Credit Unions

Join the Strength in Our Cooperative

Like credit unions, we’re also structured as a cooperative — privately owned by our members

Our cooperative’s strength enables us to provide quality credit products at flexible terms, housing and community development programs, mortgage finance products, correspondent services, and educational resources that meet the evolving needs of credit unions. When you partner with the FHLBNY you also gain access to a dedicated team of specialists to help you thrive within your local community and reach your business goals.

Get your Board “On Board”

Our Membership Overview provides key points to help your Board consider the power of membership.

Not a Member?

By becoming a member, you will have access to programs and tools that are dedicated to your credit union’s success.

Fulfill your credit union’s business strategies, meet the needs of your members, and stay competitive in a complex market.

Our partnership provides a strong foundation that supports your relationship with your members. Our members are shareholders – your business empowers the FHLBNY to continuously offer competitively priced products and services to benefit your bottom line.

Unique Membership Benefits:

- Reliable, competitive, and flexible funding options for all market conditions

- Attractive cash dividends*

- Innovative mortgage participation, funding, and purchase options to access the

secondary market - Successful community growth products and affordable housing grant programs to assist in meeting economic and community development needs

- Trusted deposit products for your excess funds

- Diverse team specializing in the challenges unique to credit unions, offering support with hedging strategies and market insights to help execute your strategic plans

- Valuable educational resources

*Note: There is no guarantee that the level of future dividends will reflect the level of previous dividend payouts.

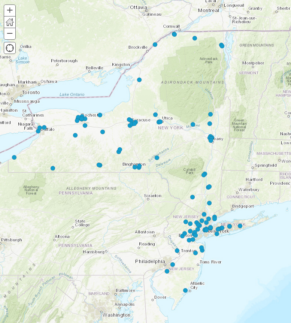

Credit Unions Benefiting from FHLBNY Membership

The number of our credit union members has doubled since the start of the financial crisis

Reliable, Flexible Funding for a Competitive Edge

Whether you’re looking to fulfill your business strategies, or meet the needs of your members and regulators, the FHLBNY has funding tools to help your credit union stay competitive in a complex market.

All financial institutions are required to have access to wholesale liquidity in order to carry out their operations. This could range from paying near-term obligations to making long-term strategic investments. Don’t get caught without a contingent liquidity source -make the FHLBNY your lender of first resort.

The strength of the FHLBank System, combined with its access to global debt markets, affords us the ability to offer:

- Highly competitive borrowing rates

- Short- and long-term, flexible funding

- Wide varieties of maturities and structures

Opportunity for NJ Credit Unions-Municipal Letters of Credit (MULOCs)

Credit unions are now eligible to act as public depositories under New Jersey law (under ‘NJ GUDPA Participation’), and therefore are able to use our MULOC product. MULOCs are a more efficient way to use capital to generate higher returns. Using this type of Letter of Credit frees up your institution’s assets for liquidity reporting or other lending purposes that provide a higher yield.

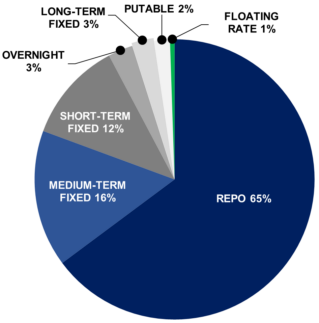

Credit Union Advances

Data as of 12/31/24

Note: Repo Advances are collateralized by securities and deposits.

Learn about funding tools for credit unions

Focus on Community Growth

The FHLBNY is focused on helping you improve the housing and economic opportunities available to the families and neighborhoods you serve.

Community Lending Program (CLP)

Participating in neighborhood development projects helps build a positive reputation in your community with local customers. By supporting the start-up and growth of local businesses, you ensure that your communities experience steady economic growth. CLP funds can be used for projects that create housing, improve business districts, and strengthen neighborhoods. As your partner, we can continue to create opportunities that strengthen our communities, together.

Affordable Housing Program (AHP)

Inherent in our mission, each year the FHLBNY sets aside 10% of its earnings to offer grant funding in support of housing opportunities for lower income families and individuals. AHP grants are awarded through a competitive process and funds can be used to subsidize the acquisition, construction, and/or rehabilitation of rental or owner-occupied housing.

Homebuyer Dream Program® (HDP®)

Expand your reach with the HDP, our set-aside program providing homeowner assistance to eligible first-time homebuyers—available through our member lenders. To empower homeownership, the HDP provides homeownership assistance for up to $20,000! By offering the HDP in your institution some of the advantages and benefits include: creating homeownership opportunities in members’ communities, increasing your residential lending opportunities, enhancing public relations, and improving CRA credit.

Secondary Market Opportunity — Earn Fee Income for the Loans You Originate

As a member, you have access to the Mortgage Asset Program (MAP®) — an alternate way for you to fund mortgages while allowing flexibility and transparency from both an operational and an economic perspective.

Key MAP® Features:

- A flexible program with competitive pricing catered to our local markets

- No loan level price adjustments

- A pathway to accumulate FHLBNY Stock – members are required to purchase capital stock equal to 4.5% of what they deliver into MAP

- Simplified credit risk sharing structure with the added potential to be rewarded with fee income for strong loan performance

- No risk-based capital impact or collateralization requirements on loans sold

- New: Partnership with Optimal Blue (OB) Marketplace to provide value-added services, such as real-time MAP rates and guidelines

- Now available: Servicing-Released sale option to maximize your upfront cash revenue received while also reducing operational expense

Download the MAP® Overview

Correspondent Services to Keep Expenses in Check

Our services are fully integrated, attractively priced and flexible. In addition, they do not require compensating or reserve balances.

“Hard dollar” interest is issued on all collected balances, instead of earnings credits, as is the case with many correspondent banks.

Our services include:

- Deposit Programs

- A secure Internet Banking System (1Link®)

- Funds Transfer

- Settlement

- Securities Safekeeping

Educational Resources Available to Members

As part of our commitment to your success, the FHLBNY provides a variety of educational resources. Visit FHLBNY Financial Intelligence for insightful information, such as:

- Workshops and webinars specific to credit unions

- Publications and calculative tools to help you determine specific funding needs and strategies

Explore our Education Programs

As a member, you gain access to a team of specialists dedicated to the needs of credit union members through FHLBNY Education Programs. Our representatives focus on specific regions to help each credit union strategize on ways to thrive within the local communities they serve.

![]()

Interested in a strategic planning session for your leadership team?

FHLBNY Education Programs

Our Focus. Your Strategic Advantage