INSURANCE COMPANIES

Your Key to Reliable Liquidity

Insurance companies play a key role within the U.S. housing market. The Federal Home Loan Bank of New York (FHLBNY) promotes housing and economic development by providing low-cost, flexible liquidity to member financial institutions. This closely aligns with our insurance company members’ significant investments and participation in the mortgage market along with their economic development initiatives. Our insurance company members count on us to be a reliable and stable source of liquidity in any market condition.

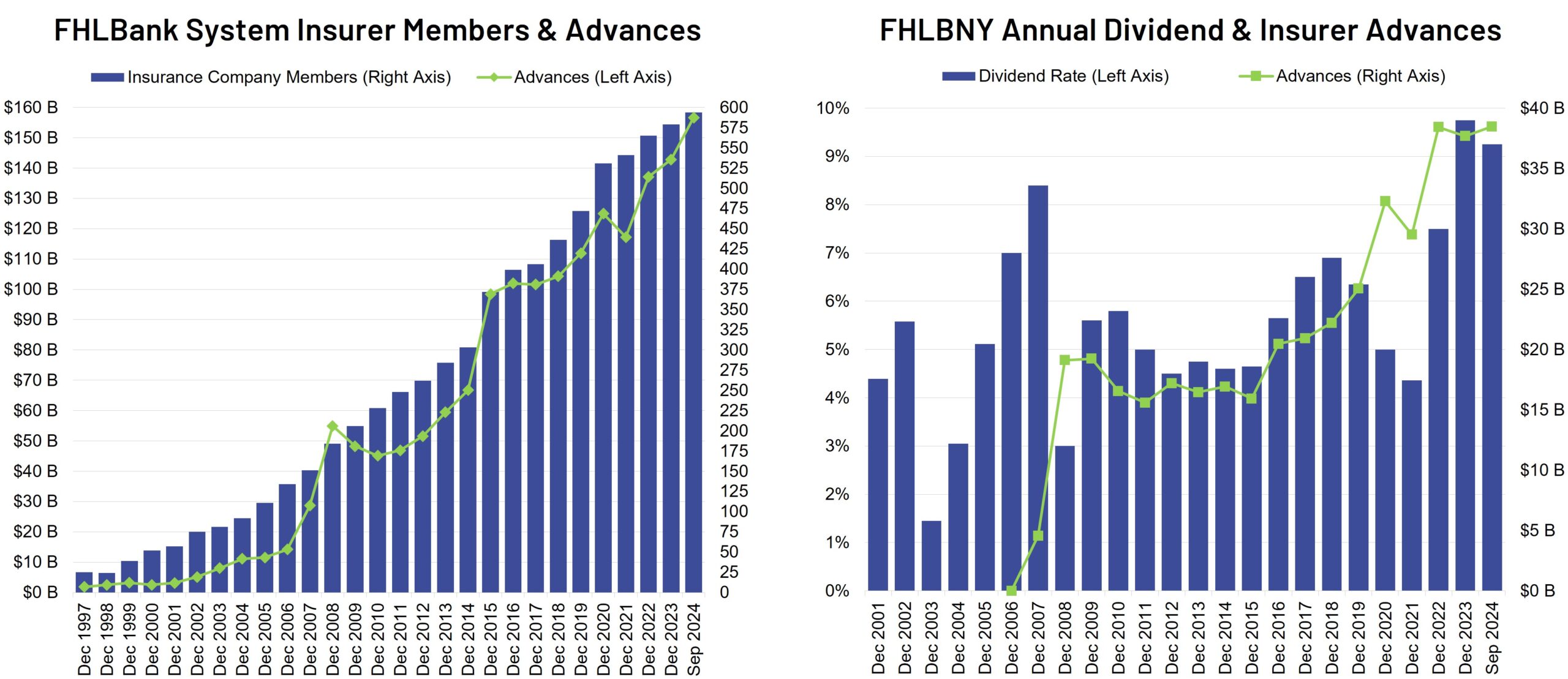

Membership and advances by insurance companies have increased exponentially as more and more realize the integral role the FHLBNY plays to insurers looking to converge liquidity and working capital needs (as shown in the chart below). Overall, the Federal Home Loan Bank System (FHLBanks) has over 570 insurance company members, and the sum of borrowings by insurance companies at all FHLBanks has increased from $4.6 billion to $37.7 billion between 2007 and 2023.

Insurance companies typically capitalize on their membership to satisfy contingent and strategic funding needs, in addition to financing capital, acquisition costs, and new facilities. This enables them to manage their liquidity positions and obtain affordable financing to support lending, investing, daily operations and grow their business in order to support the housing markets and the communities they serve.

Since the FHLBNY is structured as a cooperative, our members are shareholders. Paid from 2023 income, we returned $547.4 million in dividends to our members for a full-year dividend rate of 8.88%. This high performance is a testament to our dedication to provide value to our members

FHLBNY Insurance Company Members

Show Members List

Benefits of Partnering with the FHLBNY

Flexible Funding SourceMembership at the FHLBNY affords insurance companies access to a wide range of liquidity tools through the use of our various credit products called “advances.” Members can gain access to low-cost, wholesale funding for financial flexibility and backup liquidity to help meet unexpected cash flow needs and manage risk and profitability.

|

Key Benefits

|

How are Insurance Companies Taking Advantage of Membership?

They typically use membership to fulfill the following needs:

- Contingent and strategic liquidity

- Match funding or pool funding

- Asset and liability management

We also offer exclusive resources to our members for beneficial insight and education

Membership Eligibility Requirements

|

In order to be eligible for membership, your company should be:

Worksheets are available here to help you determine membership eligibility and calculate the initial FHLBNY membership stock amount. These tools are also provided above under Related Links.

|

Key Contacts

Alex Sornoza

VP, Member Relations and Senior Business Development Officer

(212) 441-6708

[email protected]

You have a vision for your financial future.

Our partnership can play a key role to help get you there.

Related Links

Insurance Companies Overview Factsheet

Forms & Agreements for New Members

About the Federal Home Loan Banks

HLB 009 HIC – Health Insurance Companies Eligibility Worksheets

HLB 009 LC – Life Insurance Companies Eligibility Worksheets

HLB 009 PC – Property & Casualty Insurance Companies Eligibility Worksheets

Whitepapers

Business Wire

Best’s Special Report:

Insurers’ Funding Agreements With Federal Home Loan Banks Likely to Increase