Financial Intelligence

Positioning Your Institution for Success

What if you had the ability, through your membership in the Federal Home Loan Bank of New York (“FHLBNY”), to optimize your balance sheet, reduce risk, enhance your bottom-line, grow capital or invest in your business?

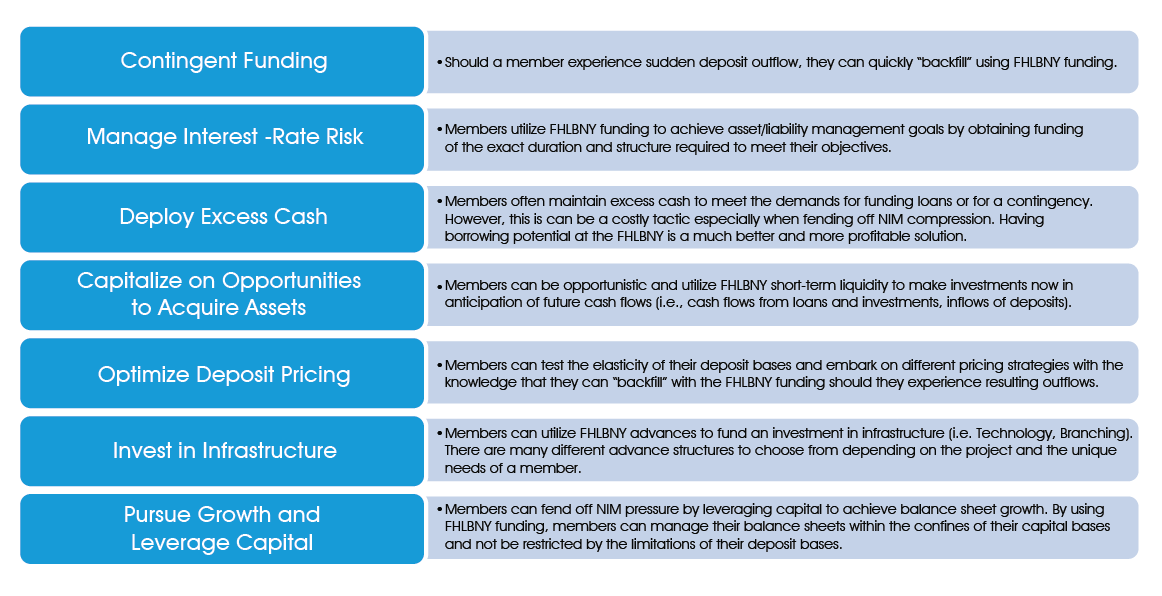

Being a member of the FHLBNY places you in a powerful position to alter the trajectory of your institution’s success. While most of our members are active within the cooperative, there are some that can further leverage our strategic partnership to realize the impactful advantages of “just in time funding” – by obtaining the precise types and amount of liquidity when it’s needed, your institution can attain the following important benefits:

Can your institution benefit from FHLBNY advances funding?

Having the potential to utilize FHLBNY liquidity is a powerful tool for our members and should not be overlooked nor underestimated. Do you have an excess of un-deployed cash, are your deposits not efficiently priced, are you forgoing asset growth opportunities or, perhaps, are you reluctant to use borrowed funds? Considering some of the key benefits noted above, many institutions are better served by being in a borrowing position.

The common theme amongst our inactive members is a reluctance to use borrowed funds as a component of their overall funding plan. Reasons include the perception that it is costly, a perceived negative regulatory attitude (which perpetuates to the Board), and a philosophy that borrowed funds do not build franchise value. Actually, FHLBNY advances can help you to keep your “foot on the gas” to achieve growth. They can assist with lowering your overall cost of funds—reducing risk and helping to achieve ALM goals—while supporting earnings and capital growth.

Almost two-thirds of our membership rely on FHLBNY as a critical component to their business model and use advances extensively.

Members realize that to remain relevant in this operating environment, institutions must pursue additional scale through sustained growth of capital. We are at a pivotal point where we are seeing shrinkage in the industry, and the pace of mergers and acquisitions is escalating with no signs of slowing down—now is not the time to forgo opportunities!

Ready to maximize your membership? Conduct a test borrowing

Many of our inactive members do not have adequate collateral pledged and/or have not conducted a test borrowing for quite some time (if ever). If this sounds familiar, it’s strongly encouraged that you arrange a test borrowing with the help of the Member Services Desk or a dedicated FHLBNY Relationship Manager as it’s very important to understand the steps involved in borrowing.

Although it is a relatively simple process, there are multiple actions which require proper authorizations, PIN numbers, etc.—all of which can complicate a borrowing request if you’re unprepared. This is precisely why regulators strongly encourage conducting test borrowings – so that liquidity is there when you need it most.

Provided that a member has collateral pledged, FHLBNY liquidity will always be available to you. As stated by José R. González, president and CEO of the FHLBNY, “As long as markets remain open, and a member has pledged sufficient qualifying collateral and is willing to purchase the requisite amount of capital stock, the FHLBNY will always continue to lend to our members to help you meet your community’s needs.”

Successfully executing a borrowing and wiring out the funds requires a bit of set-up. The FHLBNY is here to help you every step of the way.

Successfully executing a borrowing and wiring out the funds requires a bit of set-up. The FHLBNY is here to help you every step of the way.

Let’s get in touch to get your institution started!

Please contact a Relationship Manager at 212-441-6700 or the Member Services Desk at 212-441-6600 to assess your collateral needs and to conduct a test borrowing.

Disclaimer: Notwithstanding any language to the contrary, nothing contained in these disclosures is intended to constitute an offer, inducement, promise, or contract of any kind. Any product descriptions and pricing may be subject to change without notice.

The content provided in these disclosures is presented as a courtesy to be used only for informational purposes and is not represented to be error free. The FHLBNY makes no representations or warranties of any kind with respect to the content contained herein, such representations and warranties being expressly disclaimed. The FHLBNY is not a financial or investment advisor.

Moreover, the FHLBNY does not represent or warrant that the content of these disclosures is accurate, complete or current for any specific or particular purpose or application. It is not intended to provide nor should anyone consider that it provides legal, accounting, tax or other advice. Such advice should only be rendered in reference to the particular facts and circumstances appropriate to each situation. The FHLBNY encourages you to contact appropriate professional(s) and consultant(s) to assess your specific needs and circumstances and to render such advice accordingly. In addition, the FHLBNY is not endorsing or recommending the use of the means or methods contained in or through these disclosures for any special or particular purpose.

It is solely your responsibility to evaluate the risks or merits of any funding or investment strategy. In no event will FHLBNY or any of its officers, directors or employees be liable for any damages — whether direct, indirect, special, general, consequential, for alleged lost profits, or otherwise – that might result from any use of or reliance on these materials.

Key Contacts

Relationship Managers:

(212) 441-6700

Member Services Desk:

(212) 441-6600 or

(800) 546-5101, option 1