last edition three weeks ago. Whereas the 2-year is ~5 bps lower, the 5 and 10-year are higher by ~2 and 12 bps, respectively. The steepening in the curve is partially a reflection of concerns about lingering inflation forces and uncertain potential tariff policy impacts in the year ahead. In this week’s release of the December FOMC Minutes, Fed officials noted potential “risks of higher-than-expected inflation”. The Friday jobs report and next week’s inflation reports will be potential market-movers. The market prices end-2025 fed funds ~3.91% which equates to less than two 25-bps Fed cuts. The market’s end-2026 forward is ~3.95% which is clearly higher than the Fed’s December FOMC median projection of 3.375%.

CHART 3 LOWER LEFT

Source: Bloomberg; FHLB-NY. Given the new year, here we review Fed and market pricing at the year past and the year ahead. Portrayed in red is the market’s forward pricing (LHS, %) of Fed Funds Effective for the year ahead on January 2, 2024. This pricing, clearly, was aggressive in projecting Fed cuts. Indeed, as shown in blue, actual realized Fed Funds remained stable until September’s 50-bps cut, followed by the 25-bps cuts of November and December (note, contrary to the blue line’s trend shape, the cuts and drop in Fed Funds occurred on post-FOMC discrete dates of September 18, November 7, and December 18). In sum, actual Fed Funds finished 2024 ~50 bps higher than the market’s start-of-year forecast. For 2025, the market has pared back its pricing of cuts, shown in green, with only ~1.6 25-bps cuts priced into the curve. Indeed, the Fed is increasingly liable to go on hold for a few months, as it awaits further clarity on economic conditions and inflationary forces.

CHART 4 LOWER RIGHT

Source: Bloomberg. January and March of each year are typically the biggest months for investment grade corporate bond issuance. Shown here are the January tallies over the last ten years. For 2025, the $71bn represents the first four business days of this month; the tally is closer to $76bn as of Thursday, with 37 issuers coming to market. Expectations are for the month’s total to reach the $175 to $200bn range. While some fixed-rate issuance is swapped to floating by the issuer, much of it is not and thereby adds fixed-rate supply and potential upward pressure, all else equal, on term rates. Although yields have risen in the past few months, corporate bond spreads remain at or near historical tight levels, and so the next three weeks are likely to maintain a steady pace of issuance.

FHLBNY Advance Rates Observations

Front-End Rates

- Short-end rates, as of midday Thursday, were generally a few bps lower from our last edition three weeks ago, with the 1- to 6-month sector 2 to 5 bps lower. As maturities cross into the timeline of potential Fed cuts, albeit less pronounced as discussed in the prior slide, the short-end rates can move lower, all else equal. Investor demand for short paper, meanwhile, has remained solid and robust Money Market Fund AUM levels have supported our paper.

- The market will particularly focus on the inflation reports in the week ahead.

Term Rates

- The longer-term curve, generally mirroring moves in USTs and swaps, is steeper from three weeks ago. While the 2-year dipped a few bps, the 5 and 10-year are 5 and 13 bps higher, respectively. Kindly refer to the previous section for color on market dynamics and changes. We encourage members to engage with the Member Services Desk for current rate levels and market dynamics.

- On the UST term supply front, the upcoming week serves a welcome reprieve from auctions. Note that UST auctions usually occur at 1pm and can occasionally spur volatility around that time. Please contact the Member Services Desk for further information on market dynamics, rate levels, or products.

Price Incentives for Advances Executed Before Noon: In effect as of Tuesday, September 5, 2023, the FHLBNY is pleased to now offer price incentives for advances executed before Noon each business day. These pricing incentives offer an opportunity to provide economic value to our members, while improving cash and liquidity management for the FHLBNY. For further details, kindly refer to the Bulletin.

Looking for more information on the above topics? We’d love to speak with you!

Archives

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.